- United States

- /

- Chemicals

- /

- NYSE:VHI

Three Undiscovered Gems In The United States With Promising Potential

Reviewed by Simply Wall St

The market has stayed flat over the past 7 days but has risen 33% in the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this dynamic environment, identifying stocks with solid fundamentals and growth potential can be particularly rewarding for investors looking to uncover undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| First National Bank Alaska | 221.06% | 2.98% | 1.82% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated offers management services to cosmetic treatment centers in Japan, Vietnam, and internationally, with a market cap of $968.14 million.

Operations: SBC Medical Group Holdings generates revenue from healthcare facilities and services, amounting to $217.54 million.

SBC Medical Group Holdings, recently added to the NASDAQ Composite Index, has demonstrated impressive performance with earnings growing by 164% over the past year, significantly outpacing the healthcare industry’s 8%. Trading at 92.9% below its estimated fair value, SBC offers a compelling investment case. Despite substantial shareholder dilution in the past year and high share price volatility over three months, it remains profitable with free cash flow of US$64.23M as of September 2024.

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $953.53 million.

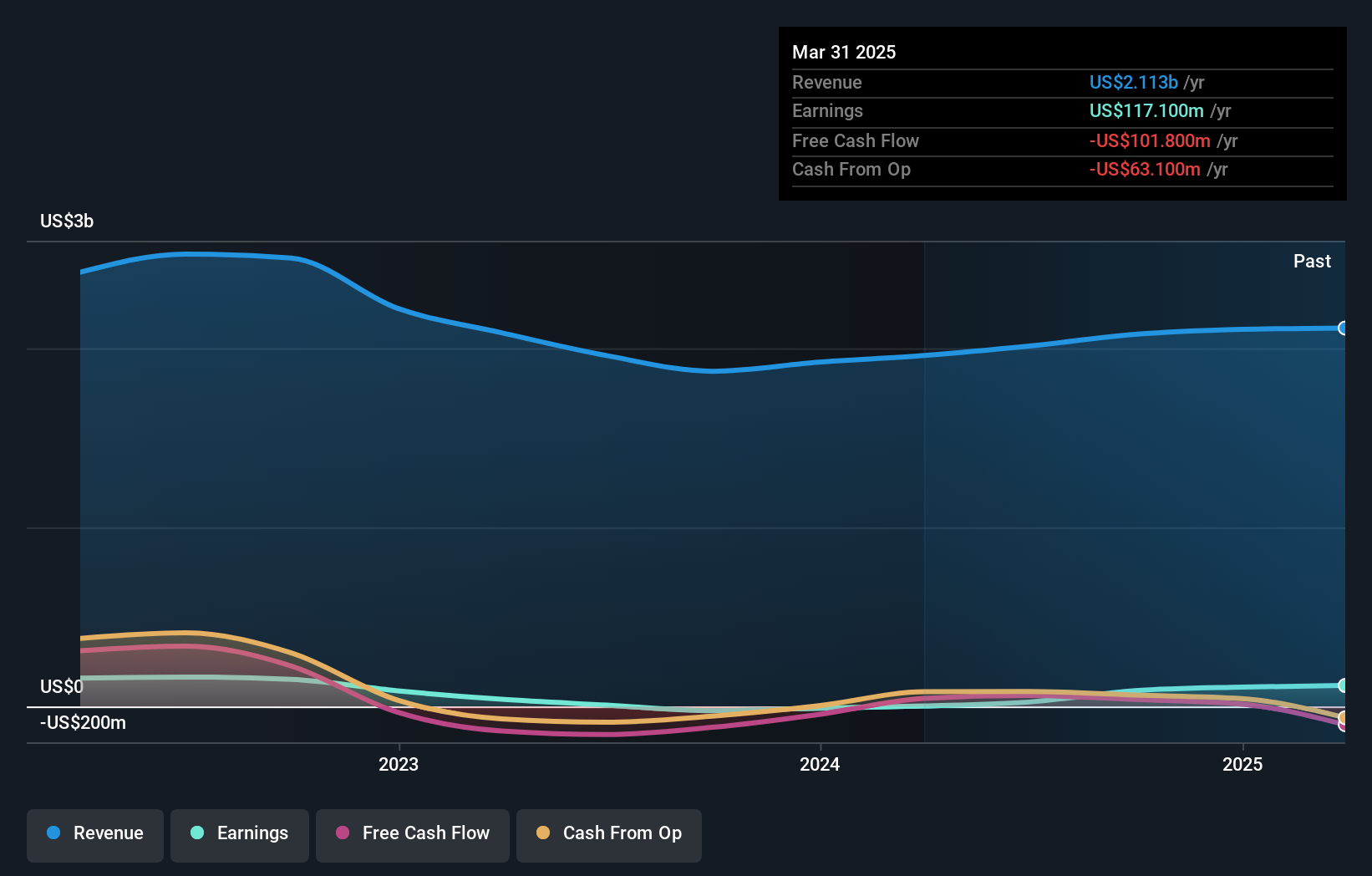

Operations: Valhi, Inc. generates revenue primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million). The company’s gross profit margin is a key financial metric to consider in evaluating its profitability across these diverse sectors.

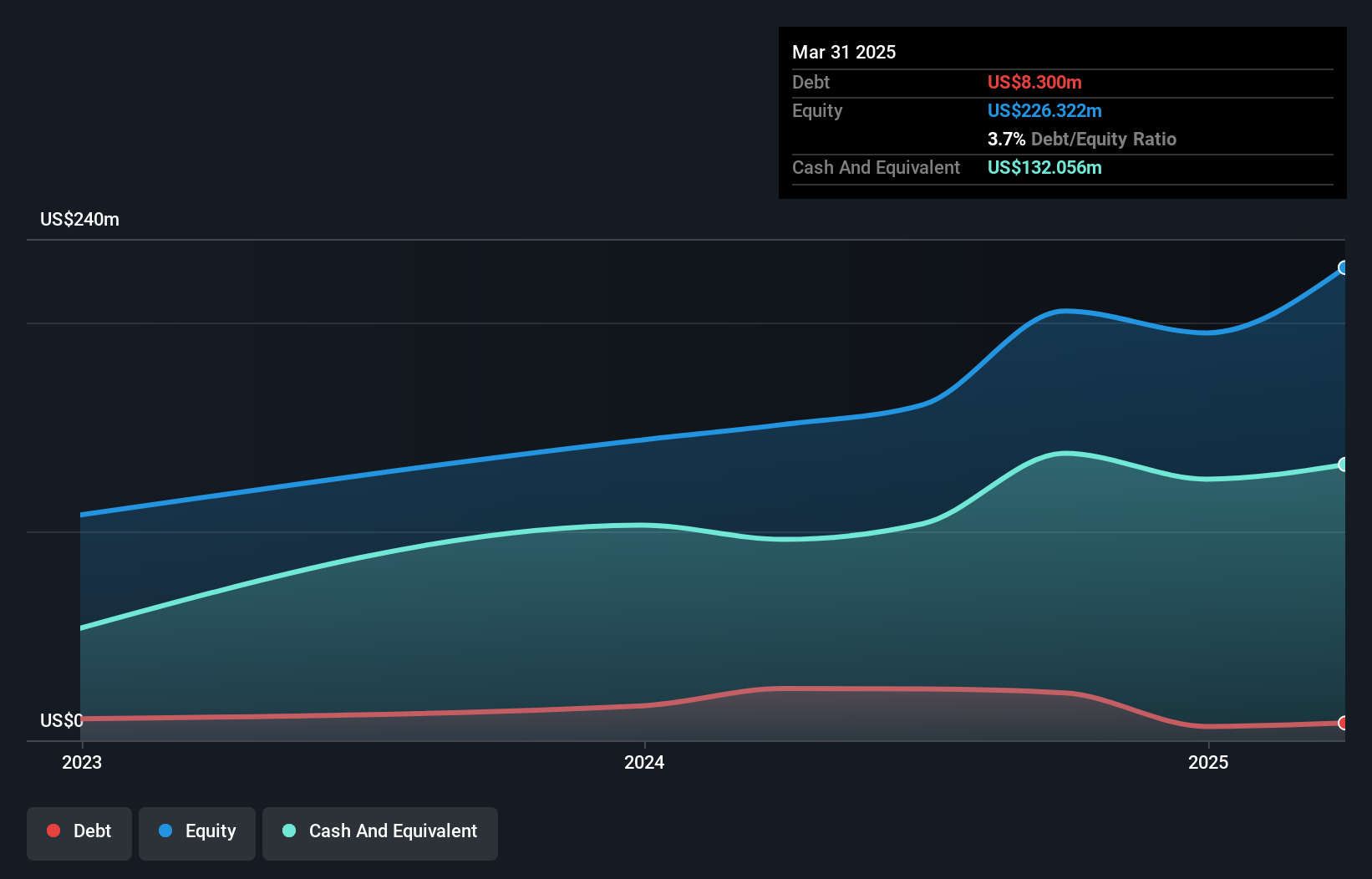

Valhi has demonstrated significant growth, with earnings surging by 215.4% over the past year, outpacing the Chemicals industry’s -4.8%. The company’s debt to equity ratio has improved from 78% to 38.7% in five years, reflecting better financial health. Additionally, Valhi's interest payments are well covered by EBIT at a ratio of 4.7x. Recent earnings reports show a net income of US$19.9 million for Q2 2024 compared to a net loss of US$3.2 million last year, highlighting strong performance improvements.

- Dive into the specifics of Valhi here with our thorough health report.

Understand Valhi's track record by examining our Past report.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. provides financial services through an AI-powered platform in China and has a market cap of $451.19 million.

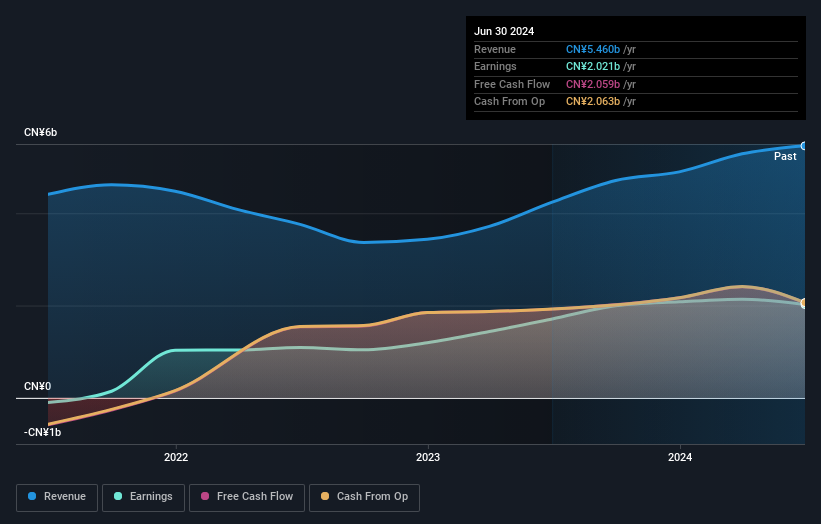

Operations: Yiren Digital generates revenue primarily from its Financial Services Business (CN¥3.04 billion) and Insurance Brokerage Business (CN¥579.22 million), with additional contributions from the Consumption & Lifestyle Business (CN¥1.84 billion).

Yiren Digital, a player in the consumer finance industry, has shown impressive earnings growth of 18.2% over the past year, outpacing the industry's -8.4%. Trading at 83.8% below its estimated fair value, it offers significant upside potential. The company is debt-free and recently repurchased 815,522 shares for $4 million between April and June 2024. Additionally, Yiren Digital announced a semi-annual dividend policy and appointed Yuning Feng as the new CFO to steer financial operations effectively.

- Take a closer look at Yiren Digital's potential here in our health report.

Examine Yiren Digital's past performance report to understand how it has performed in the past.

Taking Advantage

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 204 more companies for you to explore.Click here to unveil our expertly curated list of 207 US Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VHI

Valhi

Engages in the chemicals, component products, and real estate management and development businesses in Europe, North America, the Asia Pacific, and internationally.

Excellent balance sheet slight.