- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMLR

Semler Scientific (SMLR) Is Down 9.4% After DOJ Probe Settlement and Class Action Lawsuits

Reviewed by Sasha Jovanovic

- Multiple law firms have announced class action lawsuits against Semler Scientific, Inc. alleging that the company failed to disclose a material Department of Justice investigation into potential False Claims Act violations, resulting in an agreement in principle to pay US$29.75 million to settle all claims.

- This wave of litigation focuses on whether Semler Scientific's public statements were materially false or misleading during the period from March 10, 2021, to April 15, 2025, prompting heightened concern among shareholders about transparency and regulatory risk.

- Next, we'll assess how the alleged failure to disclose a DOJ investigation could influence Semler Scientific's investment outlook and perceived risk profile.

The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Semler Scientific Investment Narrative Recap

To be a Semler Scientific shareholder, one must believe in the company’s dual engine vision, generating healthcare cash flow to fuel a leveraged Bitcoin investment strategy, even as healthcare revenues face pressure and regulatory risks intensify. The recent class action lawsuits and US$29.75 million DOJ settlement add focus to regulatory compliance as a near-term risk, potentially shifting attention from the critical catalyst of expanding into new cardiac markets. For now, this legal development is material, with transparency and trust under close investor scrutiny.

Among recent announcements, Semler’s September 2025 guidance, forecasting a more than 50% revenue drop in Q4 due to Medicare reimbursement headwinds, directly ties into both key risks and short-term catalysts. The company’s ability to offset shrinking QuantaFlo device sales through new launches like CardioVanta is now even more central, as revenue declines highlight the importance of diversification and reimbursement strength for supporting both operational and Bitcoin strategies.

By contrast, ongoing legal and reimbursement uncertainties tied to the DOJ settlement create critical information gaps that investors should be aware of before...

Read the full narrative on Semler Scientific (it's free!)

Semler Scientific's outlook predicts $28.8 million in revenue and $4.8 million in earnings by 2028. This reflects a 12.5% annual revenue decline and a decrease in earnings of $32.2 million from current earnings of $37.0 million.

Uncover how Semler Scientific's forecasts yield a $75.33 fair value, a 193% upside to its current price.

Exploring Other Perspectives

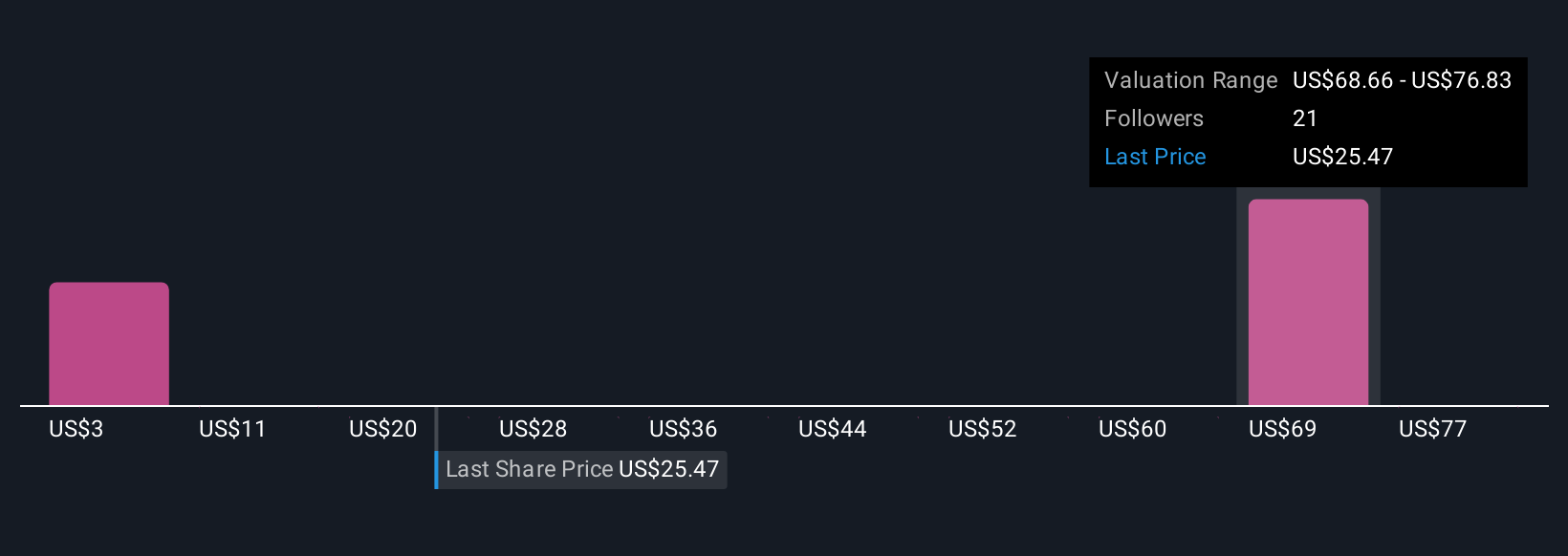

Simply Wall St Community members supplied 6 fair value estimates for Semler Scientific ranging from just US$3.32 to US$85 per share. With healthcare revenue in decline, your view on the company’s risk profile could shape expectations just as widely, consider these varied outlooks as you review the stock.

Explore 6 other fair value estimates on Semler Scientific - why the stock might be worth over 3x more than the current price!

Build Your Own Semler Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semler Scientific research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Semler Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semler Scientific's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMLR

Semler Scientific

Provides technology solutions to enhance the clinical effectiveness and efficiency of healthcare providers in the United States.

Proven track record and fair value.

Market Insights

Community Narratives