- United States

- /

- Medical Equipment

- /

- NasdaqGM:STAA

Market Participants Recognise STAAR Surgical Company's (NASDAQ:STAA) Revenues Pushing Shares 30% Higher

Despite an already strong run, STAAR Surgical Company (NASDAQ:STAA) shares have been powering on, with a gain of 30% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

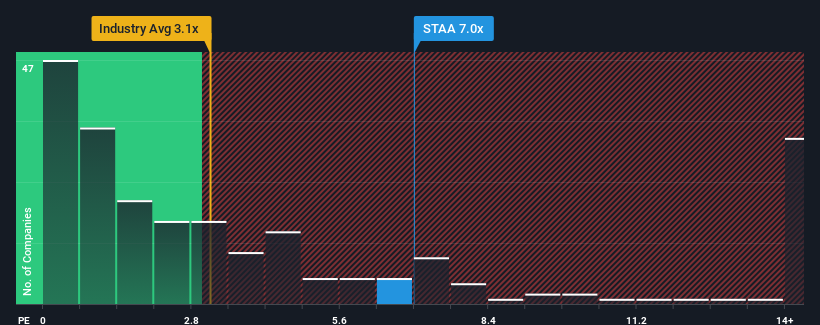

Since its price has surged higher, given around half the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider STAAR Surgical as a stock to avoid entirely with its 7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for STAAR Surgical

How STAAR Surgical Has Been Performing

STAAR Surgical certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think STAAR Surgical's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like STAAR Surgical's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 97% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 13% per year over the next three years. With the industry only predicted to deliver 10% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that STAAR Surgical's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

STAAR Surgical's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that STAAR Surgical maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 1 warning sign for STAAR Surgical that you need to take into consideration.

If these risks are making you reconsider your opinion on STAAR Surgical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STAA

STAAR Surgical

Designs, develops, manufactures, and sells implantable lenses for the eye and accessory delivery systems to deliver the lenses into the eye.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives