- United States

- /

- Healthcare Services

- /

- NasdaqGS:LFST

How Clinician Retention and Payer Relationship Challenges at LifeStance Health Group (LFST) Have Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this week, LifeStance Health Group revealed ongoing challenges with clinician retention and complex relationships with insurance payers at the Morgan Stanley Global Healthcare Conference.

- This disclosure highlights the continued difficulty of maintaining workforce stability and reliable payer arrangements, both of which are essential for outpatient mental health providers operating at a national scale.

- We’ll examine how LifeStance’s clinician retention challenges could reshape analyst expectations for its growth and operational momentum.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

LifeStance Health Group Investment Narrative Recap

To have confidence in LifeStance Health Group as a shareholder, you need to believe in the large and growing demand for outpatient mental health services and the company's ability to efficiently recruit, retain, and deploy clinicians across its national network. This week’s disclosure of ongoing clinician retention and payer relationship challenges, highlighted at the Morgan Stanley Global Healthcare Conference, points to risks that could limit operational momentum in the near term. However, the market’s reaction, while negative, suggests that investors do not yet see a fundamental shift in short-term catalysts or risk factors for the business.

Among the company’s recent announcements, the reaffirmed 2025 revenue guidance of US$1.40 billion to US$1.44 billion and improved Center Margin projection, both maintained as of August 7, stand out. This steady outlook underscores management’s belief in a stable revenue environment, even as operational pressures with payers and workforce continue to be closely watched by the market.

But, contrasting these forecasts, investors should be aware that the pace of clinician recruitment and retention remains a risk that could...

Read the full narrative on LifeStance Health Group (it's free!)

LifeStance Health Group's outlook anticipates $2.0 billion in revenue and $111.7 million in earnings by 2028. This is based on analysts forecasting a 14.6% annual revenue growth rate and an increase in earnings of $127.9 million from the current -$16.2 million.

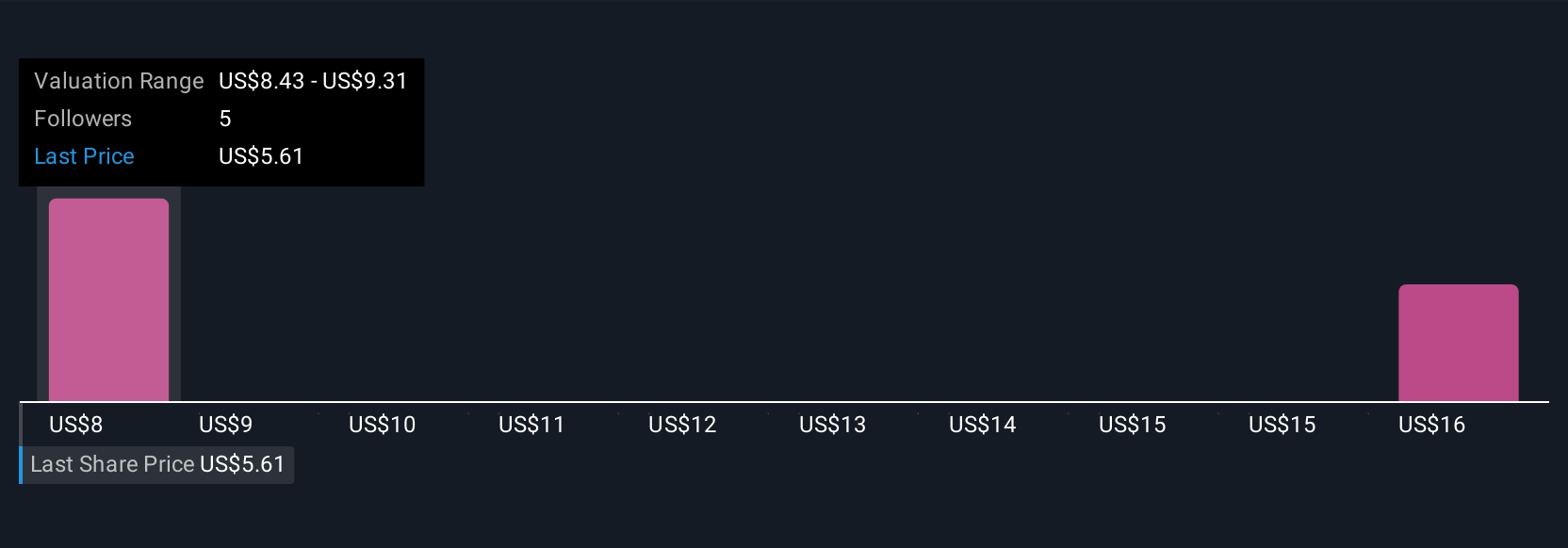

Uncover how LifeStance Health Group's forecasts yield a $8.43 fair value, a 61% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span US$8.43 to US$17.21, showing a wide range of private investor opinions. Against this variety, ongoing retention headwinds could shape LifeStance’s future performance in ways some may not expect, giving you more reason to compare viewpoints.

Explore 3 other fair value estimates on LifeStance Health Group - why the stock might be worth over 3x more than the current price!

Build Your Own LifeStance Health Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LifeStance Health Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free LifeStance Health Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LifeStance Health Group's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFST

LifeStance Health Group

Through its subsidiaries, provides outpatient mental health services to children, adolescents, adults, and geriatrics in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives