- United States

- /

- Medical Equipment

- /

- NasdaqCM:NSPR

Even though InspireMD (NASDAQ:NSPR) has lost US$8.7m market cap in last 7 days, shareholders are still up 157% over 1 year

InspireMD, Inc. (NASDAQ:NSPR) shareholders might be concerned after seeing the share price drop 14% in the last quarter. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 157% in that time. So we think most shareholders won't be too upset about the recent fall. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

See our latest analysis for InspireMD

Given that InspireMD didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year InspireMD saw its revenue grow by 3.5%. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 157%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

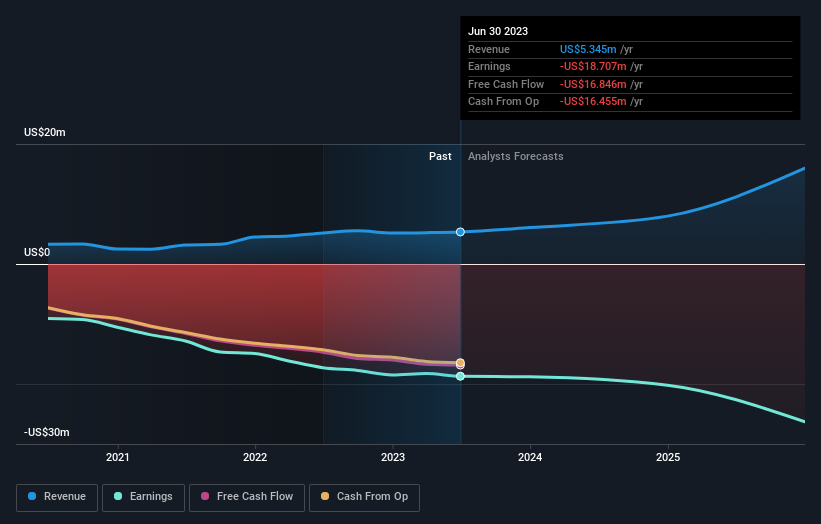

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on InspireMD

A Different Perspective

It's nice to see that InspireMD shareholders have received a total shareholder return of 157% over the last year. That certainly beats the loss of about 15% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - InspireMD has 4 warning signs (and 2 which can't be ignored) we think you should know about.

InspireMD is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NSPR

InspireMD

A medical device company, focuses on the development and commercialization of MicroNet stent platform technology for the treatment of vascular and coronary diseases in Europe, Latin America, the Middle East, and Asia Pacific.

Flawless balance sheet low.