- United States

- /

- Biotech

- /

- NasdaqGS:GBIO

Promising Penny Stocks On US Exchanges In November 2024

Reviewed by Simply Wall St

As October 2024 came to a close, major U.S. indices like the S&P 500, Nasdaq, and Dow Jones Industrial Average posted losses for the month, driven by disappointing earnings from big tech companies. In light of these market fluctuations, investors may find opportunities in lesser-known areas such as penny stocks—stocks often associated with smaller or newer companies that can still offer surprising value despite their outdated moniker. By focusing on those with solid financial foundations and potential for growth, investors might uncover promising opportunities among these overlooked stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.799 | $5.75M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.175 | $534.34M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.12B | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $50.82M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.36 | $147.91M | ★★★★★★ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $2.91 | $99.68M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.05 | $98.93M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $97.93M | ★★★★☆☆ |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Codexis (NasdaqGS:CDXS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Codexis, Inc. is a company that discovers, develops, and sells enzymes and other proteins with a market cap of $226.26 million.

Operations: The biotechnology segment generated $60.89 million in revenue.

Market Cap: $226.26M

Codexis, Inc., with a market cap of US$226.26 million, operates in the biotechnology sector generating US$60.89 million in revenue. Despite being unprofitable and experiencing increased losses over five years, Codexis maintains more cash than total debt and has sufficient cash runway for 2.7 years if free cash flow trends continue. Recent strategic moves include a non-exclusive licensing agreement with Alphazyme LLC to enhance enzyme commercialization and capital raises totaling US$31 million to bolster its financial position. The management team has been strengthened with new appointments, indicating a focus on future growth initiatives despite current challenges.

- Navigate through the intricacies of Codexis with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Codexis' future.

Generation Bio (NasdaqGS:GBIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Generation Bio Co. focuses on developing non-viral genetic medicines to treat rare and prevalent diseases, with a market cap of approximately $159.51 million.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to $13.17 million.

Market Cap: $159.51M

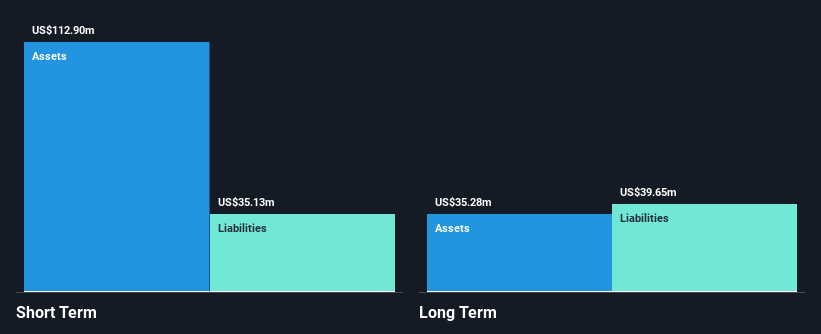

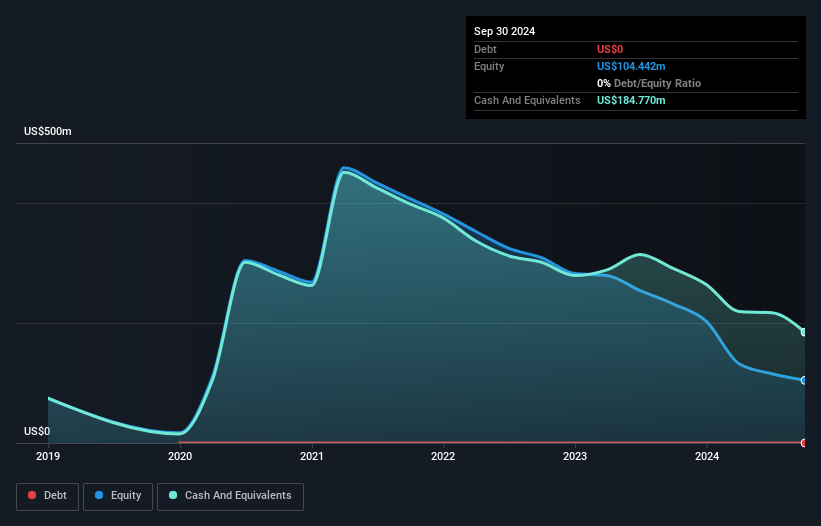

Generation Bio Co., with a market cap of US$159.51 million, is focused on developing non-viral genetic medicines. Despite being unprofitable and not expected to achieve profitability soon, it maintains strong financial health with short-term assets exceeding both short and long-term liabilities, and no debt burden. The company has a cash runway for 2.8 years if free cash flow continues to decrease at historical rates. Recent developments include promising data from its collaboration with Moderna on ctLNP and iqDNA platforms, which were presented at the ESGCT Congress, highlighting potential advancements in gene therapy delivery methods.

- Click here and access our complete financial health analysis report to understand the dynamics of Generation Bio.

- Assess Generation Bio's future earnings estimates with our detailed growth reports.

OraSure Technologies (NasdaqGS:OSUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OraSure Technologies, Inc. operates in the healthcare sector by offering point-of-care and home diagnostic tests, specimen collection devices, and microbiome laboratory services globally, with a market cap of approximately $317.66 million.

Operations: The company's revenue is primarily derived from its Diagnostics and Molecular Solutions segment, which generated $273.54 million.

Market Cap: $317.66M

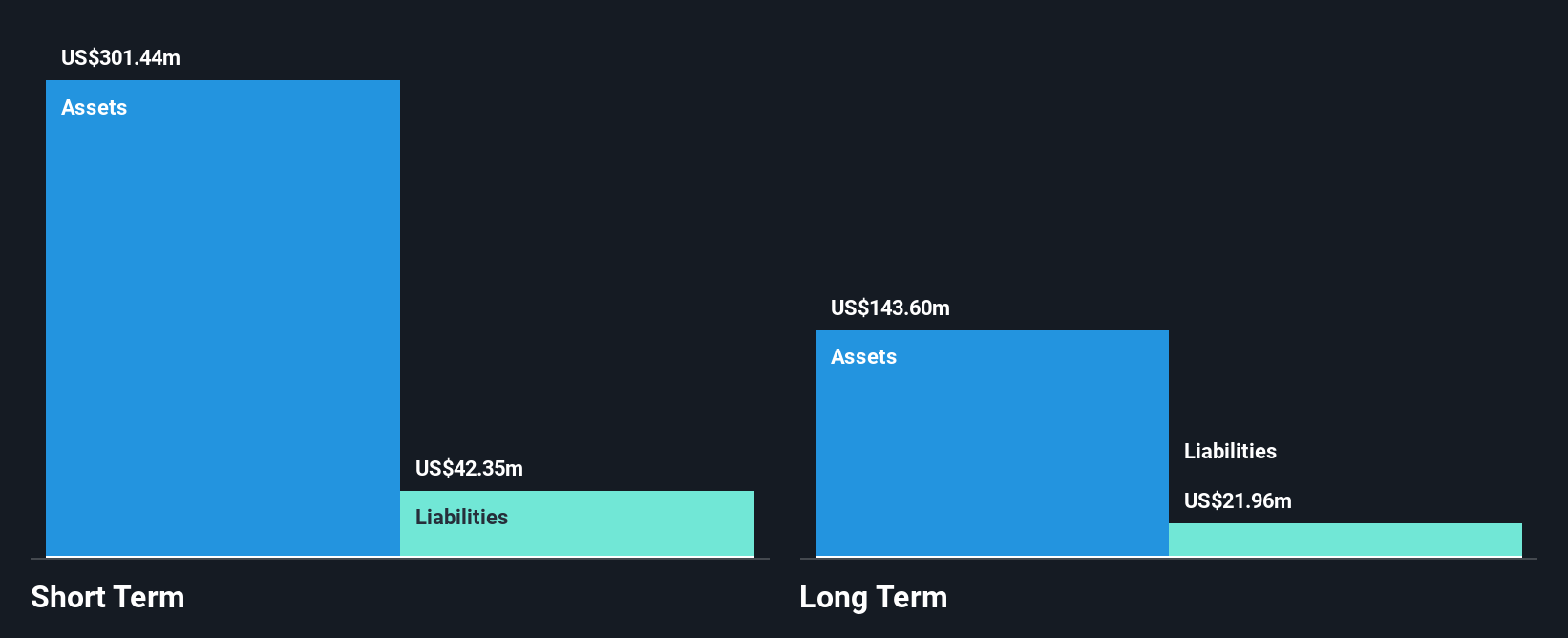

OraSure Technologies, Inc., with a market cap of US$317.66 million, operates in the healthcare sector offering diagnostic solutions. Despite recent revenue declines to US$54.34 million in Q2 2024 from US$85.44 million a year ago, the company remains debt-free with short-term assets exceeding liabilities significantly. Its net profit margin has improved slightly over the past year despite large one-off losses impacting financial results. Recent strategic moves include board expansion and filing for a $12.66 million shelf registration, indicating potential capital raising activities which could support future growth initiatives amidst challenging earnings forecasts.

- Take a closer look at OraSure Technologies' potential here in our financial health report.

- Explore OraSure Technologies' analyst forecasts in our growth report.

Summing It All Up

- Jump into our full catalog of 756 US Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GBIO

Generation Bio

Develops non-viral genetic medicines for the treatment of rare and prevalent diseases.

Flawless balance sheet low.