- United States

- /

- Healthcare Services

- /

- NasdaqGM:NAKA

Will Board Turnover and Fresh Capital Reshape Kindly MD's Strategic Direction (NAKA)?

Reviewed by Sasha Jovanovic

- Kindly MD, Inc. recently announced that Eric Weiss resigned from the board and governance committee, with Mark Yusko appointed as sole chair and Perianne Boring joining as a member, and revealed it secured an open credit facility with Two Prime that refinanced a US$200,000,000 convertible debenture.

- This series of governance shifts and major refinancing signals a period of significant change and balance sheet management by the company.

- We’ll examine how Kindly MD’s substantial refinancing and board changes are impacting its investment narrative and future direction.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Kindly MD's Investment Narrative?

Owning Kindly MD stock means believing in a bold turnaround story marked by rapid, ambitious changes, but also accepting some of the highest short-term risks in the US healthcare sector today. The company's refinancing of its US$200 million convertible debenture via a new Two Prime credit facility offers immediate balance sheet relief, removing near-term debt maturity worries that could have constrained operational flexibility or diluted shareholders further. This shift enhances Kindly MD’s ability to focus on core initiatives like its healthcare–crypto integration post-merger, but it doesn’t address ongoing challenges. Losses have widened, meaningful revenue is lacking, and the newly restructured board and management team are still very inexperienced. Recent share dilution, steep price declines, and a rocky path to profitability all remain. For now, the refinancing may ease urgent threats, but uncertainty lingers as losses persist and the turnaround hinges on untested leadership.

On the flipside, investors should be aware of the company’s limited track record post-refinancing.

Exploring Other Perspectives

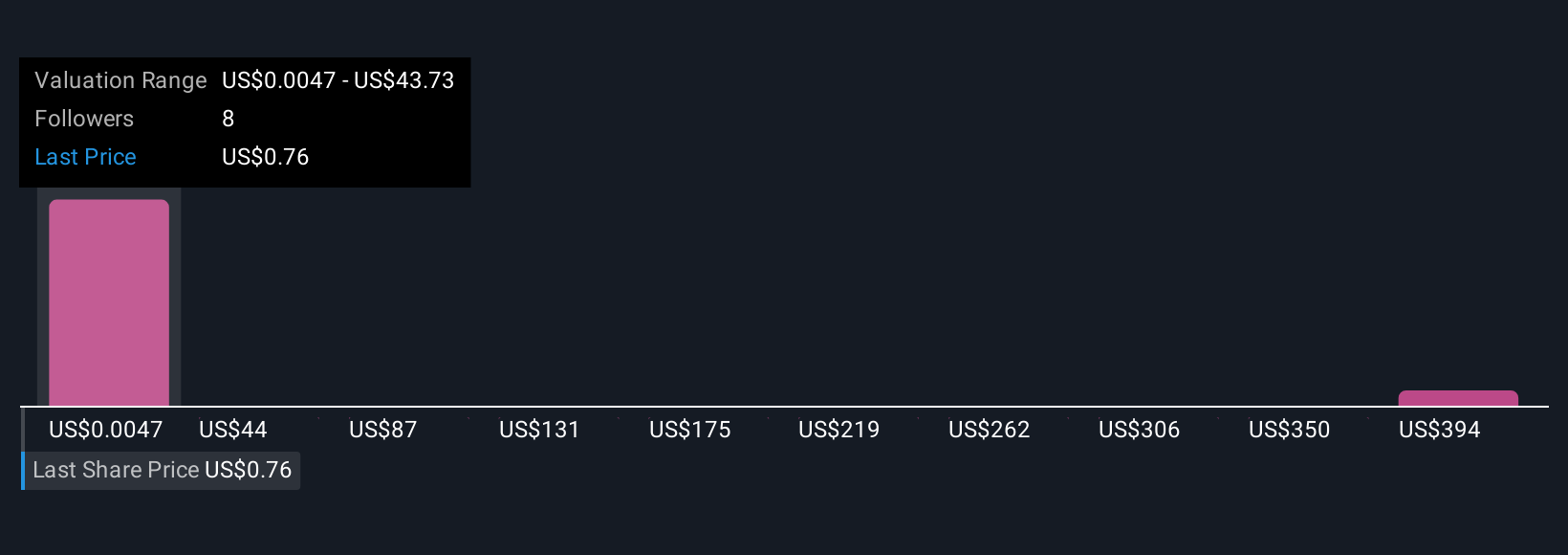

Explore 7 other fair value estimates on Kindly MD - why the stock might be worth less than half the current price!

Build Your Own Kindly MD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kindly MD research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Kindly MD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kindly MD's overall financial health at a glance.

No Opportunity In Kindly MD?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kindly MD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAKA

Kindly MD

A healthcare and healthcare data company, provides direct health care services to patients integrating prescription medicine and behavioral health services.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives