- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Exploring 3 Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, though it has seen an 8.0% increase over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying small-cap stocks that are perceived as undervalued and have notable insider activity can offer unique opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.2x | 2.9x | 48.62% | ★★★★★☆ |

| West Bancorporation | 12.6x | 4.0x | 38.00% | ★★★★☆☆ |

| S&T Bancorp | 10.8x | 3.7x | 44.77% | ★★★★☆☆ |

| Forestar Group | 6.0x | 0.7x | -408.76% | ★★★★☆☆ |

| Niagen Bioscience | 50.1x | 6.5x | 33.72% | ★★★☆☆☆ |

| MVB Financial | 12.2x | 1.6x | 45.41% | ★★★☆☆☆ |

| Franklin Financial Services | 14.8x | 2.4x | 29.80% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.6x | -3020.53% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -22.21% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -397.62% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Mitek Systems (NasdaqCM:MITK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mitek Systems specializes in the development, sale, and service of proprietary software solutions, with a focus on identity verification and mobile capture technology, and has a market cap of approximately $0.52 billion.

Operations: The company generates revenue from the development, sale, and service of proprietary software solutions, with a recent revenue figure of $177.38 million. The cost of goods sold (COGS) was $25.12 million, resulting in a gross profit margin of 85.84%. Operating expenses include significant allocations to sales and marketing ($40.13 million), research and development ($34.14 million), and general and administrative costs ($44.51 million).

PE: 33.3x

Mitek Systems, a contender among smaller U.S. companies, recently reported a significant rise in Q2 revenue to US$51.93 million and net income of US$9.15 million, showcasing its improving financial health. Insider confidence was evident when Edward West purchased 55,000 shares for approximately US$506,407 in early 2025. The company's earnings are projected to grow by 35% annually despite relying on external borrowing for funding. With new leadership under COO Garret Gafke and steady revenue guidance between US$170-180 million for fiscal 2025, Mitek is poised for potential growth in the identity and payments industry.

- Dive into the specifics of Mitek Systems here with our thorough valuation report.

Assess Mitek Systems' past performance with our detailed historical performance reports.

Tandem Diabetes Care (NasdaqGM:TNDM)

Simply Wall St Value Rating: ★★★☆☆☆

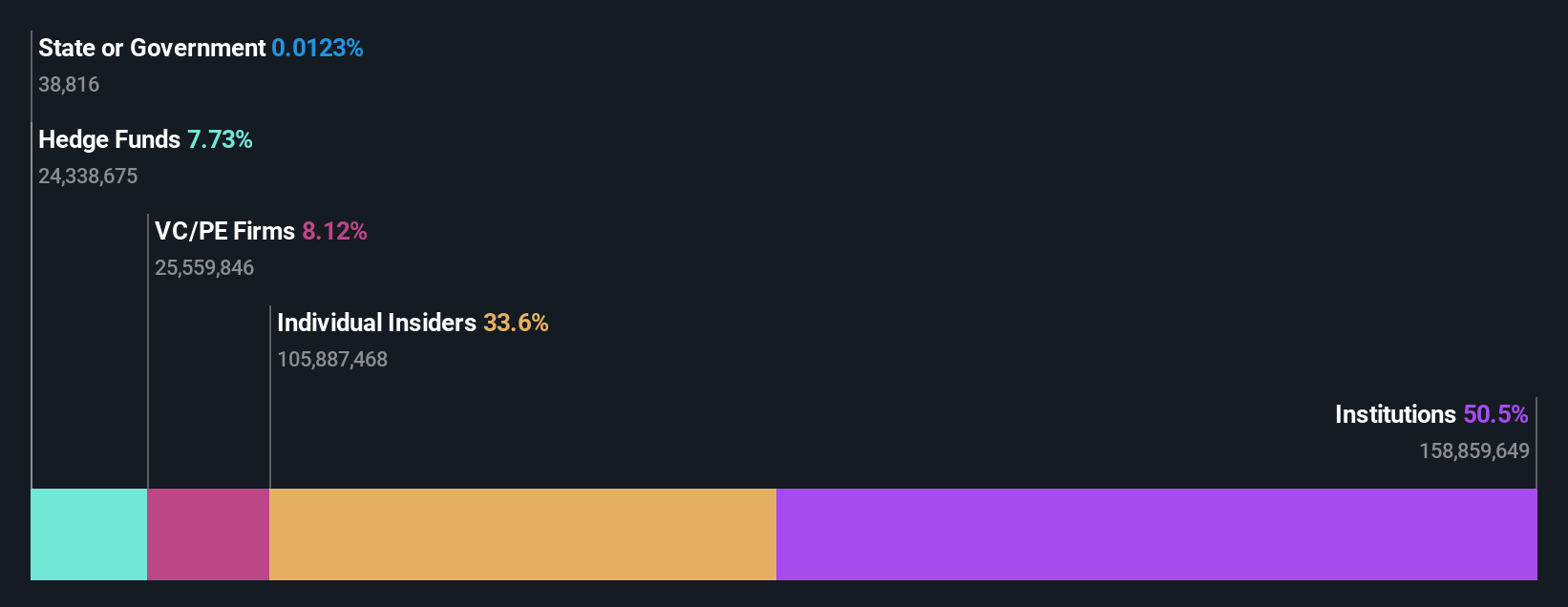

Overview: Tandem Diabetes Care specializes in designing and manufacturing insulin pumps and supplies, with a focus on diabetes management solutions, and has a market cap of approximately $1.55 billion.

Operations: Tandem Diabetes Care generates revenue primarily from insulin pumps and supplies, reaching $982.95 million in the most recent period. The company's gross profit margin has shown fluctuations, with a recent figure of 52.22%. Operating expenses are significant and include research and development costs amounting to $200.57 million, contributing to a net loss of $183.87 million for the latest period.

PE: -8.3x

Tandem Diabetes Care, known for its innovative diabetes management technology, has seen insider confidence with recent share purchases. Their Control-IQ+ technology, now commercially launched in the U.S., shows promise in improving glycemic control for type 2 diabetes patients. Despite a net loss of US$130.56 million in Q1 2025, sales rose to US$234.42 million from US$191.67 million last year. The company projects full-year sales between US$997 million and US$1.007 billion, indicating potential growth ahead.

- Unlock comprehensive insights into our analysis of Tandem Diabetes Care stock in this valuation report.

Understand Tandem Diabetes Care's track record by examining our Past report.

New Fortress Energy (NasdaqGS:NFE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: New Fortress Energy is a global energy infrastructure company primarily engaged in the development, financing, and operation of natural gas facilities and logistics, with a market cap of $5.56 billion.

Operations: The company generates significant revenue from its Terminals and Infrastructure segment, contributing $2.04 billion, while Ships and Consolidation segments add $170.59 million and $150 million respectively. The gross profit margin has shown notable improvement over time, reaching 61.92% in the third quarter of 2023 before slightly decreasing to 52.98% by the end of 2024. Operating expenses have been substantial, with General & Administrative Expenses being a consistent major component across periods.

PE: -6.0x

New Fortress Energy, a smaller player in the energy sector, recently saw insider confidence with significant share purchases over the past three months. This activity suggests a belief in its potential despite recent financial challenges, including a US$242 million net loss reported for Q4 2024. The company is engaged in strategic moves like selling its Jamaican business for US$1.06 billion and extending key contracts in Puerto Rico, positioning itself for future growth amidst volatile share prices and high-risk funding structures.

Make It Happen

- Delve into our full catalog of 90 Undervalued US Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives