- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

OPKO Health (NASDAQ:OPK) delivers shareholders impressive 105% return over 1 year, surging 17% in the last week alone

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the OPKO Health, Inc. (NASDAQ:OPK) share price has soared 105% in the last 1 year. Most would be very happy with that, especially in just one year! In more good news, the share price has risen 26% in thirty days. We note that OPKO Health reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report. On the other hand, longer term shareholders have had a tougher run, with the stock falling 38% in three years.

Since it's been a strong week for OPKO Health shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for OPKO Health

OPKO Health isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

OPKO Health actually shrunk its revenue over the last year, with a reduction of 17%. So we would not have expected the share price to rise 105%. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

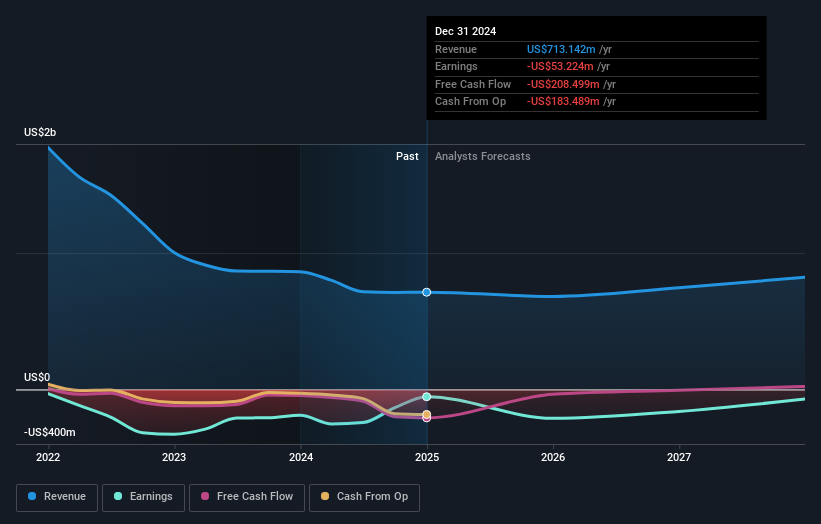

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that OPKO Health has rewarded shareholders with a total shareholder return of 105% in the last twelve months. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with OPKO Health , and understanding them should be part of your investment process.

OPKO Health is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives