- United States

- /

- Medical Equipment

- /

- NasdaqGS:TRIB

Investors Still Aren't Entirely Convinced By Trinity Biotech plc's (NASDAQ:TRIB) Revenues Despite 37% Price Jump

Those holding Trinity Biotech plc (NASDAQ:TRIB) shares would be relieved that the share price has rebounded 37% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 55% share price decline over the last year.

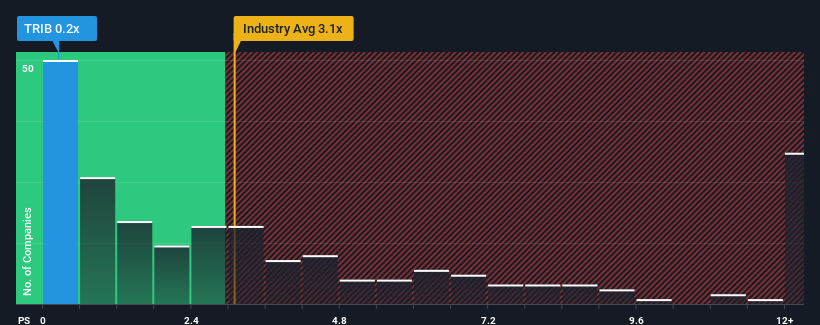

Even after such a large jump in price, Trinity Biotech may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Trinity Biotech

What Does Trinity Biotech's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Trinity Biotech's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Trinity Biotech will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Trinity Biotech?

In order to justify its P/S ratio, Trinity Biotech would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. As a result, revenue from three years ago have also fallen 44% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this information, we find it odd that Trinity Biotech is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Even after such a strong price move, Trinity Biotech's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Trinity Biotech's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 5 warning signs for Trinity Biotech (3 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Trinity Biotech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRIB

Trinity Biotech

Acquires, together with its subsidiaries, develops, acquires, manufactures, and markets medical diagnostic products for the clinical laboratory and point-of-care (POC) segments of the diagnostic market in the Americas, Asia, Africa, and Europe.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives