- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (ISRG): Revisiting Valuation After a 25% Three-Month Share Price Rally

Reviewed by Simply Wall St

Intuitive Surgical (ISRG) shares have quietly climbed about 25% over the past 3 months, and that move has investors asking whether the rally still makes sense given the company’s growth profile.

See our latest analysis for Intuitive Surgical.

Zooming out, the 25.34% 3 month share price return has come after a more measured 8.72% year to date share price gain and a 3.59% 1 year total shareholder return, suggesting momentum is rebuilding as investors refocus on Intuitive Surgical’s structural growth and margin story rather than near term volatility.

If Intuitive Surgical’s steady climb has you thinking about where else growth and innovation are being rewarded, it might be time to explore healthcare stocks for more ideas across the sector.

With shares now hovering just below analyst targets after strong multi year gains, the key question is whether Intuitive Surgical’s premium valuation still leaves upside, or if the market is already fully pricing in its next leg of growth.

Most Popular Narrative Narrative: 3.9% Undervalued

With the most followed fair value sitting modestly above the last close of $569.71, the narrative frames Intuitive Surgical as a premium growth story still with some runway.

Ongoing product innovation (including full launch of da Vinci 5, integrated force feedback, and digital/AI case insights), coupled with R&D to expand into adjacent specialties, enhances clinical outcomes and surgeon efficiency supporting future procedure growth, higher system ASPs, and increased recurring instrument and accessory revenues.

Want to know how steady double digit growth, resilient margins, and a lofty future earnings multiple all add up to that fair value target? The full narrative unpacks the precise revenue ramp, profit trajectory, and valuation math driving this call, and the assumptions might surprise you.

Result: Fair Value of $592.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent international budget pressures and intensifying competition in instruments could slow system placements and erode the high margin consumables engine that underpins this thesis.

Find out about the key risks to this Intuitive Surgical narrative.

Another Way to Look at Valuation

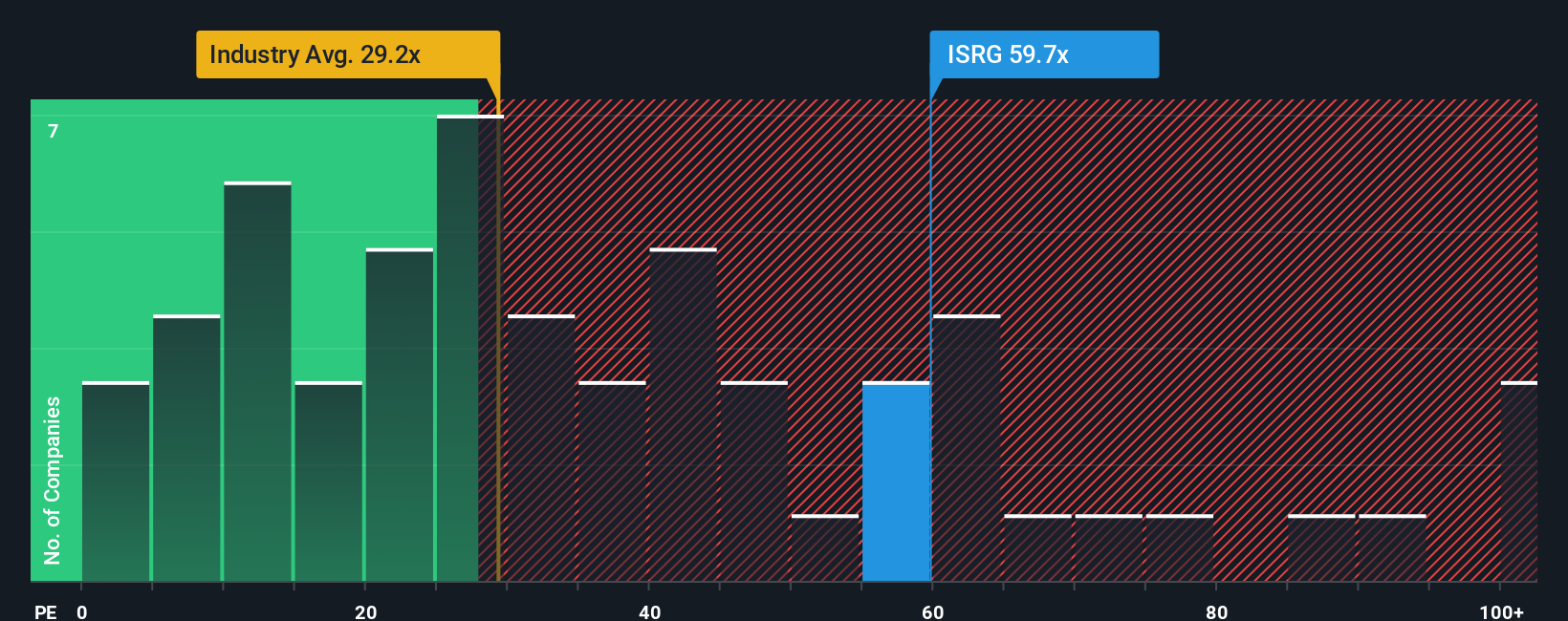

Step away from fair value narratives and the picture gets harsher. On earnings, Intuitive Surgical trades at about 73.5 times profits, far richer than the US Medical Equipment industry at 28.9 times, peers at 35.7 times, and even its own 38.7 times fair ratio. That gap signals real valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Surgical Narrative

If this view does not quite fit your own, or you prefer to dig into the numbers yourself, you can craft a tailored narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intuitive Surgical.

Ready for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work so you do not miss fresh opportunities beyond Intuitive Surgical’s story.

- Tap into rapid innovation by reviewing these 25 AI penny stocks that could benefit most as artificial intelligence reshapes entire industries and profit pools.

- Lock in potential bargains by scanning these 916 undervalued stocks based on cash flows where strong cash flows may not yet be fully reflected in market prices.

- Strengthen your income stream by assessing these 14 dividend stocks with yields > 3% offering attractive yields backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026