- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

Insulet (NasdaqGS:PODD) Reports Q4 Earnings and Offers 2025 Revenue Growth Guidance

Reviewed by Simply Wall St

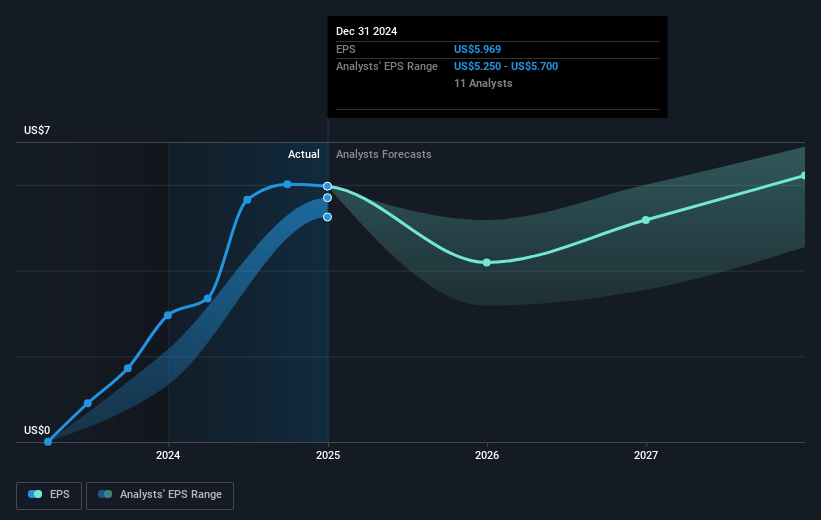

Insulet (NasdaqGS:PODD) recently issued strong revenue guidance for the first quarter and full year of 2025, anticipating significant growth across its Omnipod product lines despite challenges in drug delivery. This optimism was grounded in the company’s fourth-quarter results, which showed a 17% increase in sales to $597.5 million, although net income saw a slight decline. The positive outlook and solid sales performance contributed to a 10% increase in Insulet’s shares over the last quarter. These developments occurred alongside broader market trends where major indexes, such as the Dow and Nasdaq, experienced losses, primarily influenced by declines in specific sectors. In contrast, Insulet's focus on expanding the availability of its Omnipod system, now launched in several European countries, appeared to bolster investor confidence. In addition to this, advancements in product compatibility and clinical benefits likely supported its share price resilience amidst the volatile market dynamics.

Click here and access our complete analysis report to understand the dynamics of Insulet.

Over the past five years, Insulet's shareholders enjoyed a 56.89% total return, which underscores the company's robust performance in developing and expanding its Omnipod product line. This period has seen Insulet's earnings grow significantly, with annual earnings growth averaging a highly impressive rate. The launch of Omnipod 5, which became available in key European markets like Italy and the Nordic countries by early 2025, introduced compatibility with leading CGM sensors such as Abbott's FreeStyle Libre 2 and Dexcom G6. These advancements played a crucial role in enhancing market appeal and investor confidence.

The company's performance over the last year also surpassed both the US Market's return of 23.7% and the Medical Equipment industry's return of 11.6%, highlighting Insulet's solid footing in the market. One critical factor was the acceleration of earnings growth, which outpaced the industry substantially. Additionally, despite some insider selling in the past quarter, Insulet maintained a strong financial position that facilitated consistent expansion and innovation.

- Discover whether Insulet is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Analyze the downside risks for Insulet and understand their potential impact—click to learn more.

- Already own Insulet? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives