- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Tandem Diabetes Care, Inc. (NASDAQ:TNDM) Stock Rockets 63% But Many Are Still Ignoring The Company

Tandem Diabetes Care, Inc. (NASDAQ:TNDM) shareholders would be excited to see that the share price has had a great month, posting a 63% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

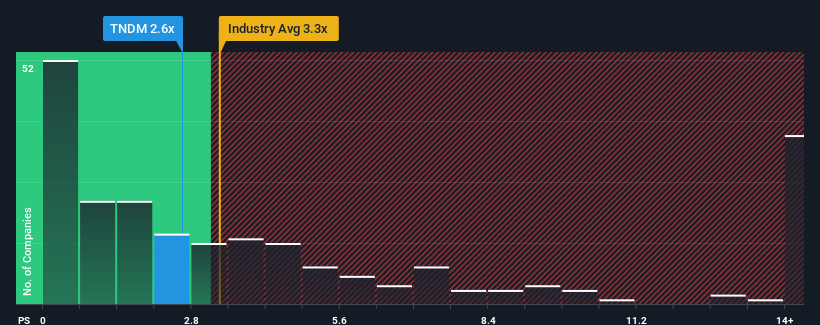

Even after such a large jump in price, Tandem Diabetes Care may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.6x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.3x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tandem Diabetes Care

How Tandem Diabetes Care Has Been Performing

While the industry has experienced revenue growth lately, Tandem Diabetes Care's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Tandem Diabetes Care's future stacks up against the industry? In that case, our free report is a great place to start.How Is Tandem Diabetes Care's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Tandem Diabetes Care's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.4%. Still, the latest three year period has seen an excellent 76% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 9.7% per year over the next three years. That's shaping up to be similar to the 9.8% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Tandem Diabetes Care's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Despite Tandem Diabetes Care's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Tandem Diabetes Care's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It is also worth noting that we have found 2 warning signs for Tandem Diabetes Care that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Tandem Diabetes Care, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TNDM

Tandem Diabetes Care

A medical device company, designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with excellent balance sheet.