- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Not Many Are Piling Into Tandem Diabetes Care, Inc. (NASDAQ:TNDM) Stock Yet As It Plummets 40%

Tandem Diabetes Care, Inc. (NASDAQ:TNDM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 40% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

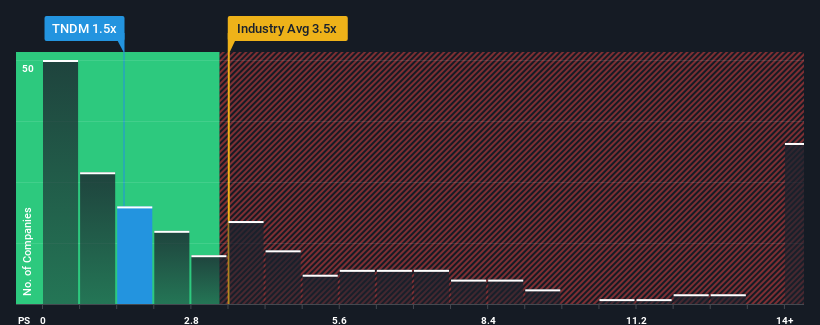

After such a large drop in price, Tandem Diabetes Care may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.5x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Tandem Diabetes Care

What Does Tandem Diabetes Care's P/S Mean For Shareholders?

Recent times have been advantageous for Tandem Diabetes Care as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Tandem Diabetes Care's future stacks up against the industry? In that case, our free report is a great place to start.How Is Tandem Diabetes Care's Revenue Growth Trending?

Tandem Diabetes Care's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. The latest three year period has also seen an excellent 34% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.4% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 9.4% each year, which is not materially different.

With this information, we find it odd that Tandem Diabetes Care is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Tandem Diabetes Care's P/S?

The southerly movements of Tandem Diabetes Care's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Tandem Diabetes Care remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Tandem Diabetes Care that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TNDM

Tandem Diabetes Care

A medical device company, designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives