- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

Analysts Just Made A Meaningful Upgrade To Their TransMedics Group, Inc. (NASDAQ:TMDX) Forecasts

TransMedics Group, Inc. (NASDAQ:TMDX) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The stock price has risen 6.8% to US$148 over the past week, suggesting investors are becoming more optimistic. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

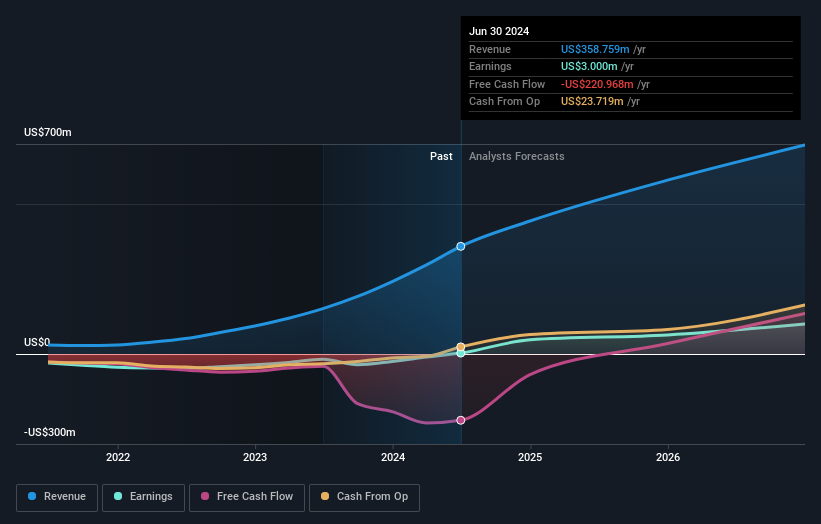

After the upgrade, the nine analysts covering TransMedics Group are now predicting revenues of US$443m in 2024. If met, this would reflect a major 24% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to bounce 1,403% to US$1.35. Before this latest update, the analysts had been forecasting revenues of US$401m and earnings per share (EPS) of US$0.98 in 2024. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for TransMedics Group

It will come as no surprise to learn that the analysts have increased their price target for TransMedics Group 20% to US$176 on the back of these upgrades.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 53% growth on an annualised basis. That is in line with its 60% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 8.2% annually. So although TransMedics Group is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, TransMedics Group could be worth investigating further.

Analysts are clearly in love with TransMedics Group at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 2 other flags we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026