- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

Insulet (PODD): Assessing Valuation After Recent Share Price Cooldown

Reviewed by Simply Wall St

Insulet stock reaction to recent performance

Insulet (PODD) has quietly slipped over the past week and month, even though shares are still up solidly this year, making investors wonder whether the pullback is an opportunity or an early warning.

See our latest analysis for Insulet.

The recent softness, including a roughly 12% three-month share price return, sits against a near 20% year-to-date share price gain and a more modest one-year total shareholder return. This suggests momentum is cooling as investors reassess growth and risk.

If Insulet’s moves have you rethinking healthcare exposure, it could be a good moment to explore other healthcare stocks that might complement or balance your portfolio.

With Insulet still delivering double digit growth and trading at a notable discount to analyst targets, investors now face a key question: is there a genuine buying opportunity here, or is the market already pricing in future gains?

Most Popular Narrative: 18.7% Undervalued

With Insulet last closing at $307.56 versus a narrative fair value of $378.21, some investors may view this as the basis for an ambitious long term growth story.

Analysts are assuming Insulet's revenue will grow by 17.8% annually over the next 3 years.

Analysts assume that profit margins will increase from 10.0% today to 14.1% in 3 years time.

To understand what is used to support those projected changes in revenues and profits, and the future earnings multiple that underpins this price tag, you can explore the full narrative.

Result: Fair Value of $378.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on Omnipod and rising competition in diabetes devices could derail those growth assumptions if adoption or pricing power weakens.

Find out about the key risks to this Insulet narrative.

Another View: Rich Multiples Temper The Story

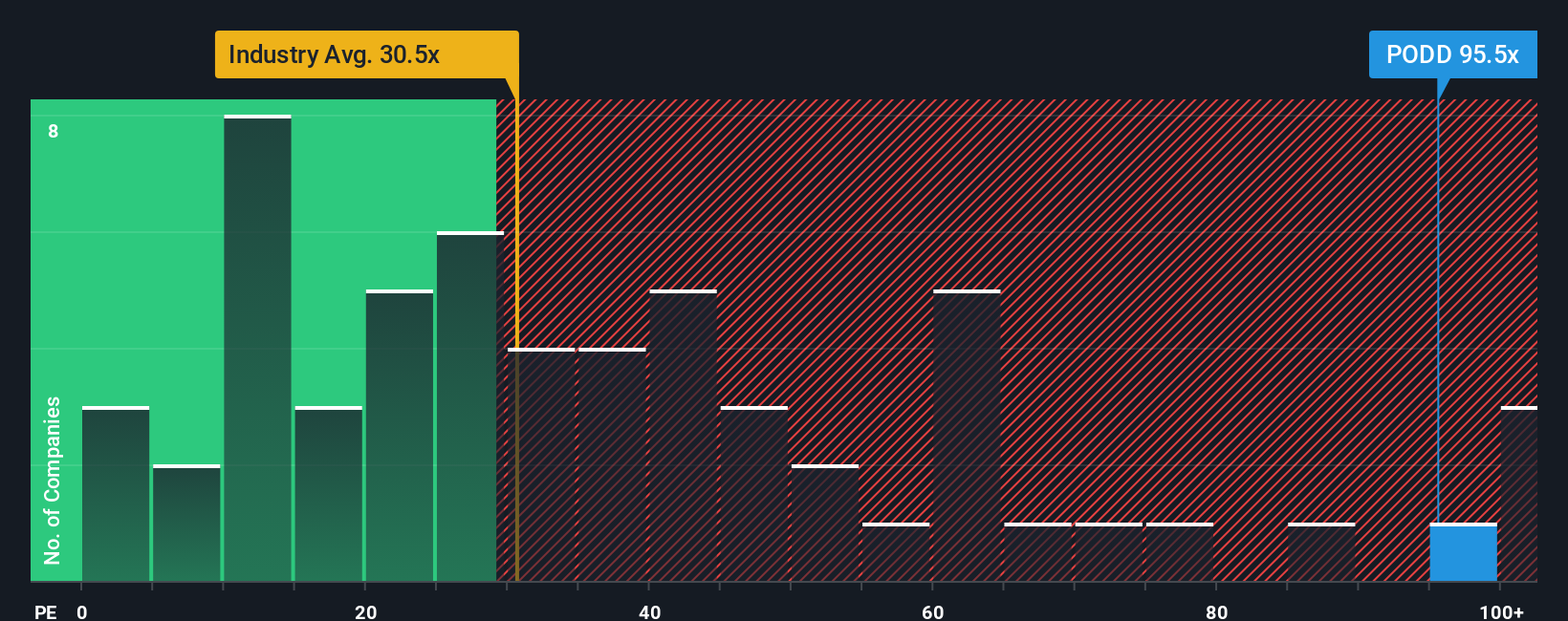

While the narrative fair value suggests upside, the market is already paying a steep price. Insulet trades on a price to earnings ratio of 87.9 times, versus about 30 times for peers and 37.6 times as a fair ratio. This means any stumble could trigger a sharp de rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insulet Narrative

If you are not fully aligned with this view or prefer digging into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Insulet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment move?

Use the Simply Wall St Screener now to uncover focused opportunities across sectors before everyone else, and keep your watchlist filled with fresh, high conviction ideas.

- Capture potential multi baggers early by targeting these 3571 penny stocks with strong financials that already show robust balance sheets and real earnings power, not just speculative hype.

- Position your portfolio for structural growth by zeroing in on these 25 AI penny stocks helping power automation, intelligent software, and next generation data infrastructure.

- Lock in stronger income streams by filtering for these 14 dividend stocks with yields > 3% that combine cash payouts with businesses designed to endure a range of economic conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026