- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (NasdaqGM:LNTH) Advances Alzheimer's PET Diagnostic With Successful Trial Results

Reviewed by Simply Wall St

Lantheus Holdings (NasdaqGM:LNTH) announced clinical success with its MK-6240 PET radiodiagnostic, showing promise in Alzheimer’s detection, and plans an NDA submission to the FDA. Over the last quarter, Lantheus experienced a 13% price increase, likely supported by positive trial results and broader market resilience. Its earnings report reflected increased sales but lower net income, offering mixed signals. The S&P 500 and Nasdaq have been performing robustly, with strong earnings from tech giants enhancing investor sentiment. Lantheus’s clinical advancements align with these positive trends, potentially fortifying investor confidence in the company's long-term potential.

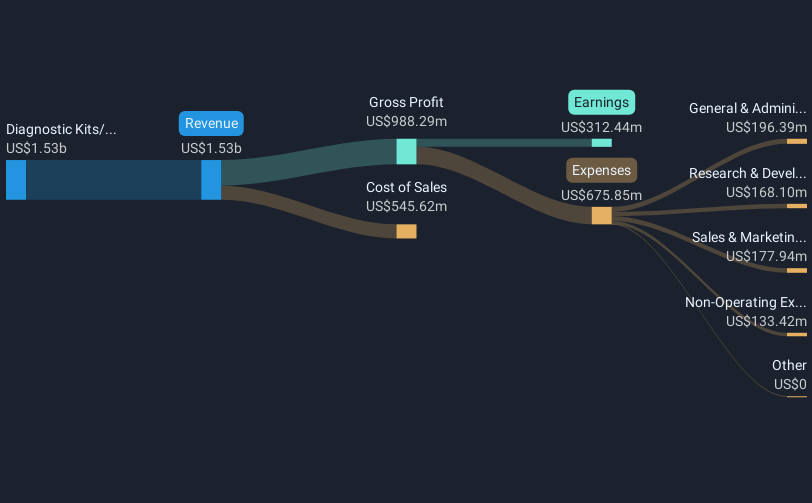

The recent clinical success reported by Lantheus Holdings can bolster the company's strategic expansion into Alzheimer's diagnostics, possibly enhancing revenue diversification and growth projections. This aligns with analyst expectations of 10.9% annual revenue growth over the next three years, potentially driven by products like Neuraceq and the ongoing success of PYLARIFY. The positive news has already contributed to a 13% share price increase in the past quarter, and with a current share price of $99.57, the analyst price target of $134.38 remains 25.9% higher, indicating room for potential value appreciation if growth expectations are met.

Over the past five years, Lantheus Holdings has delivered a very large total return of 713.25% to its shareholders. In contrast, over the past year alone, Lantheus has outperformed both the broader US Market, which returned 9.6%, and the US Medical Equipment industry, which returned 7.7%. This suggests that the company has maintained strong momentum relative to its peers and the market, solidifying investor confidence in its business model and clinical advancements.

Given these developments, the company's revenue and earnings forecasts could experience a positive impact, with earnings expected to grow annually by 16.5% over the next few years. The financial performance could be further strengthened by strategic transactions, improved reimbursement settings, and successful pipeline asset commercialization. However, the potential risks associated with acquisitions and market pressures could also impact these expectations, so investors should remain cautious while analyzing future projections.

Gain insights into Lantheus Holdings' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives