- United States

- /

- Healthcare Services

- /

- NasdaqGS:RCM

R1 RCM's (NASDAQ:RCM) Promising Earnings May Rest On Soft Foundations

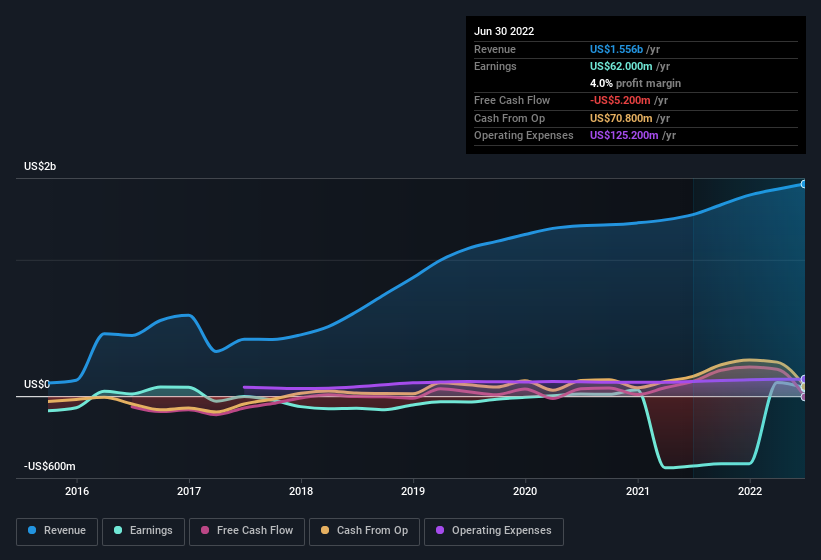

Despite posting some strong earnings, the market for R1 RCM Inc.'s (NASDAQ:RCM) stock hasn't moved much. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

See our latest analysis for R1 RCM

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, R1 RCM increased the number of shares on issue by 51% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of R1 RCM's EPS by clicking here.

How Is Dilution Impacting R1 RCM's Earnings Per Share (EPS)?

R1 RCM was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a fairly significant impact on shareholders.

If R1 RCM's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

On top of the dilution, we should also consider the US$125m impact of unusual items in the last year, which had the effect of suppressing profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to June 2022, R1 RCM had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On R1 RCM's Profit Performance

R1 RCM suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Given the contrasting considerations, we don't have a strong view as to whether R1 RCM's profits are an apt reflection of its underlying potential for profit. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that R1 RCM is showing 4 warning signs in our investment analysis and 2 of those don't sit too well with us...

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RCM

R1 RCM

Provides technology-driven solutions for the financial performance and patient experience of health systems, hospitals, and physician groups.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives