- United States

- /

- Medical Equipment

- /

- NasdaqGM:KIDS

OrthoPediatrics (NASDAQ:KIDS) adds US$57m to market cap in the past 7 days, though investors from three years ago are still down 46%

OrthoPediatrics Corp. (NASDAQ:KIDS) shareholders should be happy to see the share price up 18% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 46% in the last three years, falling well short of the market return.

While the stock has risen 9.8% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for OrthoPediatrics

OrthoPediatrics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, OrthoPediatrics saw its revenue grow by 23% per year, compound. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 13% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

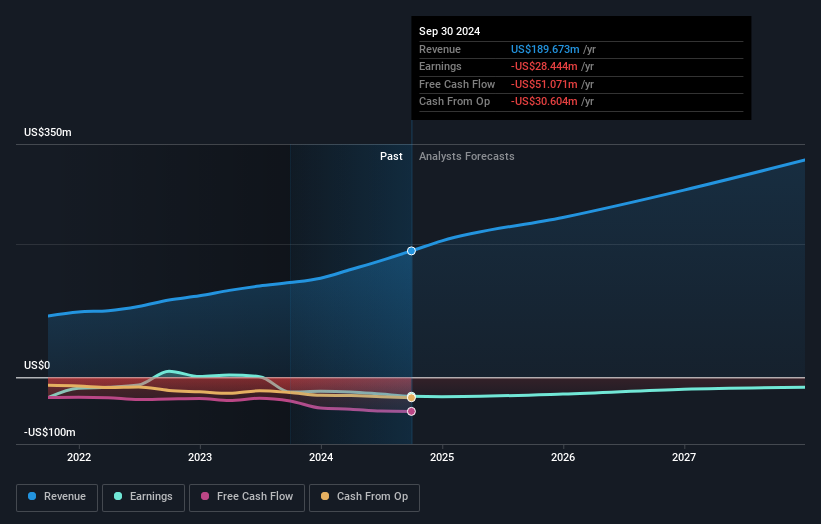

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at OrthoPediatrics' financial health with this free report on its balance sheet.

A Different Perspective

Investors in OrthoPediatrics had a tough year, with a total loss of 6.4%, against a market gain of about 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 8% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand OrthoPediatrics better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with OrthoPediatrics .

Of course OrthoPediatrics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KIDS

OrthoPediatrics

A medical device company, engages in designing, developing, and marketing anatomically appropriate implants, instruments, and specialized braces for children with orthopedic conditions in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives