- United States

- /

- Medical Equipment

- /

- NasdaqCM:LNSR

LENSAR, Inc. (NASDAQ:LNSR) Doing What It Can To Lift Shares

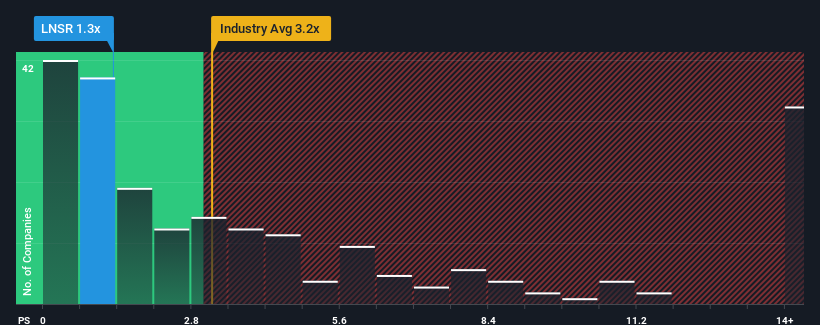

With a price-to-sales (or "P/S") ratio of 1.3x LENSAR, Inc. (NASDAQ:LNSR) may be sending bullish signals at the moment, given that almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 3.2x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for LENSAR

How Has LENSAR Performed Recently?

LENSAR certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think LENSAR's future stacks up against the industry? In that case, our free report is a great place to start.How Is LENSAR's Revenue Growth Trending?

In order to justify its P/S ratio, LENSAR would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The latest three year period has also seen an excellent 62% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 21% over the next year. That's shaping up to be materially higher than the 9.4% growth forecast for the broader industry.

With this information, we find it odd that LENSAR is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From LENSAR's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems LENSAR currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for LENSAR that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LNSR

LENSAR

A commercial-stage medical device company, focuses on designing, developing, and marketing laser system for the treatment of cataracts and the management of pre-existing or surgically induced corneal astigmatism in the United System.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives