- United States

- /

- Medical Equipment

- /

- NasdaqCM:PDEX

Here's Why Pro-Dex (NASDAQ:PDEX) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Pro-Dex (NASDAQ:PDEX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Pro-Dex with the means to add long-term value to shareholders.

We've discovered 3 warning signs about Pro-Dex. View them for free.Pro-Dex's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Pro-Dex has achieved impressive annual EPS growth of 48%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

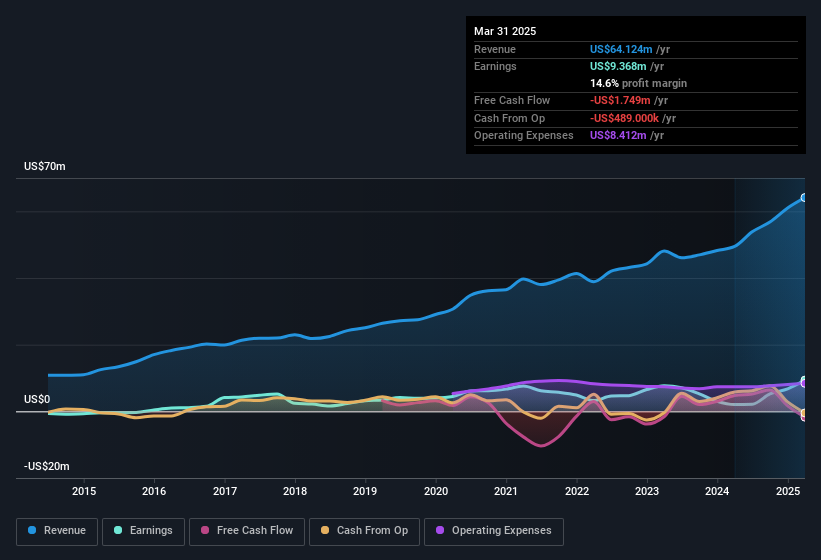

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Pro-Dex is growing revenues, and EBIT margins improved by 5.2 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

See our latest analysis for Pro-Dex

Since Pro-Dex is no giant, with a market capitalisation of US$150m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Pro-Dex Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Pro-Dex with market caps under US$200m is about US$663k.

The Pro-Dex CEO received US$441k in compensation for the year ending June 2024. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Pro-Dex To Your Watchlist?

Pro-Dex's earnings per share growth have been climbing higher at an appreciable rate. This appreciable increase in earnings could be a sign of an upward trajectory for the company. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. We don't want to rain on the parade too much, but we did also find 3 warning signs for Pro-Dex (2 are significant!) that you need to be mindful of.

Although Pro-Dex certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PDEX

Pro-Dex

Designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026