- United States

- /

- Medical Equipment

- /

- NasdaqGS:NVCR

Investors Give NovoCure Limited (NASDAQ:NVCR) Shares A 27% Hiding

Unfortunately for some shareholders, the NovoCure Limited (NASDAQ:NVCR) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

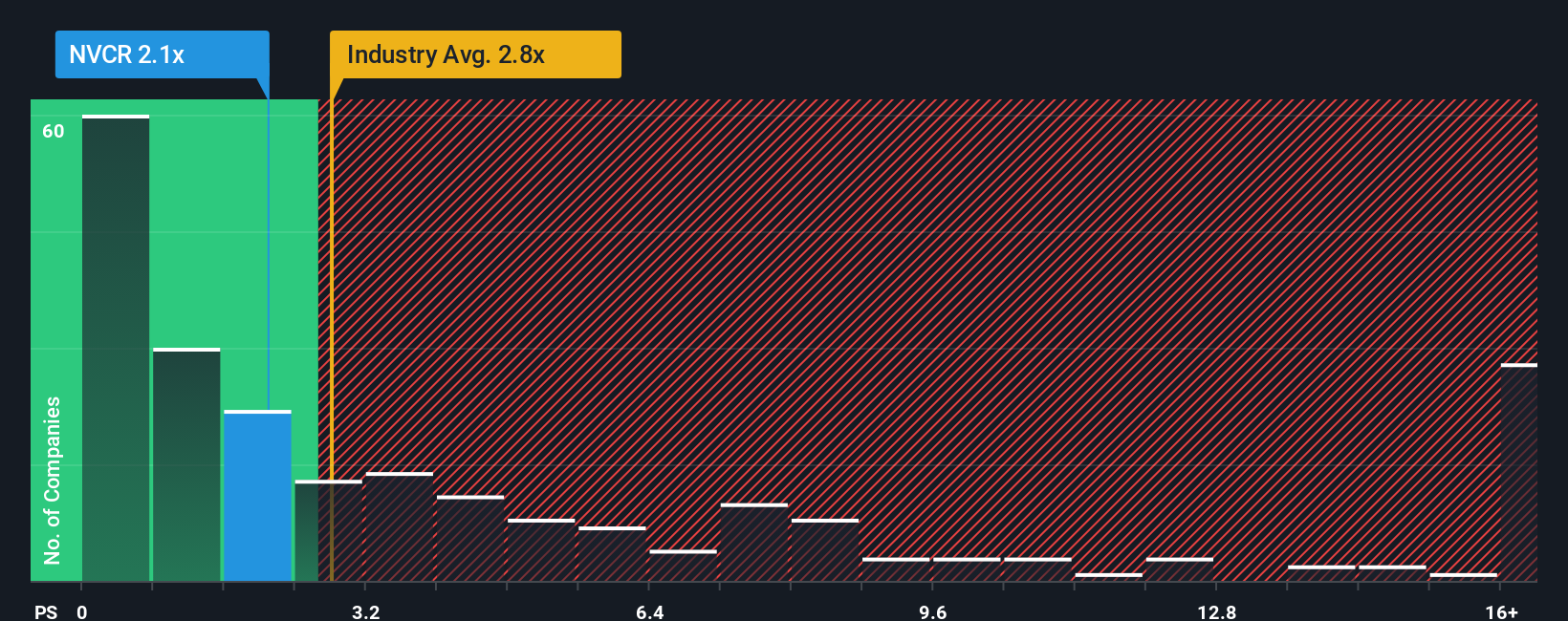

After such a large drop in price, NovoCure's price-to-sales (or "P/S") ratio of 2.1x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for NovoCure

What Does NovoCure's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, NovoCure has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on NovoCure will help you uncover what's on the horizon.How Is NovoCure's Revenue Growth Trending?

In order to justify its P/S ratio, NovoCure would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. Revenue has also lifted 16% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 11% per year over the next three years. With the industry predicted to deliver 9.2% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that NovoCure's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does NovoCure's P/S Mean For Investors?

NovoCure's recently weak share price has pulled its P/S back below other Medical Equipment companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of NovoCure's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for NovoCure that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NovoCure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NVCR

NovoCure

An oncology company, engages in the development, manufacture, and commercialization of tumor treating fields (TTFields) devices for the treatment of solid tumor cancers in the United States, Germany, France, Japan, Greater China, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives