- United States

- /

- Biotech

- /

- NasdaqGS:BDTX

3 US Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with tech stocks under pressure and bond yields on the rise, investors are looking for opportunities beyond the major indices. For those willing to explore smaller or newer companies, penny stocks—despite their somewhat outdated name—continue to offer intriguing possibilities. These stocks often represent affordability and growth potential, particularly when backed by solid financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.33 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.87 | $6.14M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.41 | $10.57M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3175 | $12.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.37 | $44.07M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.23 | $24.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9234 | $86.33M | ★★★★★☆ |

Click here to see the full list of 743 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Black Diamond Therapeutics (NasdaqGS:BDTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Diamond Therapeutics, Inc. is a clinical-stage oncology medicine company specializing in the discovery and development of MasterKey therapies for patients with genetically defined tumors, with a market cap of $109.21 million.

Operations: Black Diamond Therapeutics, Inc. does not currently report any revenue segments.

Market Cap: $109.21M

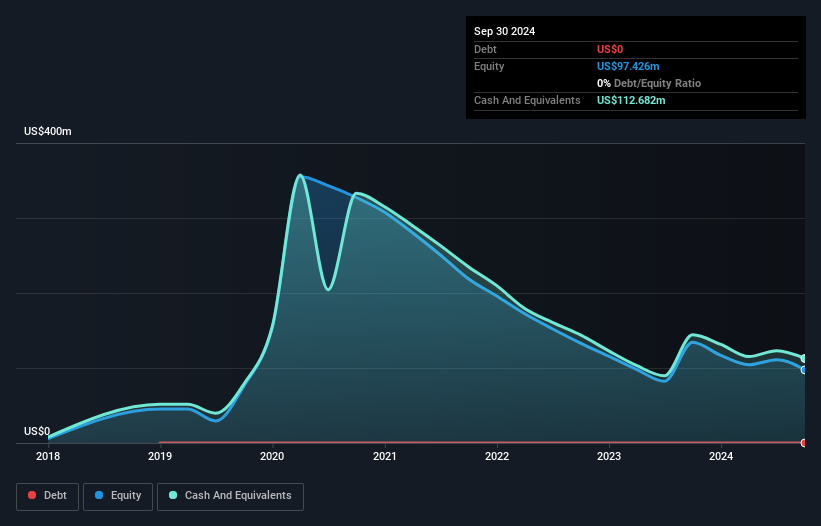

Black Diamond Therapeutics, with a market cap of US$109.21 million, is a pre-revenue clinical-stage biotech firm focused on oncology therapies. The company maintains a strong cash position, with short-term assets of US$115.5 million surpassing both short and long-term liabilities. Despite being debt-free for five years, it remains unprofitable and has seen losses increase by 9.9% annually over the past five years. Recent earnings reports show reduced net losses compared to the previous year, indicating some financial improvement despite shareholder dilution and high volatility in its stock performance over the past year.

- Get an in-depth perspective on Black Diamond Therapeutics' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Black Diamond Therapeutics' future.

SOPHiA GENETICS (NasdaqGS:SOPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOPHiA GENETICS SA is a cloud-native software technology company in the healthcare sector, with a market cap of $192.01 million.

Operations: The company generates revenue from its Healthcare Software segment, amounting to $64.49 million.

Market Cap: $192.01M

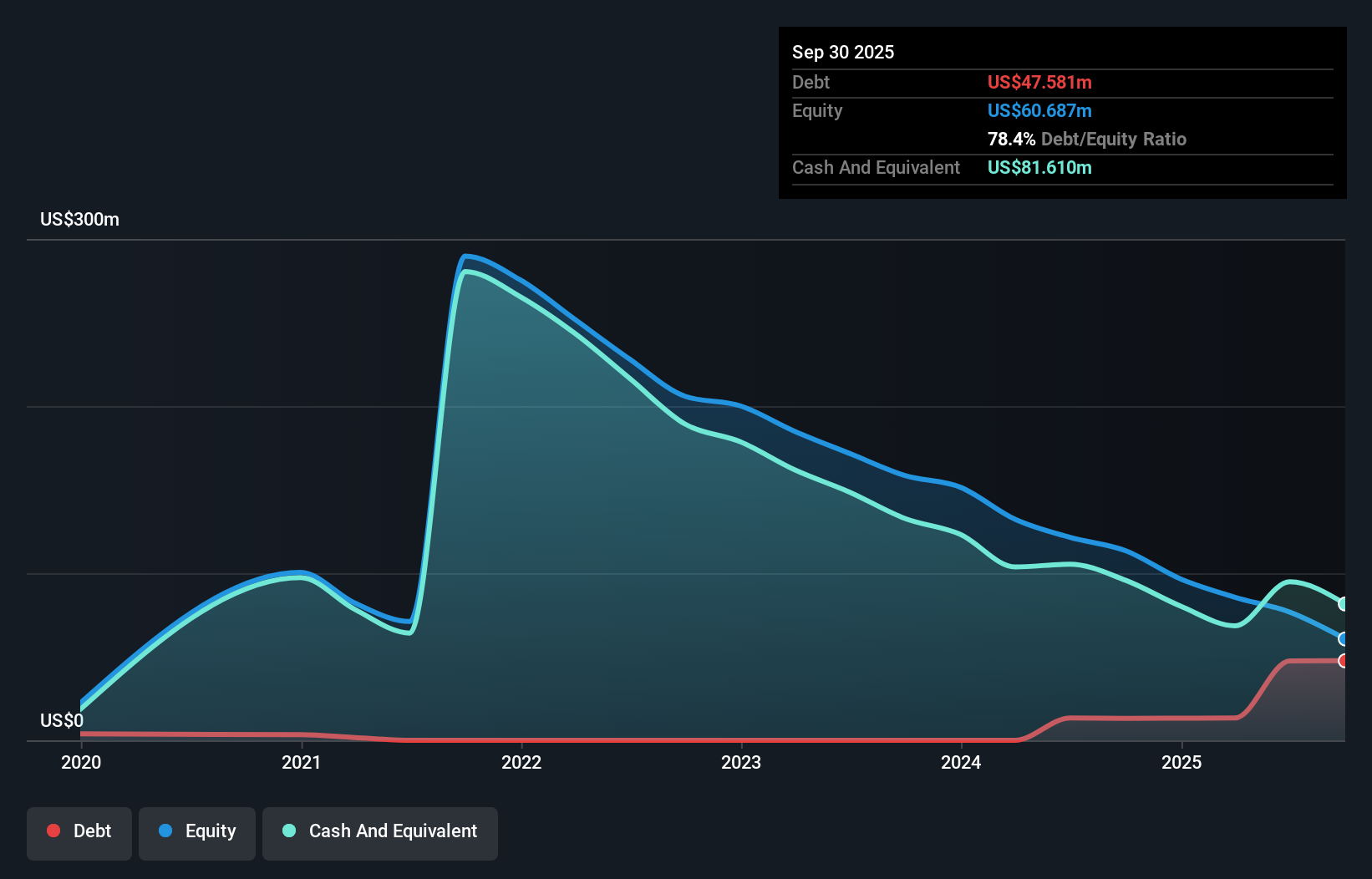

SOPHiA GENETICS, with a market cap of US$192.01 million, operates in the healthcare software sector and reported revenue of US$64.49 million. Despite being unprofitable with increasing losses over five years at 11.7% annually, it maintains more cash than debt and short-term assets exceed liabilities. Recent earnings showed a net loss of US$18.44 million for Q3 2024, up from the previous year, but improved nine-month losses compared to last year indicate some financial stabilization. The company has undergone executive changes with Ross Muken promoted to President and George Cardoza appointed as CFO to enhance strategic operations and financial management.

- Dive into the specifics of SOPHiA GENETICS here with our thorough balance sheet health report.

- Assess SOPHiA GENETICS' future earnings estimates with our detailed growth reports.

Nevro (NYSE:NVRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nevro Corp. is a medical device company that provides products for patients with chronic pain in the United States and internationally, with a market cap of approximately $123.28 million.

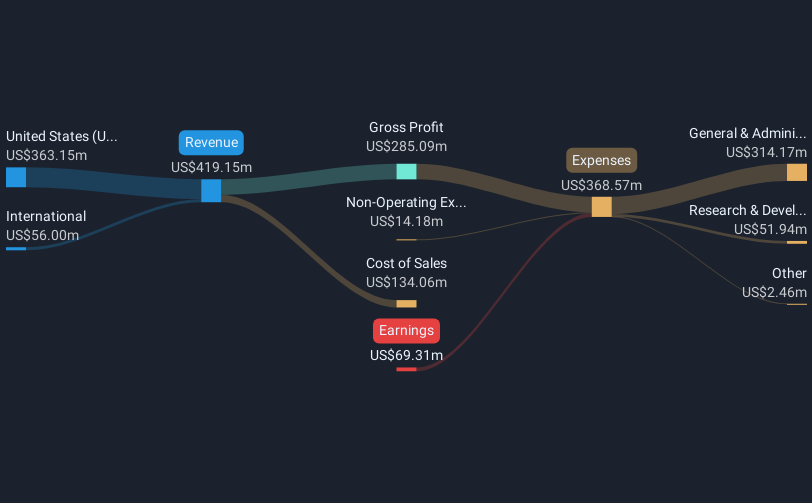

Operations: The company generates revenue from its Medical Products segment, totaling $419.15 million.

Market Cap: $123.28M

Nevro Corp., with a market cap of US$123.28 million, is navigating the penny stock landscape by leveraging its innovative medical devices targeting chronic pain. Despite being unprofitable, it has successfully reduced losses by 11.2% annually over the past five years and maintains more cash than debt. The company's short-term assets significantly exceed both its short- and long-term liabilities, providing financial stability amidst industry volatility. Recent product data highlights Nevro1's superior performance in SI joint fusion, potentially boosting future revenue streams. However, shareholder dilution and an inexperienced management team present ongoing challenges for sustained growth and profitability.

- Navigate through the intricacies of Nevro with our comprehensive balance sheet health report here.

- Gain insights into Nevro's future direction by reviewing our growth report.

Seize The Opportunity

- Embark on your investment journey to our 743 US Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BDTX

Black Diamond Therapeutics

A clinical-stage oncology medicine company, focuses on the discovery and development of MasterKey therapies for patients with genetically defined tumors.

Flawless balance sheet low.

Market Insights

Community Narratives