- United States

- /

- Medical Equipment

- /

- NasdaqGM:TELA

Investors Still Aren't Entirely Convinced By TELA Bio, Inc.'s (NASDAQ:TELA) Revenues Despite 39% Price Jump

Those holding TELA Bio, Inc. (NASDAQ:TELA) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 78% share price drop in the last twelve months.

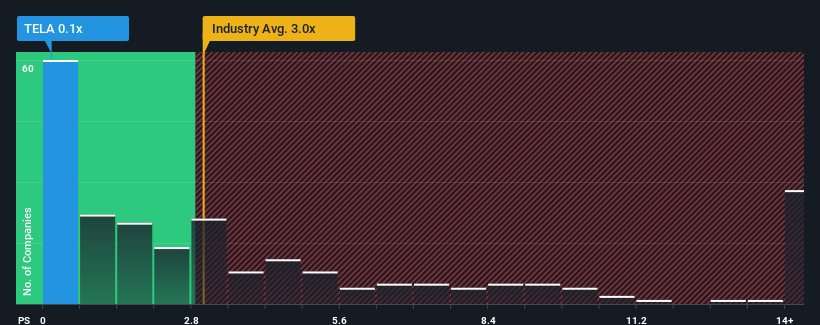

Although its price has surged higher, TELA Bio may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

We've discovered 2 warning signs about TELA Bio. View them for free.See our latest analysis for TELA Bio

What Does TELA Bio's Recent Performance Look Like?

There hasn't been much to differentiate TELA Bio's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on TELA Bio will be hoping that this isn't the case.

Keen to find out how analysts think TELA Bio's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like TELA Bio's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 124% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 24% per year as estimated by the five analysts watching the company. With the industry only predicted to deliver 10% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that TELA Bio's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From TELA Bio's P/S?

Even after such a strong price move, TELA Bio's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at TELA Bio's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for TELA Bio (1 is a bit concerning!) that you should be aware of.

If you're unsure about the strength of TELA Bio's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade TELA Bio, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TELA Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TELA

TELA Bio

A commercial-stage medical technology company, focuses on providing soft-tissue reconstruction solutions that optimize clinical outcomes by prioritizing the preservation and restoration of the patient’s anatomy.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives