- United States

- /

- Medical Equipment

- /

- NasdaqCM:LNSR

LENSAR, Inc.'s (NASDAQ:LNSR) Shares Leap 33% Yet They're Still Not Telling The Full Story

LENSAR, Inc. (NASDAQ:LNSR) shares have continued their recent momentum with a 33% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 63% in the last year.

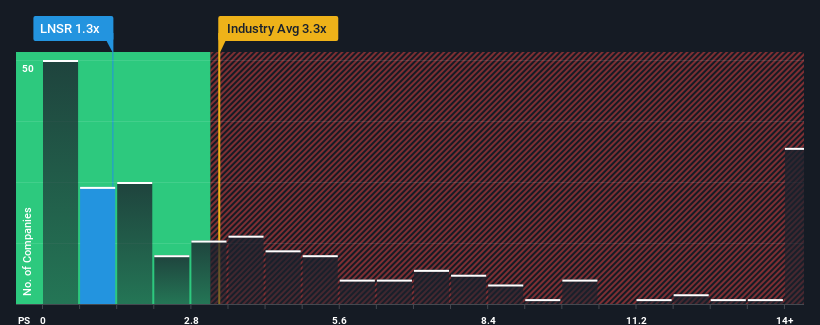

Although its price has surged higher, LENSAR may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.3x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for LENSAR

What Does LENSAR's P/S Mean For Shareholders?

LENSAR's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on LENSAR will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LENSAR.How Is LENSAR's Revenue Growth Trending?

LENSAR's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 52% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 28% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 8.6% growth forecast for the broader industry.

With this in consideration, we find it intriguing that LENSAR's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift LENSAR's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at LENSAR's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for LENSAR that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LNSR

LENSAR

A commercial-stage medical device company, focuses on designing, developing, and marketing laser system for the treatment of cataracts and the management of pre-existing or surgically induced corneal astigmatism in the United System.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives