- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMLR

Earnings growth outpaced the respectable 56% return delivered to Semler Scientific (NASDAQ:SMLR) shareholders over the last year

Semler Scientific, Inc. (NASDAQ:SMLR) shareholders might be concerned after seeing the share price drop 23% in the last quarter. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 56%.

Since the stock has added US$40m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

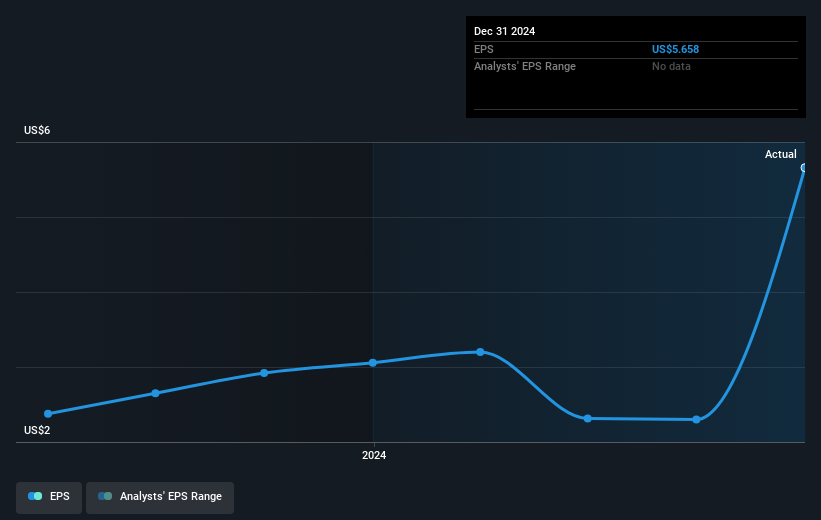

During the last year Semler Scientific grew its earnings per share (EPS) by 85%. It's fair to say that the share price gain of 56% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Semler Scientific as it was before. This could be an opportunity. This cautious sentiment is reflected in its (fairly low) P/E ratio of 9.85.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Semler Scientific's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Semler Scientific shareholders have received a total shareholder return of 56% over one year. That certainly beats the loss of about 2% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Semler Scientific (1 is significant) that you should be aware of.

Semler Scientific is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMLR

Semler Scientific

Provides technology solutions to enhance the clinical effectiveness and efficiency of healthcare providers in the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives