- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

High Growth Tech Stocks In US Market With Promising Potential

Reviewed by Simply Wall St

As the U.S. market experiences slight declines amid anticipation of U.S.-China tariff talks and mixed performances in key indices like the S&P 500 and Nasdaq, investors are closely monitoring developments that could impact economic conditions. In this environment, high growth tech stocks with robust fundamentals and adaptability to changing trade dynamics hold promising potential for those looking to navigate the current market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.47% | 39.60% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Clene | 61.80% | 67.01% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.54% | 110.32% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

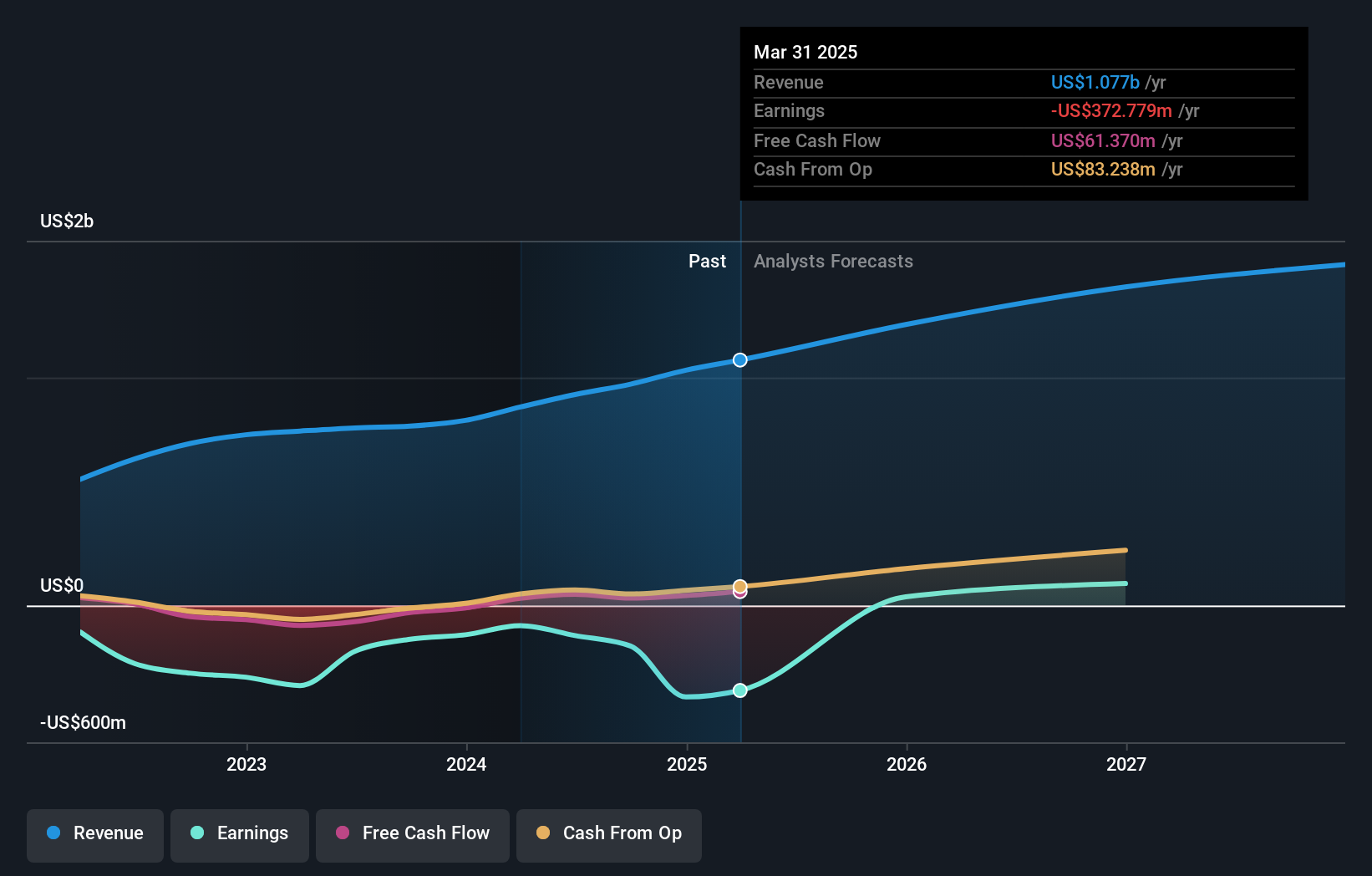

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI-powered technology to serve financial services, other service providers, their customers, and asset investors across the United States, Israel, and the Cayman Islands, with a market cap of $851.26 million.

Operations: Pagaya leverages its AI-driven technology to enhance decision-making processes for financial services, catering to a diverse clientele in the U.S., Israel, and the Cayman Islands. With a market cap of $851.26 million, the company focuses on integrating advanced data science techniques into its operations.

Pagaya Technologies, amidst a volatile market, has shown promising signs of growth and recovery. After a challenging period, the company reported a significant turnaround with first-quarter revenue rising to $290 million from $245 million year-over-year and net income hitting $7.89 million, reversing a previous loss of $21.22 million. This resurgence is underpinned by robust guidance for 2025, projecting network volumes up to $11 billion and total revenue potentially reaching $1.3 billion. Notably, R&D investments remain pivotal in driving these advances, emphasizing Pagaya's commitment to innovation despite past profitability challenges.

- Click to explore a detailed breakdown of our findings in Pagaya Technologies' health report.

Explore historical data to track Pagaya Technologies' performance over time in our Past section.

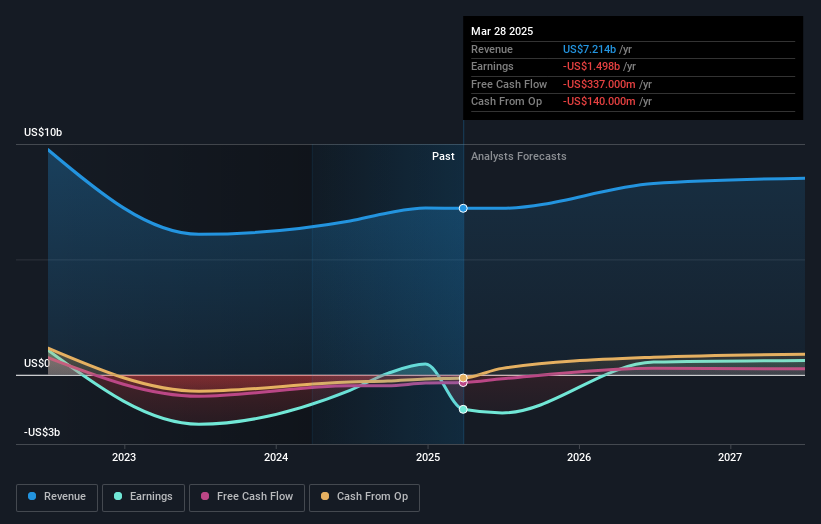

Sandisk (NasdaqGS:SNDK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sandisk Corporation is a global company specializing in the development, manufacturing, and sale of data storage devices and solutions utilizing NAND flash technology, with a market capitalization of approximately $5.31 billion.

Operations: The company generates revenue primarily from its computer storage devices segment, amounting to $7.21 billion. Sandisk operates across various regions, including the United States, Europe, the Middle East, Africa, and Asia.

Amidst a challenging landscape, Sandisk is navigating with strategic agility, recently projecting Q4 revenue between $1.75 billion and $1.85 billion, signaling robust operational momentum. Despite facing a substantial impairment charge of $1.83 billion in Q3, the company's commitment to innovation remains unshaken with R&D investments crucial for future competitiveness in the flash memory sector. Notably, Sandisk's earnings are expected to surge by 111.75% annually, outpacing its tech peers and underscoring its potential turnaround from current unprofitability within three years. This growth trajectory is bolstered by recent technological advancements shared with Kioxia in 3D flash memory technology which promises enhanced performance and efficiency—key drivers in retaining technological leadership and customer reliance moving forward.

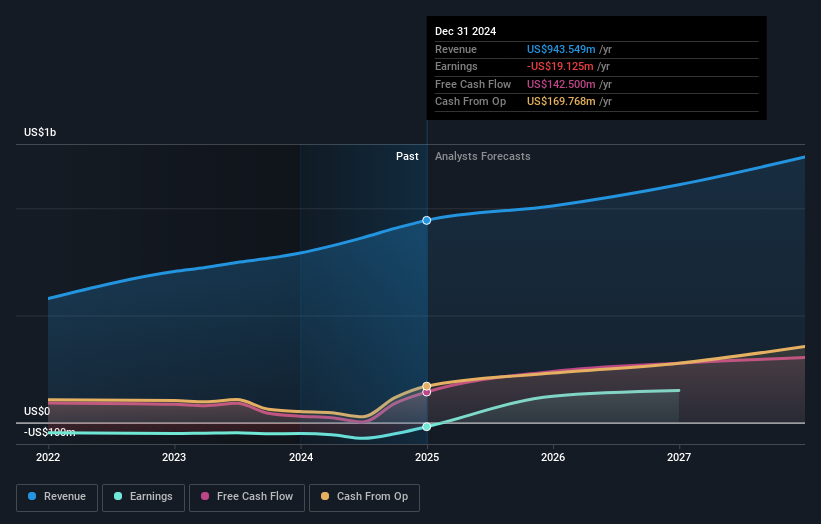

Waystar Holding (NasdaqGS:WAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waystar Holding Corp. provides a cloud-based software solution for healthcare payments and has a market cap of $7.10 billion.

Operations: The company generates revenue primarily through its healthcare software segment, which accounts for $975.19 million.

Waystar Holding has demonstrated a robust turnaround, with its first-quarter earnings showing a swing from a net loss of $15.93 million to a net profit of $29.27 million year-over-year, alongside an impressive revenue jump from $224.79 million to $256.44 million. This financial resurgence is underpinned by strategic innovations such as the AltitudeAI™ suite, which enhances healthcare payment processes and administrative efficiency across the U.S., impacting over 50% of the patient population. Furthermore, Waystar's recent product launches aim directly at reducing healthcare administrative costs—estimated at $440 billion annually—by integrating advanced AI and automation technologies that streamline insurance claim management and patient billing processes, ensuring substantial operational efficiencies and client satisfaction in the burgeoning digital health space.

- Click here to discover the nuances of Waystar Holding with our detailed analytical health report.

Gain insights into Waystar Holding's past trends and performance with our Past report.

Next Steps

- Dive into all 233 of the US High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives