- United States

- /

- Healthcare Services

- /

- NasdaqGS:LFST

A Fresh Look at LifeStance Health Group (LFST) Valuation Following Analyst Upgrade and Earnings Momentum

Reviewed by Kshitija Bhandaru

LifeStance Health Group (LFST) just got a boost, as Zacks upgraded the stock to its highest rating after noticing better earnings estimates. This upgrade often signals that there are strengthening fundamentals beneath the surface.

See our latest analysis for LifeStance Health Group.

LifeStance Health Group’s share price has shown a swift bounce in recent months, climbing nearly 19% over the last 90 days after a challenging first half of the year. Still, with a one-year total shareholder return of -18%, the recovery is just taking shape and momentum is starting to build as investors reprice its prospects.

If you’re tracking companies making headlines in healthcare, it’s worth checking out See the full list for free.

With shares rebounding and analyst upgrades drawing attention, investors are left to consider whether LifeStance Health Group is undervalued after its recent struggles or if the market is already pricing in its turnaround potential.

Most Popular Narrative: 33.1% Undervalued

Compared to its closing price of $5.64, the consensus narrative suggests LifeStance Health Group could have over 30% upside if optimistic forecasts play out. The case hinges on surging demand for mental health care and technology-driven growth propelling profits higher.

The ongoing migration of patients from cash-pay to commercial insurance, along with policy initiatives supporting mental health parity, positions LifeStance to benefit from more stable reimbursement streams and higher patient volumes. This, in turn, boosts revenue predictability and growth.

Want to know the growth blueprint behind this high valuation? The key element is a future profit profile that most investors would only expect from market leaders. See what record-breaking financial projections underpin this price target and discover the surprising drivers the narrative counts on for upside.

Result: Fair Value of $8.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and tightening insurance reimbursements could threaten LifeStance Health Group’s recovery if market conditions shift against current optimistic forecasts.

Find out about the key risks to this LifeStance Health Group narrative.

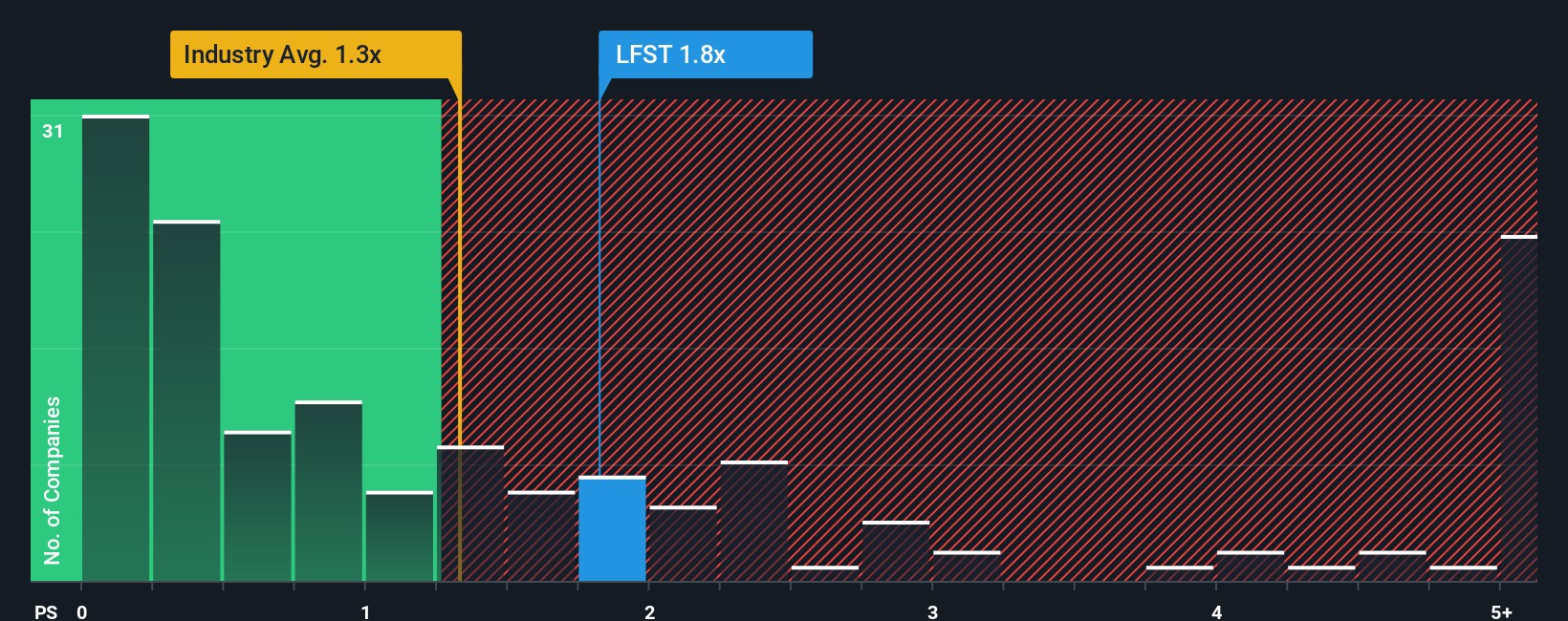

Another View: Comparing Market Ratios

While the earlier case points to LifeStance Health Group being undervalued, a closer look at market ratios tells a different story. The stock trades at a price-to-sales ratio of 1.7x, which is higher than both the industry average of 1.4x and its fair ratio of 1.4x. This means investors are paying a premium compared to peers and what the market could normalize toward. Does this suggest the optimism is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LifeStance Health Group Narrative

If you have a different perspective or like to dig into the numbers on your own, you can quickly piece together your own analysis and viewpoint in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding LifeStance Health Group.

Looking for More Investment Ideas?

Don’t let other promising opportunities slip by. Supercharge your portfolio with uniquely positioned stocks you might have overlooked. There is always room for the next big winner.

- Capitalize on early-stage innovation and keep growth on your radar with these 3574 penny stocks with strong financials, featuring emerging companies showing strong fundamentals.

- Boost your passive income strategy and avoid missing remarkable payouts by reviewing these 19 dividend stocks with yields > 3%, offering yields above 3% and robust dividend histories.

- Position yourself ahead of the curve in artificial intelligence by checking out these 25 AI penny stocks, packed with high-potential AI-driven businesses transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFST

LifeStance Health Group

Through its subsidiaries, provides outpatient mental health services to children, adolescents, adults, and geriatrics in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives