- United States

- /

- Healthtech

- /

- OTCPK:PEAR.Q

Slammed 82% Pear Therapeutics, Inc. (NASDAQ:PEAR) Screens Well Here But There Might Be A Catch

Pear Therapeutics, Inc. (NASDAQ:PEAR) shareholders that were waiting for something to happen have been dealt a blow with a 82% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 98% share price decline.

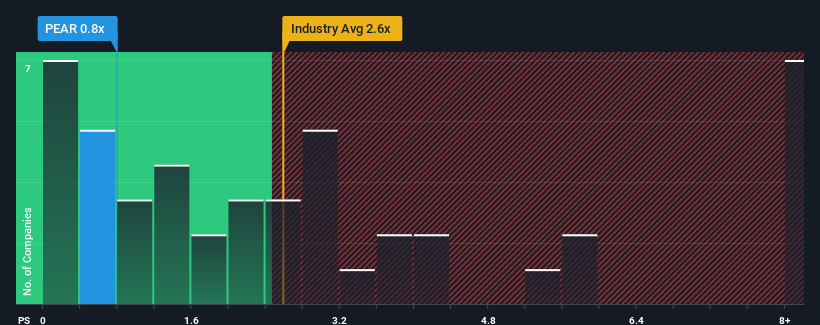

Since its price has dipped substantially, Pear Therapeutics may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Pear Therapeutics

How Pear Therapeutics Has Been Performing

With revenue growth that's superior to most other companies of late, Pear Therapeutics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Pear Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Pear Therapeutics would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 202% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 61% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 73% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 18% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Pear Therapeutics' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Pear Therapeutics' P/S Mean For Investors?

Pear Therapeutics' recently weak share price has pulled its P/S back below other Healthcare Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Pear Therapeutics' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 5 warning signs we've spotted with Pear Therapeutics (including 2 which are potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Pear Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:PEAR.Q

Pear Therapeutics

A commercial-stage healthcare company, develops and sells software-based medicines in the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives