- United States

- /

- Medical Equipment

- /

- NasdaqGM:TELA

TELA Bio (NASDAQ:TELA investor three-year losses grow to 88% as the stock sheds US$35m this past week

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of TELA Bio, Inc. (NASDAQ:TELA) investors who have held the stock for three years as it declined a whopping 88%. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 74% in a year. Unfortunately the share price momentum is still quite negative, with prices down 49% in thirty days. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

If the past week is anything to go by, investor sentiment for TELA Bio isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Because TELA Bio made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, TELA Bio grew revenue at 29% per year. That's well above most other pre-profit companies. So why has the share priced crashed 23% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

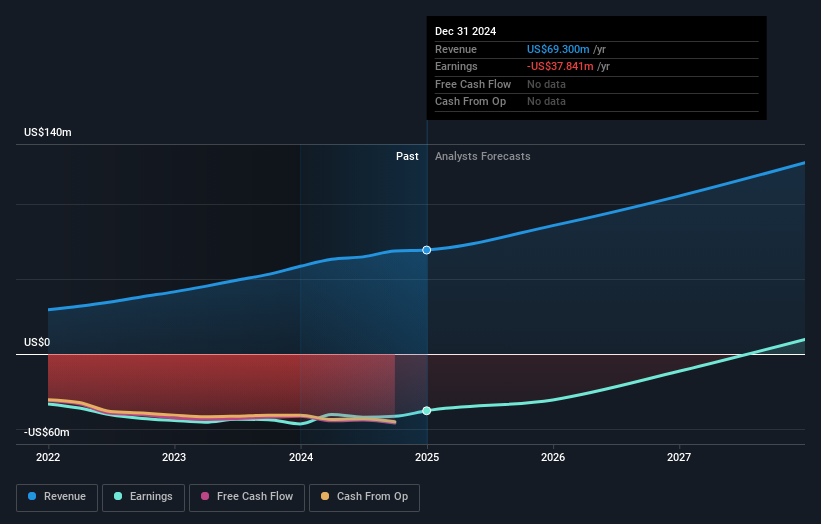

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think TELA Bio will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 9.4% in the last year, TELA Bio shareholders lost 74%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand TELA Bio better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for TELA Bio you should be aware of, and 1 of them is concerning.

TELA Bio is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if TELA Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TELA

TELA Bio

A commercial-stage medical technology company, focuses on providing soft-tissue reconstruction solutions that optimize clinical outcomes by prioritizing the preservation and restoration of the patient’s anatomy.

Excellent balance sheet with reasonable growth potential.