- United States

- /

- Medical Equipment

- /

- NasdaqGM:LMAT

The Bull Case for LeMaitre Vascular (LMAT) Could Change Following Raised 2025 Guidance and Strong Q2 Results

Reviewed by Sasha Jovanovic

- LeMaitre Vascular recently reported a stronger-than-expected second quarter, with revenues exceeding analyst forecasts and management raising its 2025 guidance following the successful international launch of Artegraft.

- This operational outperformance reflects expanding global demand for vascular interventions and the company's ability to convert new product launches into tangible growth.

- We will now explore how the raised financial guidance, backed by robust international sales, shapes LeMaitre Vascular's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

LeMaitre Vascular Investment Narrative Recap

To be a LeMaitre Vascular shareholder, you need to believe in the company's ability to expand global demand for minimally invasive vascular procedures and successfully execute new product launches, as seen with the international rollout of Artegraft. The recent quarterly beat and guidance raise meaningfully strengthen the near-term revenue growth catalyst, but do not entirely remove near-term risk around regulatory compliance, particularly following the FDA warning letter issued in August, a potential headwind investors should not overlook.

Of the recent company announcements, the FDA warning letter in late August stands out as most relevant in the current context. While strong global sales momentum for Artegraft is driving optimism, the noted manufacturing and documentation violations raise legitimate questions about quality control and the potential for future supply disruption or further regulatory action, issues that could undercut recent commercial gains if unresolved.

However, beneath the top-line growth, investors should be aware that regulatory and quality challenges could...

Read the full narrative on LeMaitre Vascular (it's free!)

LeMaitre Vascular's forecast points to $312.8 million in revenue and $65.6 million in earnings by 2028. This outlook requires a 10.1% annual revenue growth rate and an $18.5 million increase in earnings from the current level of $47.1 million.

Uncover how LeMaitre Vascular's forecasts yield a $104.78 fair value, a 19% upside to its current price.

Exploring Other Perspectives

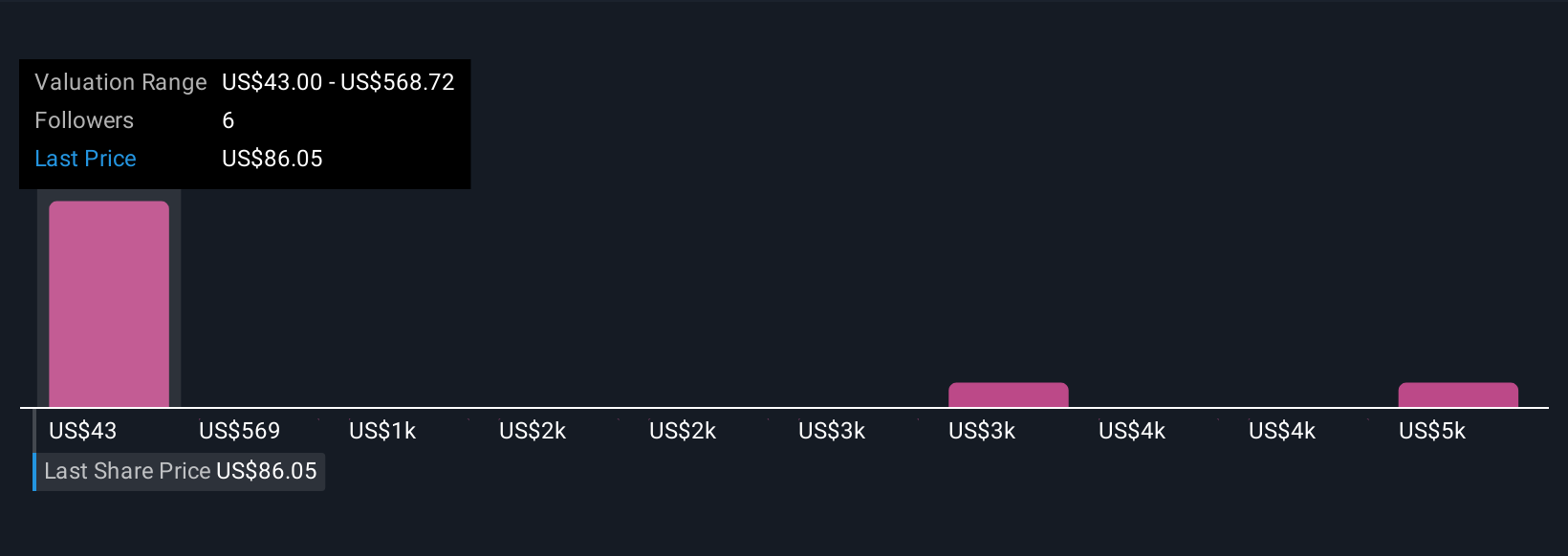

Five fair value estimates from the Simply Wall St Community span from US$43 to a striking US$5,300 per share. While some see significant upside, others point to risks such as regulatory headwinds that could influence LeMaitre Vascular’s trajectory going forward; explore all viewpoints to inform your decision.

Explore 5 other fair value estimates on LeMaitre Vascular - why the stock might be a potential multi-bagger!

Build Your Own LeMaitre Vascular Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LeMaitre Vascular research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free LeMaitre Vascular research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LeMaitre Vascular's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LMAT

LeMaitre Vascular

Develops, manufactures, and markets medical devices and implants used in the field of vascular surgery in the Americas, Europe, the Middle Esat, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives