- United States

- /

- Medical Equipment

- /

- NasdaqCM:STEX

Will Streamex's (STEX) Shelf Registration Redefine Its Capital Allocation and Ownership Strategy?

Reviewed by Sasha Jovanovic

- Streamex Corp. recently filed a shelf registration to offer up to 10,359,211 shares of common stock, valued at approximately $57.39 million, in a move associated with its Employee Stock Ownership Plan (ESOP).

- This significant equity registration could indicate the company's intent to raise capital, pursue growth opportunities, or adjust its ownership structure in the coming months.

- We'll explore how this substantial shelf registration filing shapes Streamex's investment narrative, particularly regarding its potential for capital raising and ESOP integration.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

What Is Streamex's Investment Narrative?

For anyone considering a stake in Streamex, the big picture centers on faith in the company’s ability to reposition itself following its transition from BioSig Technologies, recent leadership changes, and its pursuit of blockchain-integrated financial products. The newly announced shelf registration tied to the ESOP introduces fresh possibilities and risks: while it could supply Streamex with much-needed capital for growth initiatives and stabilize its capital structure, there’s also a chance of significant short-term dilution, especially given the sizable net loss and volatile share price history. If this offering proceeds, it could impact the key catalysts investors have been eyeing, such as the pending ETF integration with Simplify Asset Management or progress toward regulatory compliance. The potential for greater dilution now competes with hopes for operational breakthroughs, and the importance of balance-sheet strength grows as Streamex aims to address Nasdaq compliance concerns and capitalize on its recent index inclusion.

However, with dilution risk heightened by this shelf registration, investors should carefully watch for any new capital raising activity.

Exploring Other Perspectives

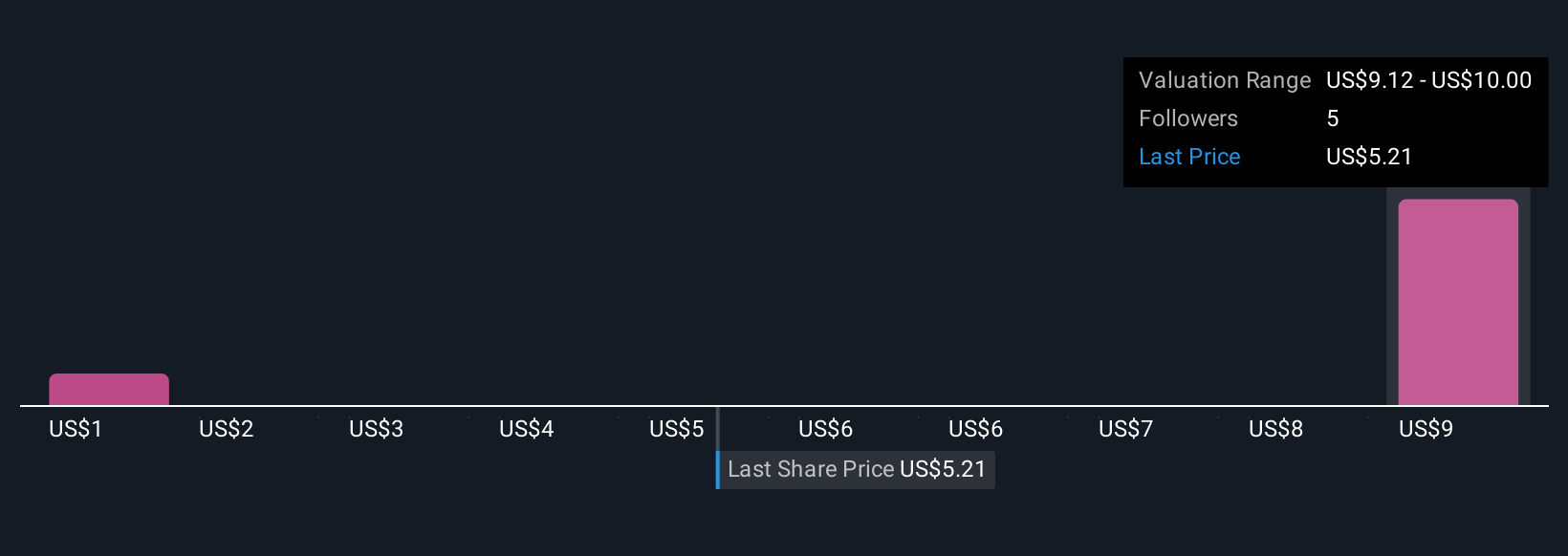

Explore 2 other fair value estimates on Streamex - why the stock might be worth as much as 58% more than the current price!

Build Your Own Streamex Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Streamex research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Streamex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Streamex's overall financial health at a glance.

No Opportunity In Streamex?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:STEX

Streamex

A real world asset (RWA) tokenization company with Institutional grade infrastructure.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives