- United States

- /

- Communications

- /

- NasdaqGM:CLFD

Exploring High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.5%, yet it remains up by 22% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks often involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these promising growth projections.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.40% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Blueprint Medicines | 22.61% | 55.18% | ★★★★★★ |

| Travere Therapeutics | 29.54% | 61.86% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Clearfield (NasdaqGM:CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clearfield, Inc. is a company that manufactures and sells fiber connectivity products both in the United States and internationally, with a market capitalization of approximately $492.81 million.

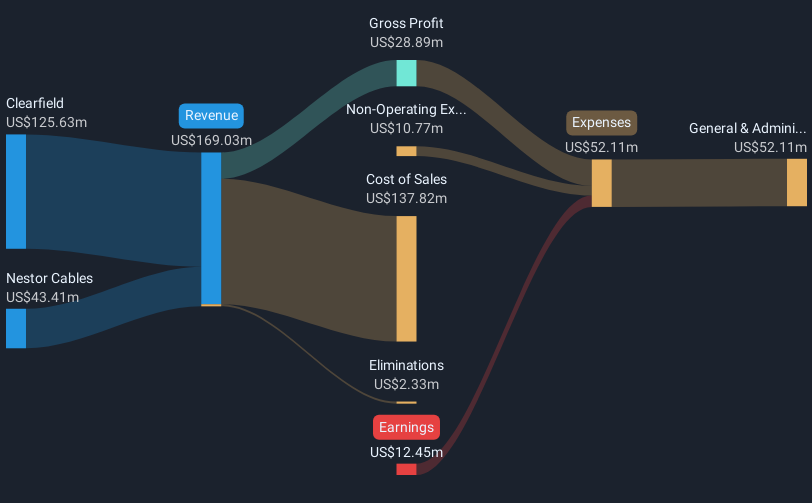

Operations: The company generates revenue primarily through its Clearfield segment, contributing $125.63 million, and Nestor Cables segment, adding $43.41 million.

Clearfield's recent product launch, the StreetSmart Ready Connect Terminal, underscores its commitment to addressing operator needs with innovative solutions tailored for compact and complex environments. This strategic move, coupled with robust conference engagements and a pivotal audit firm change to Deloitte, signals Clearfield's proactive stance in refining operational excellence and market reach. Despite a challenging fiscal year resulting in a net loss of $12.45 million from revenues of $166.71 million—a stark contrast to the previous year's $268.72 million—Clearfield is navigating through its recovery phase by focusing on U.S market-driven revenue growth projected between $170 million to $185 million for FY2025. These maneuvers are foundational as Clearfield steers towards profitability and sustains its competitive edge in the high-tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Clearfield.

Review our historical performance report to gain insights into Clearfield's's past performance.

Simulations Plus (NasdaqGS:SLP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simulations Plus, Inc. specializes in creating software for drug discovery and development, leveraging artificial intelligence and machine learning to model and simulate molecular properties, with a market cap of $567.61 million.

Operations: The company generates revenue primarily from software sales, amounting to $44.15 million, and services contributing $30.29 million. The focus on AI-driven molecular simulation supports its drug discovery and development solutions.

Simulations Plus, Inc. (SLP) is navigating a dynamic growth trajectory with a projected annual revenue increase of 14.3% and an impressive earnings growth rate of 32.1%, outpacing the U.S market average. In fiscal 2025, SLP anticipates revenues between $90 million to $93 million, highlighting its robust business model amidst competitive pressures. Furthermore, the company's commitment to innovation is evident from its R&D focus; recent collaborations with the FDA and University of Connecticut enhance its research capabilities in drug delivery technologies, promising enhanced market competitiveness through scientific advancements. This strategic emphasis on R&D not only fuels SLP's growth but also solidifies its standing in the high-tech pharmaceutical software sector.

Cars.com (NYSE:CARS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cars.com Inc. is an audience-driven technology company offering solutions for the automotive industry in the United States, with a market cap of approximately $1.09 billion.

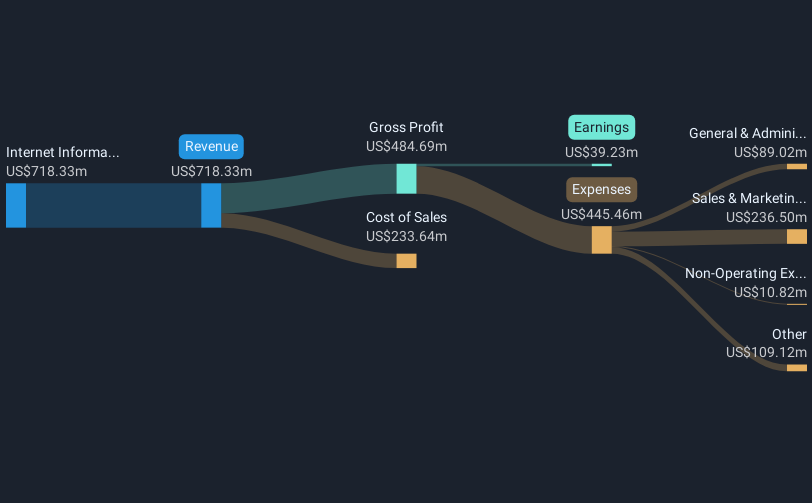

Operations: Cars.com generates revenue primarily from its Internet Information Providers segment, totaling $718.33 million. The company operates within the automotive industry in the United States, leveraging technology-driven solutions to engage its audience.

Cars.com has demonstrated a robust financial performance with a notable increase in net income to $18.72 million from $4.49 million year-over-year as of Q3 2024, underscoring its operational efficiency and market adaptability. Despite a challenging environment, the company has managed to sustain revenue growth, projecting an annual increase of 4% to 5.5%, slightly below the US market average but significant within its sector. This growth is complemented by strategic share repurchases totaling $115.97 million, enhancing shareholder value and reflecting confidence in its future prospects. Additionally, Cars.com's focus on expanding OEM & National revenues suggests a targeted approach to leveraging industry trends towards digital automotive solutions.

- Get an in-depth perspective on Cars.com's performance by reading our health report here.

Explore historical data to track Cars.com's performance over time in our Past section.

Turning Ideas Into Actions

- Reveal the 226 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Clearfield, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLFD

Clearfield

Manufactures and sells various fiber connectivity products in the United States and internationally.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives