- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (NasdaqGS:ISRG) Gains FDA Clearance for Innovative SP SureForm 45 Stapler

Reviewed by Simply Wall St

Intuitive Surgical (NasdaqGS:ISRG) recently announced the FDA clearance of its SP SureForm 45 stapler for use with the da Vinci SP surgical system, an advancement set to enhance surgical procedures by increasing safety and efficiency. Despite the broader market facing a sharp decline, with the Nasdaq sliding 6% amid a tech rout, Intuitive's shares rose 8%, suggesting that the company's innovations and product approvals provided support against market pressures. While the broader market declined significantly due to various factors, including tariff uncertainties and technology sector volatility, Intuitive's recent developments may have contributed positively to its stock performance.

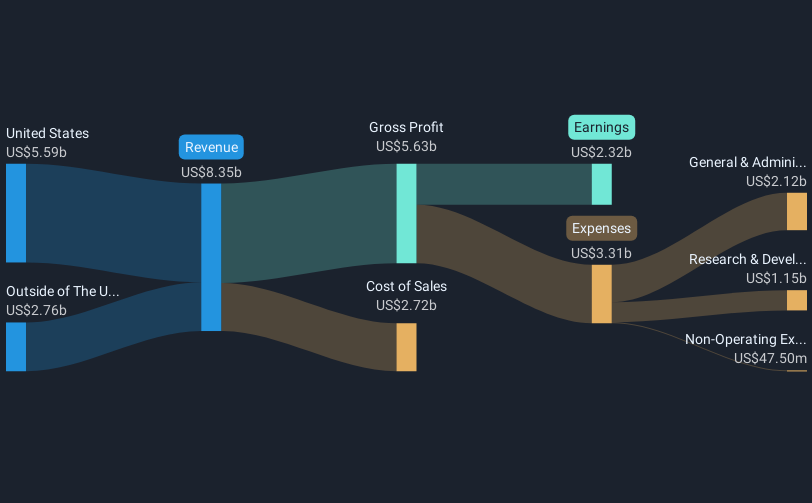

Intuitive Surgical's recent FDA clearance for its SP SureForm 45 stapler signals potential enhancements in surgical procedures, likely boosting its operational efficiency and integration with the da Vinci SP system. This innovation may support revenue growth through increased adoption and system upgrades. Over the past five years, the company's total return, factoring in share price and dividends, was 207.02%, showcasing a significant long-term growth trajectory. In comparison, over the last year, Intuitive Surgical's performance exceeded both the US market and the Medical Equipment industry, which returned 4.7% and 1.8% respectively.

The anticipated impact on revenue and earnings forecasts is promising, as strategic R&D investments and global approvals could elevate the company's market penetration and profitability. Revenue is currently forecasted to grow annually by 12%, while earnings are projected to expand by 12.8% per year. Intuitive Surgical's recent share price rise by 8% places it in context with an analyst price target of US$619.74, up 26.2% from its current value. Despite its high Price-To-Earnings Ratio compared to industry peers, the company's continued innovation and market expansion efforts could justify the target, depending on future earnings outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intuitive Surgical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives