- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

A Fresh Look at Progyny (PGNY) Valuation Following Expanded Fertility Benefits With Fellow Health

Reviewed by Kshitija Bhandaru

If you are considering what to do with Progyny (PGNY) after today’s announcement, you are not alone. The company revealed that Fellow Health is joining its network to offer mail-in semen analysis as a covered benefit. This move addresses a longstanding hurdle in fertility care by giving patients a private and convenient option for an essential step in the process. It also strengthens Progyny’s push to expand its ecosystem of accessible, clinical-grade solutions.

The news comes as Progyny continues to build on its reputation as a leader in women’s health and family-building benefits. Over the past year, the stock has delivered a 29% total return, with momentum picking up since the start of the year. Investors appear to be watching how strategic initiatives like this one could drive further adoption of Progyny’s services and reshape its long-term growth narrative.

With a boost in the share price this year, does this uptick reflect the promise of Progyny’s expanding offerings, or are investors already pricing in future growth for the stock?

Most Popular Narrative: 21.7% Undervalued

The most widely followed narrative sees Progyny as significantly undervalued, with consensus suggesting there is still substantial upside left in the current share price.

"Investment in an integrated women's health platform (including new services such as pelvic floor therapy, leave navigation, and enhanced digital engagement) positions Progyny to cross-sell adjacent products, resulting in higher share of wallet with current clients and additional revenue streams. This supports both topline and margin expansion."

Want to know the exact playbook that has analysts this bullish? A cluster of bold financial projections underpins the fair value estimate, and some could surprise you. The narrative’s upside case relies on impressive growth rates and a future profit multiple rarely seen in today’s healthcare sector. Curious what those are and why they matter so much? Keep reading to see what could be driving this stock’s next big move.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory scrutiny or aggressive competition could quickly shift sentiment, which may threaten the bullish thesis and put pressure on both margins and growth projections.

Find out about the key risks to this Progyny narrative.Another View: What the Numbers Say

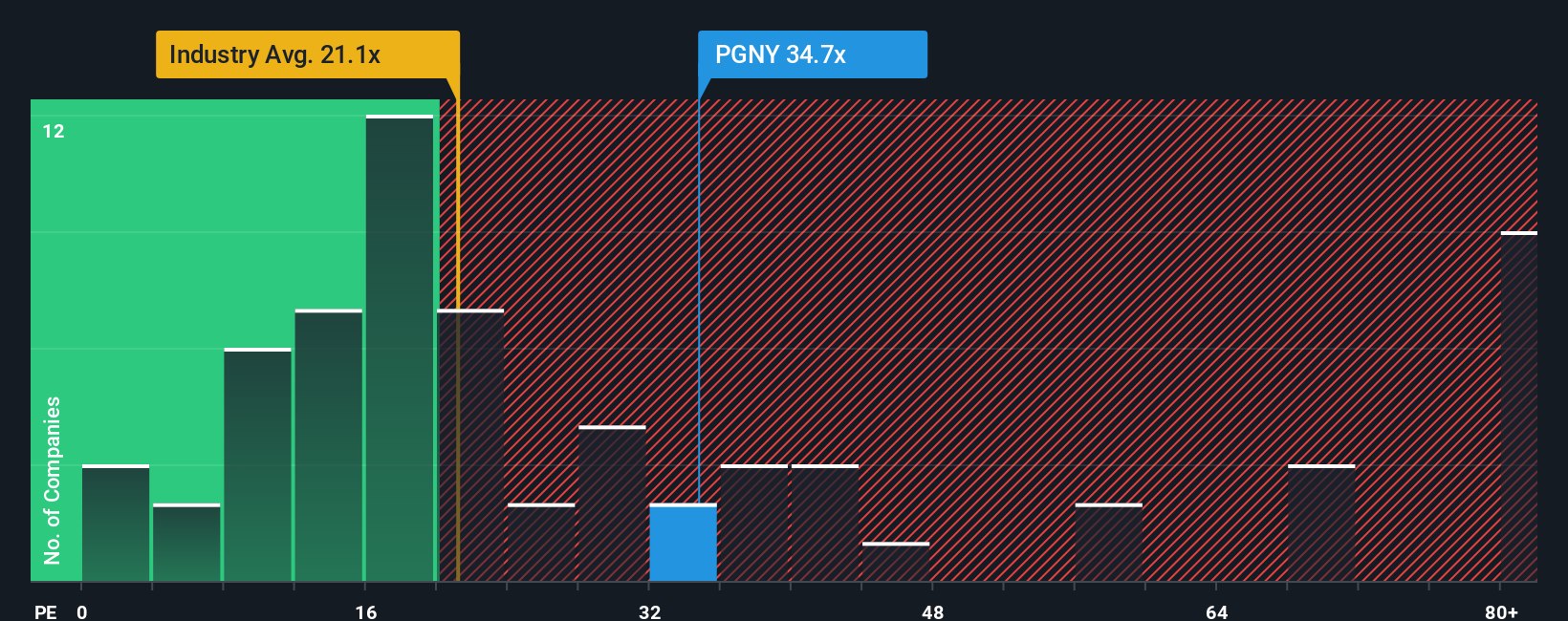

Some investors look at the current price compared to company earnings and see Progyny trading at a higher ratio than others in the healthcare industry. This raises the question: is market optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Progyny to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Progyny Narrative

If you see things differently or want a deeper look at the numbers, it only takes a few minutes to build your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Progyny.

Looking for More Standout Investment Ideas?

Opportunities don’t stop at Progyny. If you want to give your portfolio an advantage, tap into screens built to spotlight tomorrow’s winners and hidden gems before the crowd catches on.

- Uncover growth stories in health tech by trying healthcare AI stocks. This screen spotlights companies on the frontline of innovation with medical AI breakthroughs.

- Pounce on market inefficiencies with undervalued stocks based on cash flows. This tool highlights stocks that may be trading below their real worth according to underlying cash flows.

- Spot high-potential upstarts by browsing penny stocks with strong financials. Here you can find emerging companies with solid financials that are gaining serious investor attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives