- United States

- /

- Medical Equipment

- /

- OTCPK:OSAP.Q

ProSomnus, Inc.'s (NASDAQ:OSA) Shares Leap 60% Yet They're Still Not Telling The Full Story

ProSomnus, Inc. (NASDAQ:OSA) shareholders are no doubt pleased to see that the share price has bounced 60% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 80% share price decline over the last year.

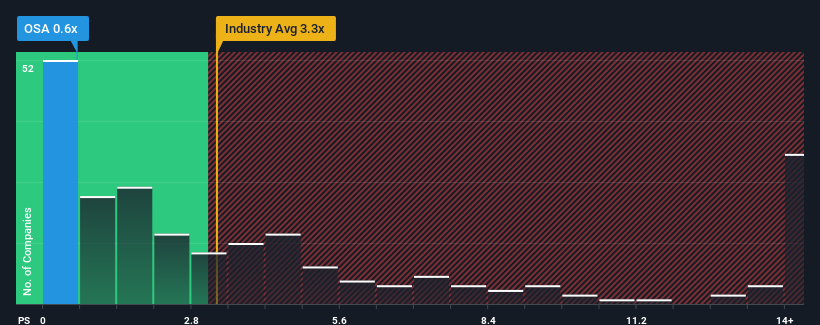

Even after such a large jump in price, ProSomnus' price-to-sales (or "P/S") ratio of 0.6x might still make it look like a strong buy right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.3x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for ProSomnus

How Has ProSomnus Performed Recently?

ProSomnus certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ProSomnus.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as ProSomnus' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 42%. The latest three year period has also seen an excellent 209% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 28% over the next year. With the industry only predicted to deliver 8.7%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that ProSomnus' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Even after such a strong price move, ProSomnus' P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

ProSomnus' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 6 warning signs for ProSomnus you should be aware of, and 3 of them don't sit too well with us.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:OSAP.Q

ProSomnus

Operates as a medical technology company that develops, manufactures, and markets precision intraoral medical devices for treating and managing patients with obstructive sleep apnea.

Medium-low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives