- United States

- /

- Medical Equipment

- /

- NasdaqGS:SRDX

Surmodics (NASDAQ:SRDX) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Surmodics, Inc. (NASDAQ:SRDX) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Surmodics

What Is Surmodics's Debt?

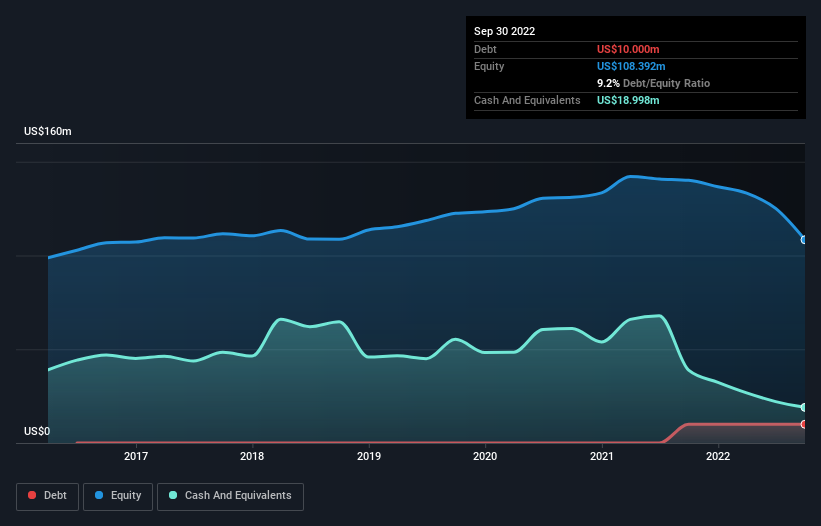

The chart below, which you can click on for greater detail, shows that Surmodics had US$10.0m in debt in September 2022; about the same as the year before. However, its balance sheet shows it holds US$19.0m in cash, so it actually has US$9.00m net cash.

How Strong Is Surmodics' Balance Sheet?

According to the last reported balance sheet, Surmodics had liabilities of US$32.1m due within 12 months, and liabilities of US$17.9m due beyond 12 months. On the other hand, it had cash of US$19.0m and US$24.2m worth of receivables due within a year. So it has liabilities totalling US$6.77m more than its cash and near-term receivables, combined.

This state of affairs indicates that Surmodics' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$534.1m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Surmodics also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Surmodics's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Surmodics made a loss at the EBIT level, and saw its revenue drop to US$100m, which is a fall of 4.9%. That's not what we would hope to see.

So How Risky Is Surmodics?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Surmodics had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$21m of cash and made a loss of US$27m. With only US$9.00m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. For riskier companies like Surmodics I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SRDX

Surmodics

Provides performance coating technologies for intravascular medical devices, and chemical and biological components for in vitro diagnostic immunoassay tests and microarrays in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives