- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

SunCar Technology Group And 2 Other Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market gears up for a Thanksgiving break, major indexes are on track for their best week since June, reflecting a positive sentiment among investors. In this context, penny stocks—often representing smaller or newer companies—continue to capture interest due to their affordability and potential for growth. While the term may seem outdated, these stocks can still offer compelling opportunities when backed by strong financials and strategic positioning in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.72 | $368.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.76 | $636.53M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.842 | $144M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.30 | $555.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.49 | $582.88M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.75 | $1.01B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.837 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.51 | $79.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 349 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

SunCar Technology Group (SDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SunCar Technology Group Inc. operates through its subsidiaries to offer cloud and mobile app-based auto eInsurance, technology, and auto services in the People’s Republic of China, with a market cap of approximately $214.22 million.

Operations: SunCar Technology Group generates revenue from three main segments: Auto Service ($219.14 million), Technology Service ($47.35 million), and Auto eInsurance Service ($194.64 million).

Market Cap: $214.22M

SunCar Technology Group, with a market cap of approximately US$214.22 million, is navigating the penny stock landscape by leveraging its diverse revenue streams across auto services, technology services, and auto eInsurance. Despite being unprofitable with a net loss of US$7.39 million for the half-year ending June 2025, SunCar has shown significant revenue growth compared to the previous year and maintains a positive cash flow runway exceeding three years. The recent AI collaboration with ByteDance's Volcano Engine could enhance operational efficiencies and service offerings significantly. However, concerns remain over its high net debt to equity ratio of 43.4% and inexperienced board tenure averaging 2.5 years.

- Unlock comprehensive insights into our analysis of SunCar Technology Group stock in this financial health report.

- Understand SunCar Technology Group's earnings outlook by examining our growth report.

AbCellera Biologics (ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. focuses on discovering and developing antibody-based medicines for unmet medical needs in the United States, with a market cap of approximately $1.09 billion.

Operations: The company's revenue is primarily derived from its discovery and development of antibodies, totaling $35.33 million.

Market Cap: $1.09B

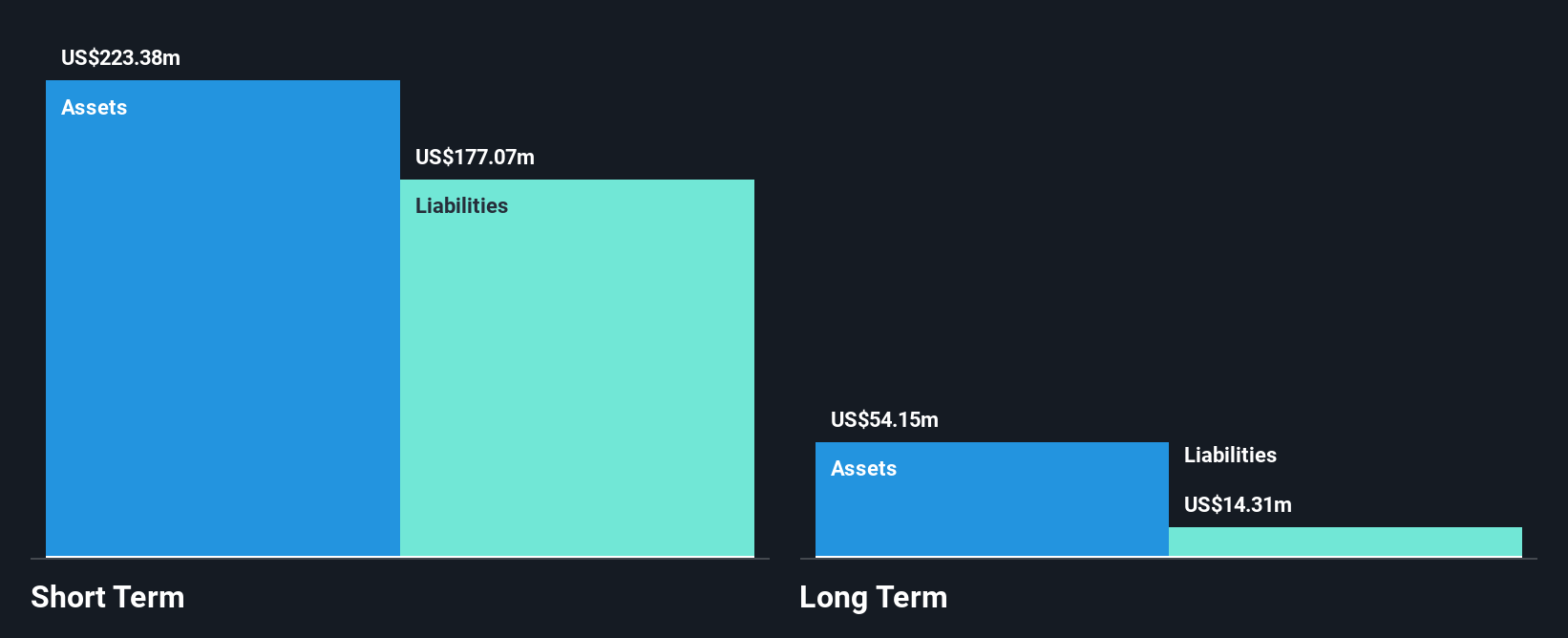

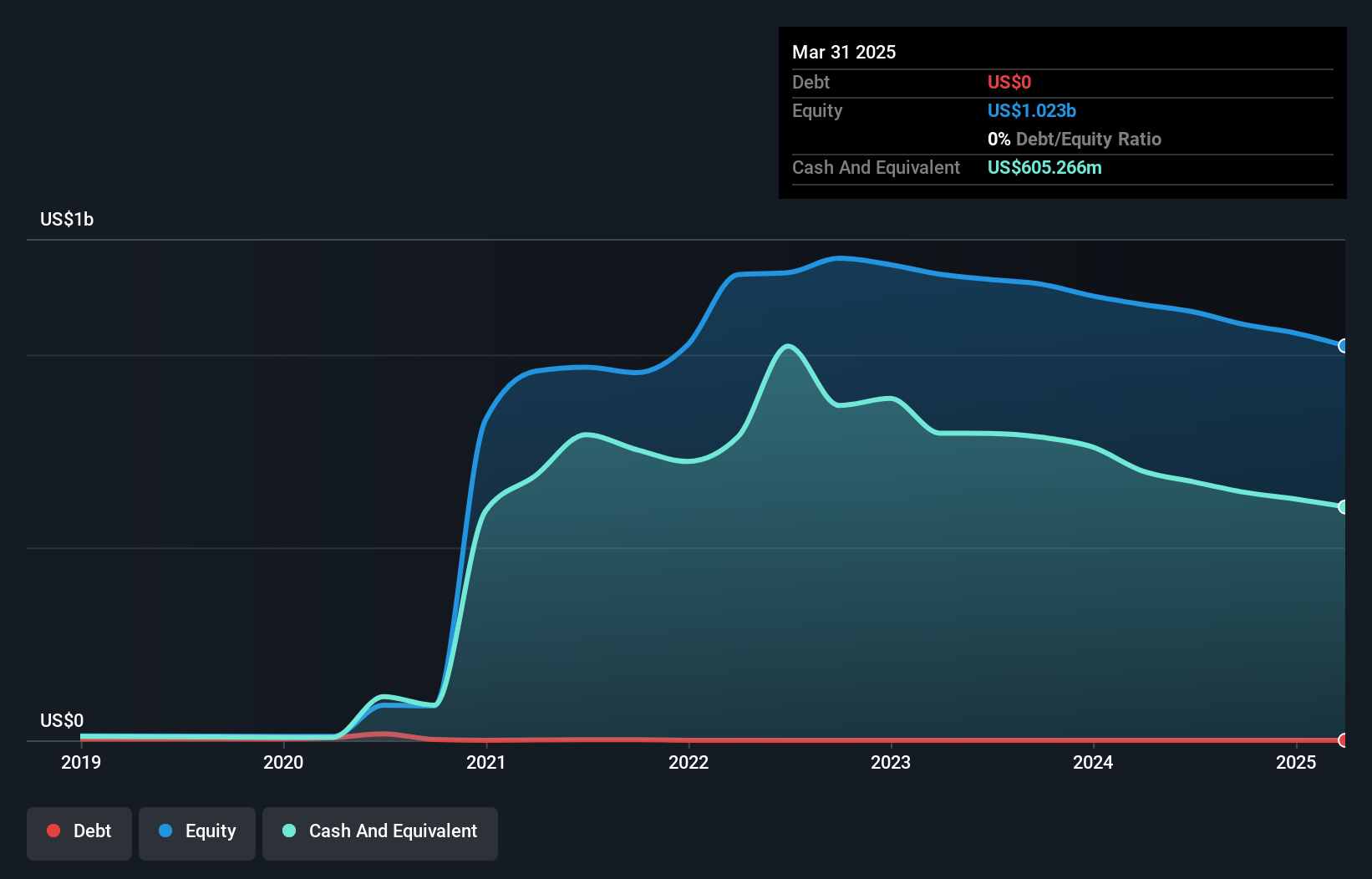

AbCellera Biologics, with a market cap of US$1.09 billion, is navigating the challenges typical of penny stocks by focusing on antibody-based medicine development. Despite being unprofitable and reporting a net loss of US$57.12 million in Q3 2025, it has seen revenue growth to US$8.96 million from the previous year’s quarter. The company benefits from strong financial stability with short-term assets significantly exceeding liabilities and no debt burden. Recent board changes include appointing Stephen Quake as an independent director, potentially enhancing strategic direction given his extensive scientific and entrepreneurial background.

- Navigate through the intricacies of AbCellera Biologics with our comprehensive balance sheet health report here.

- Explore AbCellera Biologics' analyst forecasts in our growth report.

SOPHiA GENETICS (SOPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOPHiA GENETICS SA is a cloud-native software technology company in the healthcare sector with a market cap of $334.49 million.

Operations: The company generates revenue from its healthcare software segment, amounting to $73.30 million.

Market Cap: $334.49M

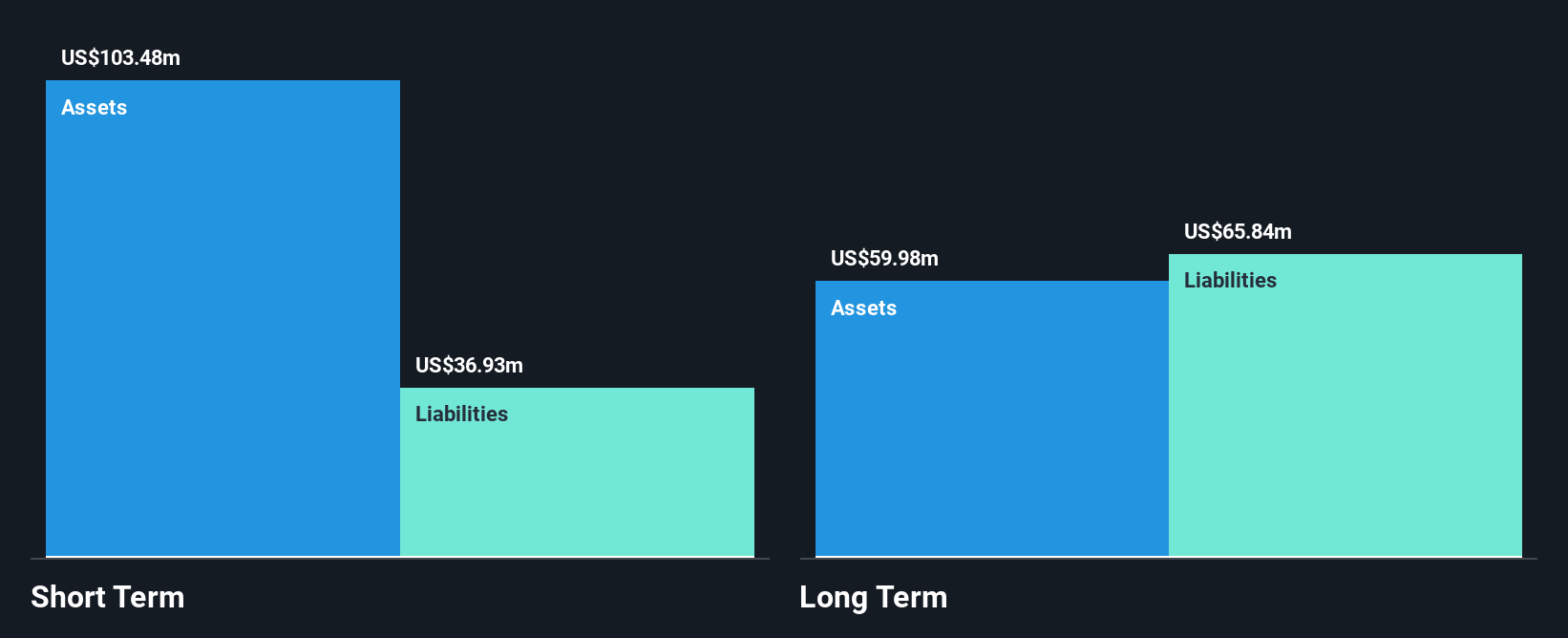

SOPHiA GENETICS, with a market cap of US$334.49 million, is leveraging its cloud-native software technology to expand in the precision oncology sector despite being unprofitable and reporting a net loss of US$20.02 million in Q3 2025. The company's revenue grew to US$19.46 million for the quarter, supported by strategic partnerships like those with Complete Genomics and A.D.A.A.M. Innovations, which aim to enhance global access to advanced genomic testing solutions. SOPHiA's robust cash position exceeds its debt levels, providing financial flexibility as it navigates high share price volatility and works towards profitability within three years.

- Jump into the full analysis health report here for a deeper understanding of SOPHiA GENETICS.

- Evaluate SOPHiA GENETICS' prospects by accessing our earnings growth report.

Summing It All Up

- Reveal the 349 hidden gems among our US Penny Stocks screener with a single click here.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.