- United States

- /

- Medical Equipment

- /

- NasdaqGS:TRIB

A Piece Of The Puzzle Missing From Trinity Biotech plc's (NASDAQ:TRIB) 35% Share Price Climb

Despite an already strong run, Trinity Biotech plc (NASDAQ:TRIB) shares have been powering on, with a gain of 35% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

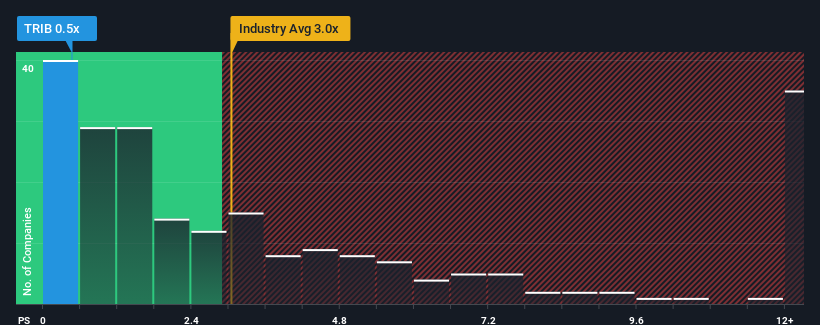

Although its price has surged higher, Trinity Biotech may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Trinity Biotech

What Does Trinity Biotech's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Trinity Biotech's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Trinity Biotech's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Trinity Biotech's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 9.3% growth forecast for the broader industry.

In light of this, it's peculiar that Trinity Biotech's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Trinity Biotech's P/S Mean For Investors?

Shares in Trinity Biotech have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Trinity Biotech's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Trinity Biotech has 5 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Trinity Biotech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trinity Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIB

Trinity Biotech

Acquires, together with its subsidiaries, develops, acquires, manufactures, and markets medical diagnostic products for the clinical laboratory and point-of-care (POC) segments of the diagnostic market in the Americas and Ireland.

Medium-low and good value.

Similar Companies

Market Insights

Community Narratives