- United States

- /

- Medical Equipment

- /

- NasdaqCM:SSKN

STRATA Skin Sciences, Inc.'s (NASDAQ:SSKN) Shares Lagging The Industry But So Is The Business

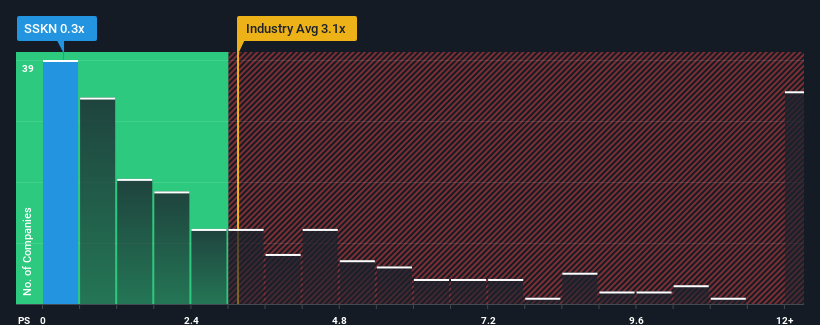

STRATA Skin Sciences, Inc.'s (NASDAQ:SSKN) price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for STRATA Skin Sciences

What Does STRATA Skin Sciences' Recent Performance Look Like?

STRATA Skin Sciences could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on STRATA Skin Sciences.How Is STRATA Skin Sciences' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like STRATA Skin Sciences' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Even so, admirably revenue has lifted 47% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 2.2% during the coming year according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 9.5%.

With this information, we are not surprised that STRATA Skin Sciences is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From STRATA Skin Sciences' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that STRATA Skin Sciences' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 3 warning signs for STRATA Skin Sciences you should know about.

If these risks are making you reconsider your opinion on STRATA Skin Sciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SSKN

STRATA Skin Sciences

A medical technology company, develops, commercializes, and markets products for the treatment of dermatologic conditions in the United States, China, Europe, the Middle East, Asia, Australia, South Africa, and Central and South America.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives