- United States

- /

- Medical Equipment

- /

- NasdaqGS:TRIB

Investors Don't See Light At End Of Trinity Biotech plc's (NASDAQ:TRIB) Tunnel And Push Stock Down 27%

Trinity Biotech plc (NASDAQ:TRIB) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

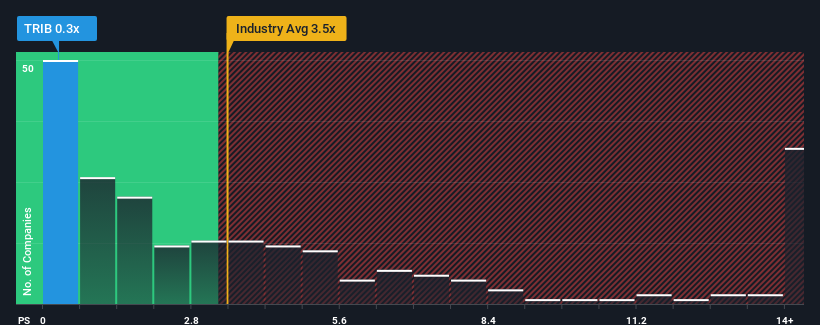

Since its price has dipped substantially, Trinity Biotech may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Trinity Biotech

How Trinity Biotech Has Been Performing

As an illustration, revenue has deteriorated at Trinity Biotech over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Trinity Biotech's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Trinity Biotech's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.4%. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 8.5% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that Trinity Biotech is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Having almost fallen off a cliff, Trinity Biotech's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Trinity Biotech revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 6 warning signs with Trinity Biotech (at least 2 which are potentially serious), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Trinity Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRIB

Trinity Biotech

Acquires, together with its subsidiaries, develops, acquires, manufactures, and markets medical diagnostic products for the clinical laboratory and point-of-care (POC) segments of the diagnostic market in the Americas and Ireland.

Medium-low and good value.

Similar Companies

Market Insights

Community Narratives