- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

OPKO Health (NASDAQ:OPK) adds US$54m to market cap in the past 7 days, though investors from three years ago are still down 81%

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of OPKO Health, Inc. (NASDAQ:OPK), who have seen the share price tank a massive 81% over a three year period. That'd be enough to cause even the strongest minds some disquiet. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for OPKO Health

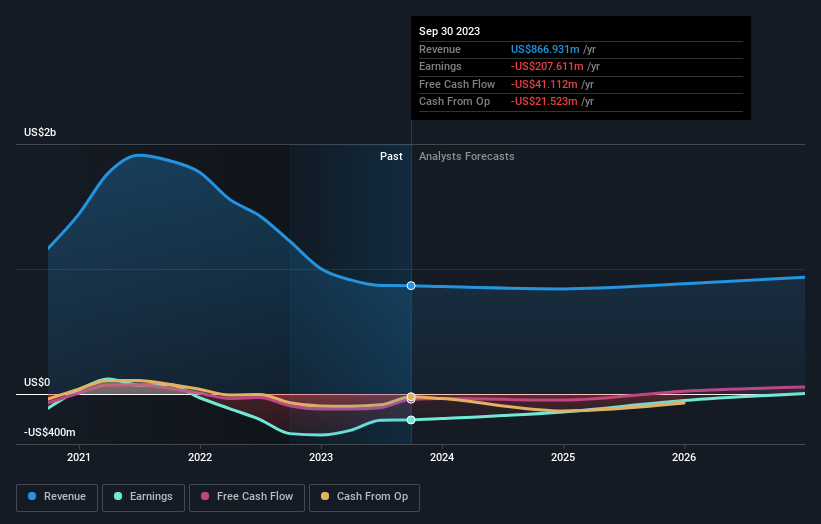

Because OPKO Health made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years OPKO Health saw its revenue shrink by 20% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 22%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in OPKO Health had a tough year, with a total loss of 16%, against a market gain of about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that OPKO Health is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Spain, Chile, Israel, Mexico, and internationally.

Mediocre balance sheet and slightly overvalued.