- United States

- /

- Healthtech

- /

- NasdaqGS:SHCR

The one-year earnings decline has likely contributed toSharecare's (NASDAQ:SHCR) shareholders losses of 57% over that period

Investing in stocks comes with the risk that the share price will fall. Anyone who held Sharecare, Inc. (NASDAQ:SHCR) over the last year knows what a loser feels like. The share price has slid 57% in that time. Because Sharecare hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 44% in the last three months.

If the past week is anything to go by, investor sentiment for Sharecare isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Sharecare

Sharecare isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

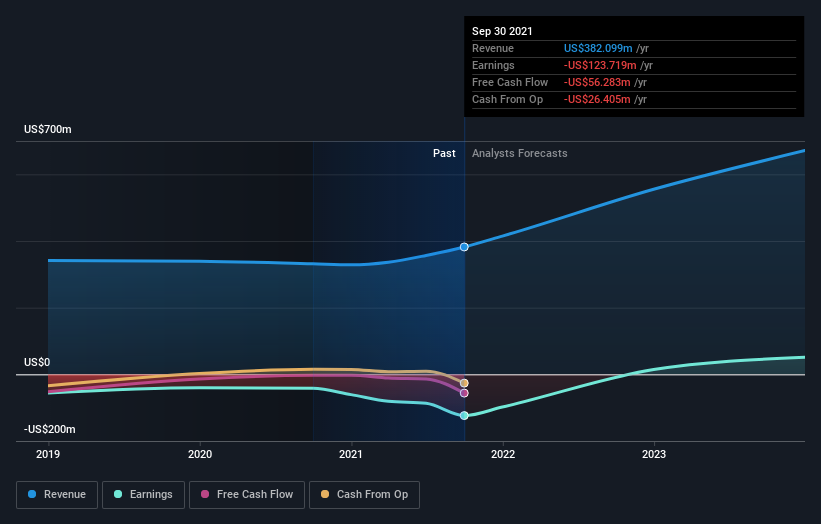

Sharecare grew its revenue by 15% over the last year. We think that is pretty nice growth. Meanwhile, the share price tanked 57%, suggesting the market had much higher expectations. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Sharecare stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 21% in the last year, Sharecare shareholders might be miffed that they lost 57%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 44%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Sharecare better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Sharecare you should know about.

We will like Sharecare better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Sharecare, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHCR

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives