- United States

- /

- Medical Equipment

- /

- NasdaqGS:SGHT

April 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

The United States stock market has recently experienced significant volatility, with major indices like the Dow Jones and Nasdaq seeing sharp declines amid ongoing economic uncertainties and tariff-related concerns. For investors seeking opportunities in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant area of interest. These stocks can potentially offer substantial returns when backed by strong financial health, as they may present hidden value and long-term growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.28 | $319.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.17 | $1.23B | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (NYSE:CINT) | $4.88 | $619.35M | ✅ 5 ⚠️ 0 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.788 | $14.01M | ✅ 4 ⚠️ 4 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $4.80 | $54.65M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.85 | $44.52M | ✅ 4 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.34 | $282M | ✅ 5 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.79 | $5.52M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $213.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $4.18 | $91.53M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 777 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

eGain (NasdaqCM:EGAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: eGain Corporation provides customer service infrastructure software solutions across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of $129.96 million.

Operations: The company generates $89 million in revenue from its Software & Programming segment.

Market Cap: $129.96M

eGain Corporation, with a market cap of US$129.96 million, operates in the Software & Programming sector, generating US$89 million in revenue. Despite recent challenges such as declining profit margins from 7.3% to 4.9% and negative earnings growth of -38.3%, eGain remains debt-free with strong short-term asset coverage over liabilities. The company has maintained stable weekly volatility at 7% and completed a significant share buyback program, repurchasing 15.16% of shares for US$30.02 million since November 2022, indicating confidence in its long-term strategy despite current earnings forecasts suggesting declines ahead.

- Unlock comprehensive insights into our analysis of eGain stock in this financial health report.

- Explore eGain's analyst forecasts in our growth report.

Vivani Medical (NasdaqCM:VANI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vivani Medical, Inc. is a preclinical stage biopharmaceutical company focused on developing miniaturized and subdermal implants for chronic disease treatment, with a market cap of $60.43 million.

Operations: Vivani Medical, Inc. has not reported any revenue segments as it is currently in the preclinical stage of its operations.

Market Cap: $60.43M

Vivani Medical, Inc., with a market cap of US$60.43 million, is a pre-revenue biopharmaceutical company focused on developing subdermal implants for chronic diseases. Despite being unprofitable, Vivani has shown progress in its clinical trials for NPM-139 and the LIBERATE-1 study, targeting obesity and type 2 diabetes treatment. The company recently announced promising preclinical data and secured additional capital through a private placement agreement worth US$8.25 million to support ongoing research efforts. With sufficient short-term assets covering liabilities and no debt, Vivani aims to leverage Australian R&D rebates to offset trial costs while advancing its innovative implant technology.

- Click here to discover the nuances of Vivani Medical with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Vivani Medical's future.

Sight Sciences (NasdaqGS:SGHT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sight Sciences, Inc. is an ophthalmic medical device company that develops and commercializes surgical and nonsurgical technologies for treating prevalent eye diseases, with a market cap of $107.29 million.

Operations: The company's revenue is derived from two main segments: Surgical Glaucoma, which generated $75.90 million, and Dry Eye, contributing $3.96 million.

Market Cap: $107.29M

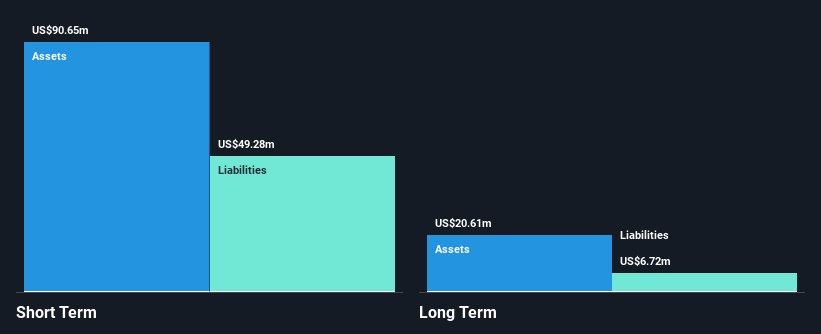

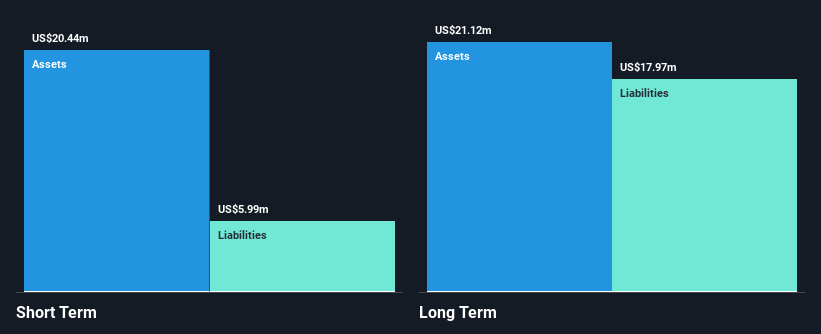

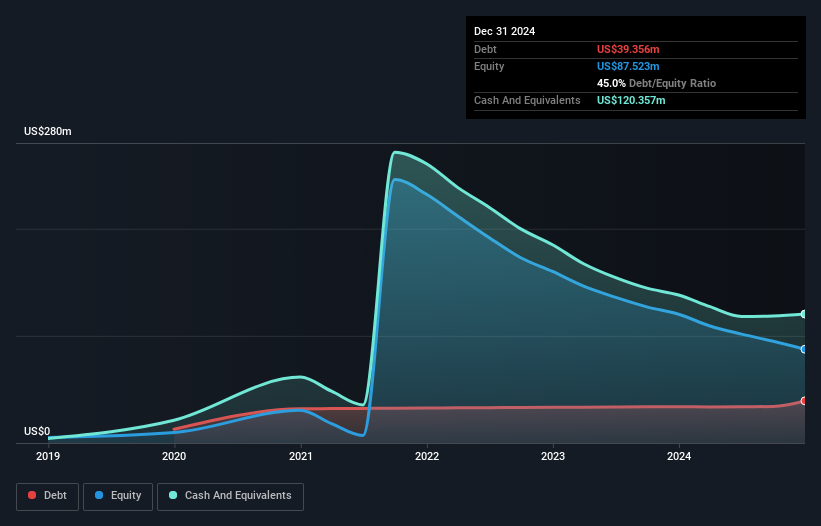

Sight Sciences, Inc., with a market cap of US$107.29 million, focuses on ophthalmic medical devices and reported 2024 sales of US$79.87 million. Despite generating revenue primarily from its Surgical Glaucoma segment, the company remains unprofitable with a net loss of US$51.51 million for 2024 and is not expected to achieve profitability in the near term. The company's cash reserves exceed its debt, providing a runway exceeding three years based on current free cash flow trends. However, significant insider selling and high share price volatility pose risks for investors considering this penny stock in their portfolio strategies.

- Click to explore a detailed breakdown of our findings in Sight Sciences' financial health report.

- Assess Sight Sciences' future earnings estimates with our detailed growth reports.

Taking Advantage

- Access the full spectrum of 777 US Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGHT

Sight Sciences

An ophthalmic medical device company, focuses on the development and commercialization of surgical and nonsurgical technologies for the treatment of eye prevalent diseases.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives