- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

Analyst Optimism and Leadership Awards Could Be a Game Changer for Progyny (PGNY)

Reviewed by Sasha Jovanovic

- Progyny recently attracted attention as a value stock, earning a Zacks Rank #2 (Buy) and an A grade for Value, with analyst ratings highlighting forward P/E and PEG ratios below industry averages alongside a strong earnings outlook.

- The company's CEO, Pete Anevski, was also named a Champion for Women’s Health by the World Economic Forum and the Global Alliance for Women’s Health in early October 2025, underscoring Progyny’s advocacy and leadership in global women’s health initiatives.

- We'll explore how increased recognition of Progyny’s investment value and analyst enthusiasm could reinforce its long-term growth story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Progyny Investment Narrative Recap

For anyone considering Progyny as a potential investment, belief in sustained demand for employer-sponsored women’s health and fertility benefits is key. The recent recognition of Progyny as a value stock by Zacks, alongside the CEO’s award for global women’s health advocacy, does not materially shift the immediate business catalysts or top risks: steady client growth remains critical, and pressure from employer cost management continues as the biggest near-term risk.

The company’s latest partnership with Amazon’s Health Benefits Connector stands out, making its services more accessible and potentially supporting future client acquisition, a direct play into one of the most important growth catalysts for Progyny. However, the potential for slowed benefit expansion if employers face tighter budgets is a point that investors should keep top of mind as they assess recent news.

Yet, it’s important to be aware that cost-conscious employers could quickly shift priorities if...

Read the full narrative on Progyny (it's free!)

Progyny's narrative projects $1.6 billion revenue and $112.9 million earnings by 2028. This requires 8.9% yearly revenue growth and a $59.8 million earnings increase from $53.1 million.

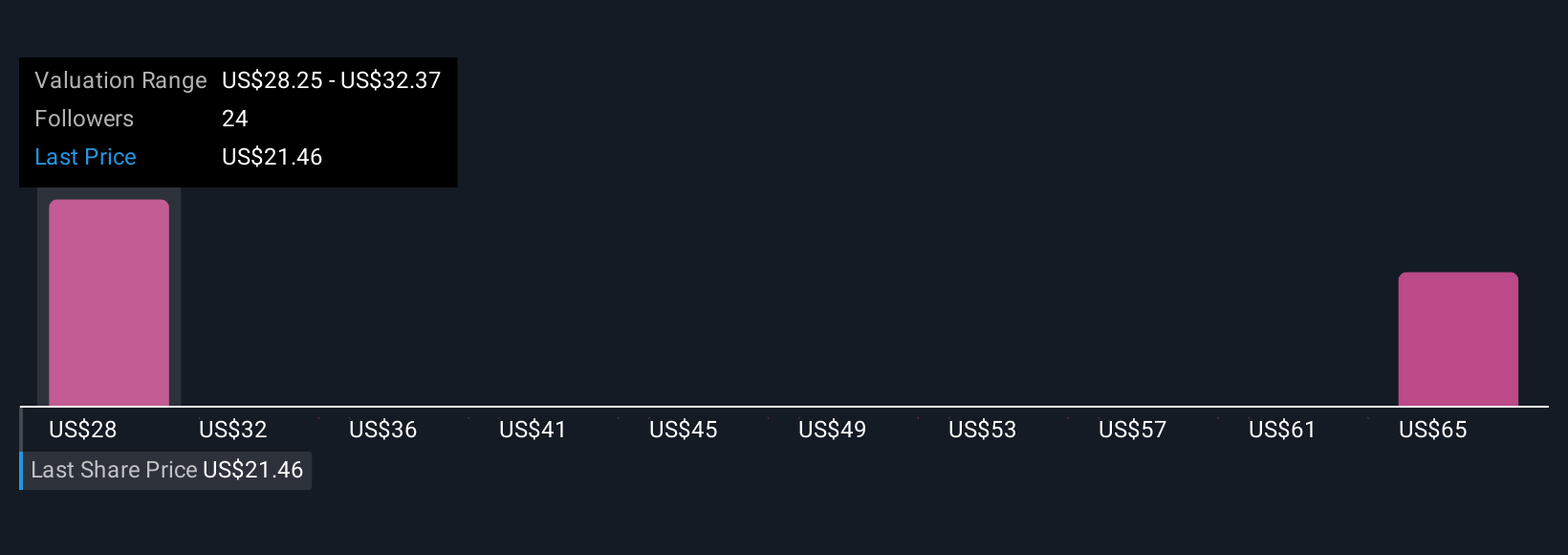

Uncover how Progyny's forecasts yield a $28.25 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for Progyny between US$28.25 and US$69.42. While many market participants are optimistic about employer demand, opinions differ sharply, explore multiple views to inform your decision.

Explore 3 other fair value estimates on Progyny - why the stock might be worth over 3x more than the current price!

Build Your Own Progyny Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Progyny research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Progyny research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Progyny's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives