- United States

- /

- Machinery

- /

- NasdaqGS:CMCO

3 Top Undervalued Small Caps In United States With Insider Activity

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat. As for the longer term, the market has risen 32% in the past 12 months and earnings are forecast to grow by 15% annually. In this environment, identifying undervalued small-cap stocks with insider activity can present unique opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 22.1x | 1.0x | 39.87% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 26.33% | ★★★★★☆ |

| Citizens & Northern | 12.9x | 2.9x | 43.78% | ★★★★☆☆ |

| MYR Group | 34.1x | 0.5x | 42.61% | ★★★★☆☆ |

| Franklin Financial Services | 9.8x | 1.9x | 39.21% | ★★★★☆☆ |

| German American Bancorp | 13.9x | 4.6x | 46.75% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -102.15% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -72.61% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -220.20% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Columbus McKinnon (NasdaqGS:CMCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Columbus McKinnon is a company specializing in the design, manufacturing, and marketing of material handling products and systems with a market cap of approximately $1.34 billion.

Operations: The company generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to $1.02 billion. The gross profit margin has shown an upward trend, reaching 37.08% in the latest period ending September 2024. Operating expenses include significant allocations to sales and marketing ($108.13 million) and general & administrative expenses ($105.42 million).

PE: 22.1x

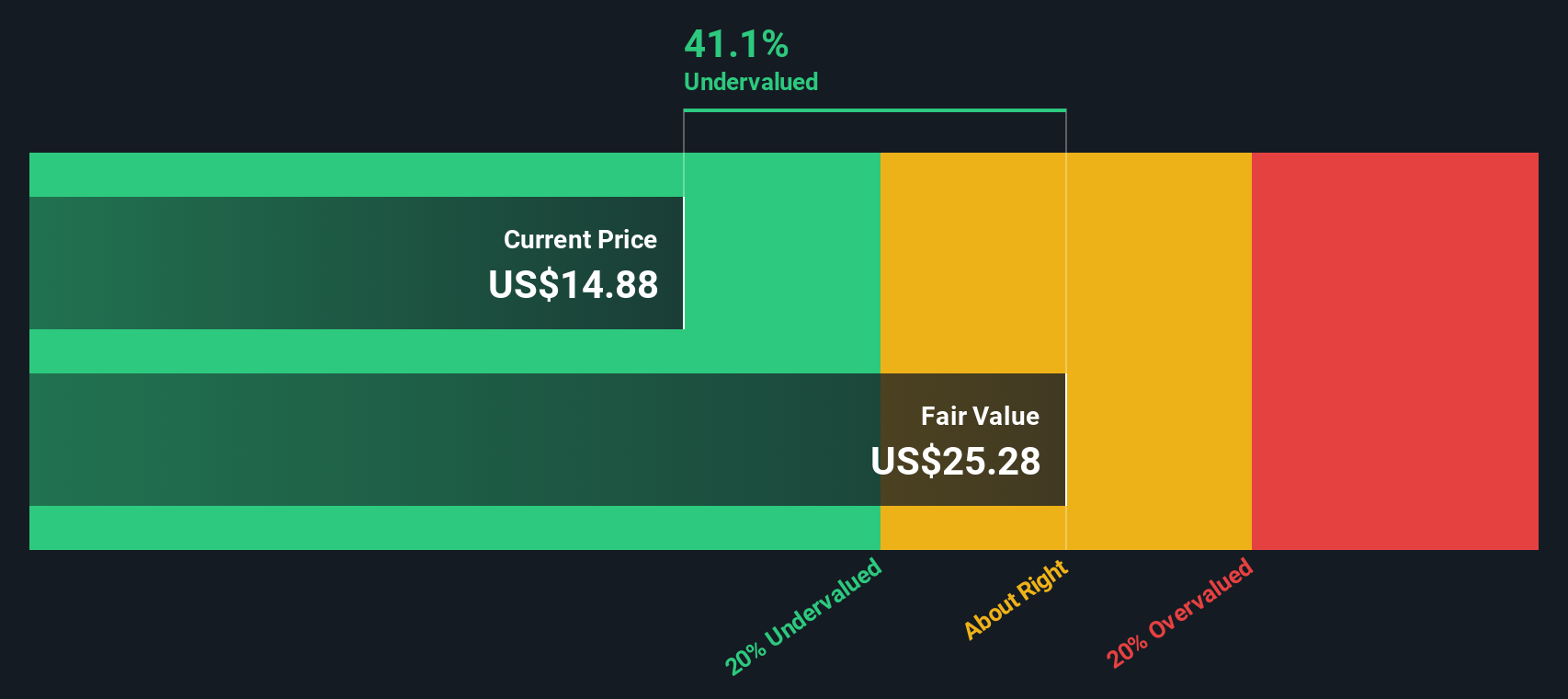

Columbus McKinnon, a smaller U.S. company, is currently undervalued with earnings forecasted to grow nearly 30% annually. Despite net income dipping slightly to US$8.63 million in Q1 2024 from US$9.28 million the previous year, insider confidence is evident as executives have shown interest in share purchases recently. The company projects modest sales growth for fiscal 2025 and maintains a quarterly dividend of US$0.07 per share, highlighting its commitment to returning value to shareholders amidst leadership changes and strategic adjustments.

- Get an in-depth perspective on Columbus McKinnon's performance by reading our valuation report here.

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a company specializing in the design and production of semiconductors with a market cap of $2.50 billion.

Operations: MaxLinear's primary revenue stream is from its semiconductor segment, which generated $448.14 million. The company's gross profit margin was 53.99%, with significant operating expenses including R&D at $252.86 million and general & administrative costs at $129.87 million for the latest reporting period ending 2024-09-26.

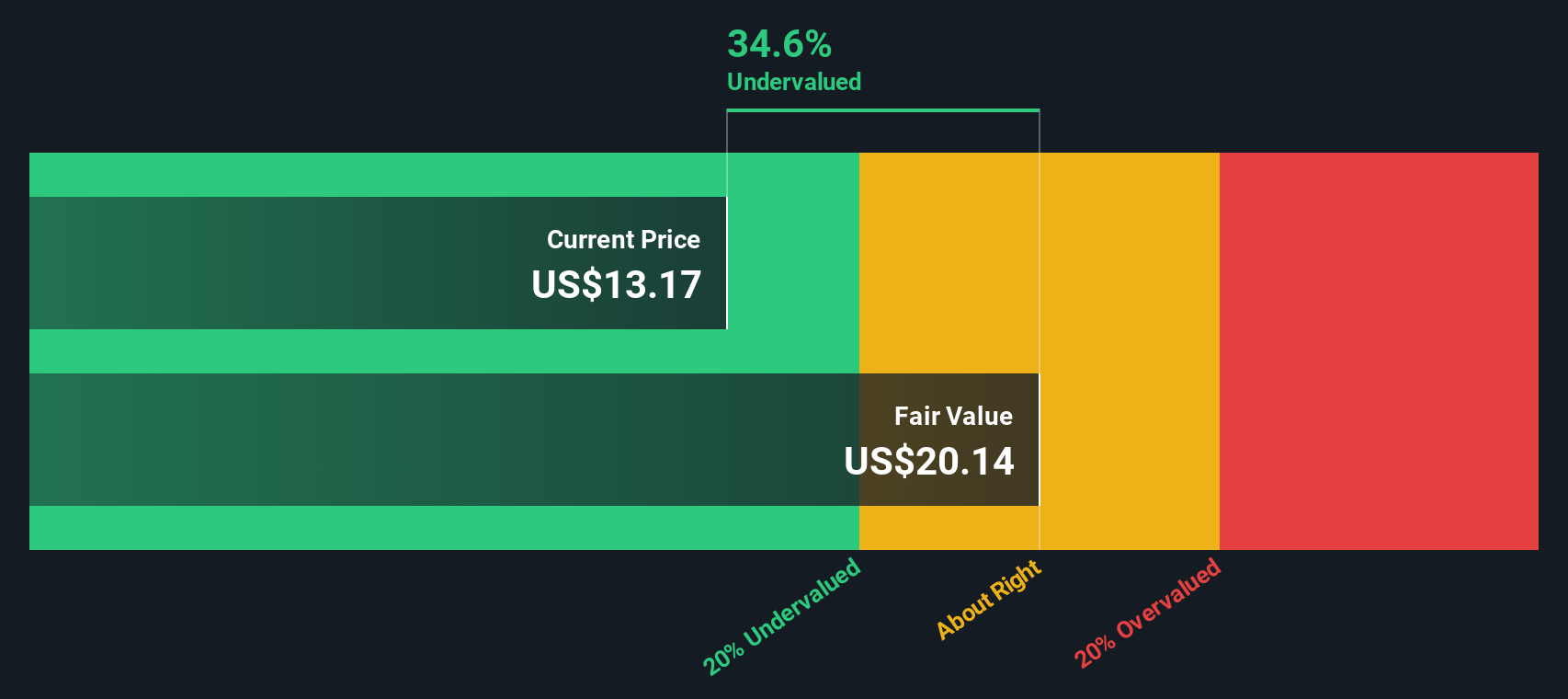

PE: -6.8x

MaxLinear, a U.S. small-cap stock, has recently garnered attention due to significant insider confidence, with CEO Kishore Seendripu purchasing 108,303 shares valued at approximately US$1.4 million between July and August 2024. The company showcased its Panther III storage accelerator at multiple conferences in August and September 2024, highlighting substantial cost savings and performance improvements over traditional solutions. Despite reporting a net loss of US$39 million for Q2 2024, MaxLinear's innovative product offerings position it well for future growth in the expanding data storage market.

Varex Imaging (NasdaqGS:VREX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Varex Imaging specializes in manufacturing X-ray imaging components for medical and industrial applications, with a market cap of approximately $0.78 billion.

Operations: Varex Imaging generates revenue primarily from its Medical and Industrial segments, with recent figures showing $601 million and $231.7 million respectively. The company experienced fluctuations in net income margin, reaching 5.40% as of September 2023 after previously recording negative margins in 2020 and early 2021. Gross profit margin has varied over the years, most recently at 32.49%.

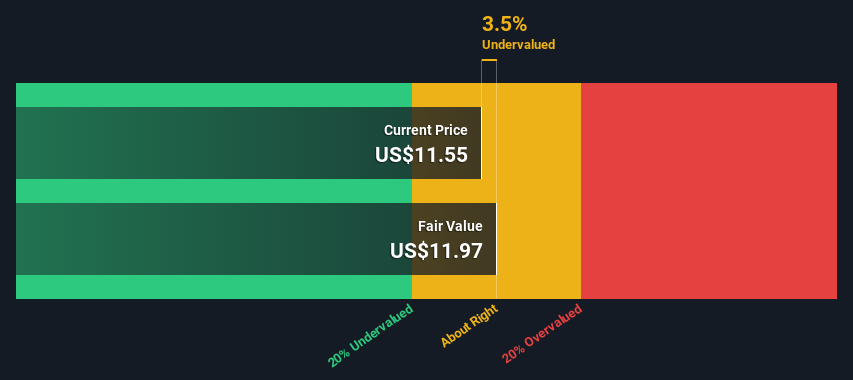

PE: 14.1x

Varex Imaging, a smaller company in the medical imaging sector, has recently seen insider confidence with CFO Shubham Maheshwari purchasing 10,000 shares worth US$108,200. Despite being dropped from several S&P indices on September 7, 2024, Varex reported Q3 sales of US$209.1 million and net income of US$1.4 million. However, earnings have declined compared to the previous year. The company's earnings are projected to grow by 16.15% annually but face challenges with high-risk funding sources and insufficient coverage of interest payments by earnings.

- Dive into the specifics of Varex Imaging here with our thorough valuation report.

Evaluate Varex Imaging's historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 54 Undervalued US Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCO

Columbus McKinnon

Designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide.

Undervalued average dividend payer.