- United States

- /

- Healthcare Services

- /

- NasdaqCM:NEO

NeoGenomics (NASDAQ:NEO) shareholder returns have been respectable, earning 70% in 1 year

NeoGenomics, Inc. (NASDAQ:NEO) shareholders might be concerned after seeing the share price drop 25% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. After all, the share price is up a market-beating 70% in that time.

The past week has proven to be lucrative for NeoGenomics investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for NeoGenomics

NeoGenomics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

NeoGenomics grew its revenue by 13% last year. That's not great considering the company is losing money. In keeping with the revenue growth, the share price gained 70% in that time. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

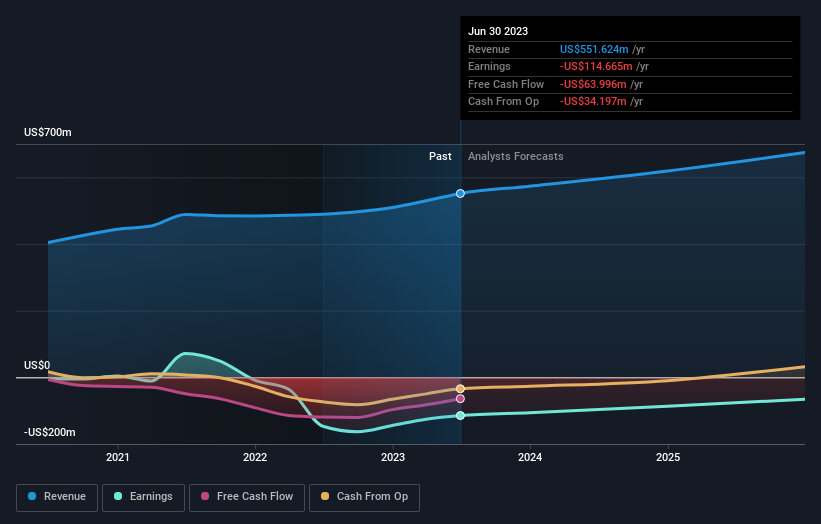

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

NeoGenomics is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think NeoGenomics will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that NeoGenomics has rewarded shareholders with a total shareholder return of 70% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 1.8% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for NeoGenomics that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade NeoGenomics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NeoGenomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NEO

NeoGenomics

Operates a network of cancer-focused testing laboratories in the United States and the United Kingdom.

Adequate balance sheet and slightly overvalued.