- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

iRhythm Technologies (IRTC) Valuation After New Global Zio ECG Data From Major Cardiac Conference

Reviewed by Simply Wall St

iRhythm Technologies (IRTC) just used a major cardiac conference to show that its Zio ECG patch performs similarly for Asian and non Asian patients, a data driven win for its global expansion story.

See our latest analysis for iRhythm Technologies.

That backdrop helps explain why, even after a softer patch with a recent pullback in the 7 day share price return and some consolidation in the past month, iRhythm’s year to date share price return of over 100% and robust 1 year total shareholder return suggest momentum is still very much on the front foot as investors reassess its growth runway and risk profile.

If this kind of clinical validation has you thinking more broadly about the sector, it could be a good moment to explore healthcare stocks as potential next ideas.

With the shares still trading below consensus targets and growth re accelerating, investors are asking whether iRhythm’s surge is only mid cycle or if the recent rally already reflects years of future expansion.

Most Popular Narrative Narrative: 17.3% Undervalued

With iRhythm Technologies closing at $181.87 against a narrative fair value of $219.93, the valuation gap frames a punchy, growth-centric story.

Expansion into international markets (UK, EU, Japan), where iRhythm is seeing strong early uptake and building clinical validation, diversifies revenue streams and positions the company for long-term topline growth as aging populations drive global demand for remote cardiac monitoring.

Want to see what powers that upside, beyond the headline conference buzz? The narrative leans on ambitious revenue compounding, rising margins and a premium future earnings multiple. Curious how those pieces fit together into that fair value call? Dive in to unpack the full set of assumptions behind this growth-heavy model.

Result: Fair Value of $219.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory remediation costs and intensifying competition from new cardiac monitoring and AI driven entrants could squeeze margins and blunt the bullish growth narrative.

Find out about the key risks to this iRhythm Technologies narrative.

Another Lens on Valuation

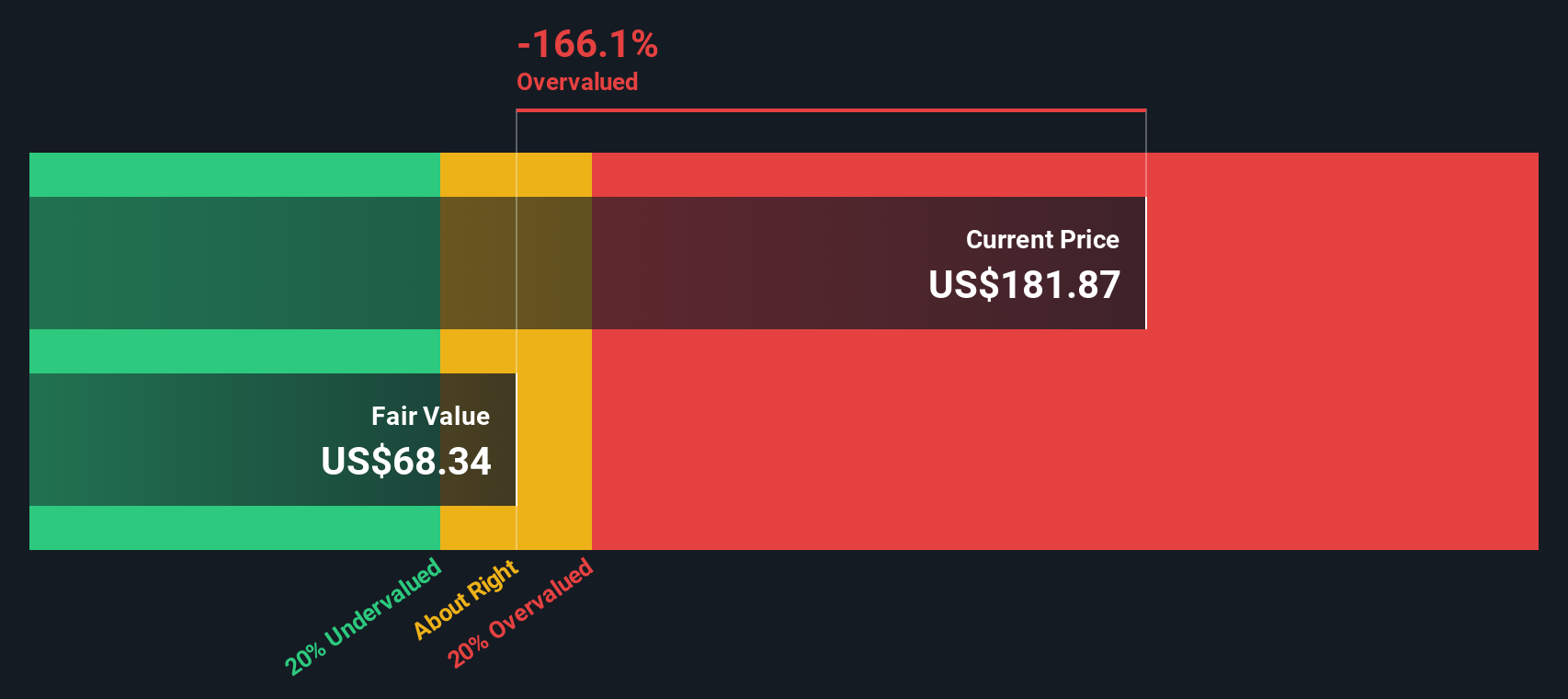

Our SWS DCF model paints a starkly different picture, putting iRhythm’s fair value at $68.34 versus the current $181.87 share price. This implies the stock may be significantly overvalued rather than 17.3% undervalued. Which story do you trust when sizing your position?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own iRhythm Technologies Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Do not stop at one opportunity. Use the Simply Wall St Screener now to uncover fresh, data backed ideas before the market fully prices them in.

- Capitalize on mispriced potential by scanning these 933 undervalued stocks based on cash flows that still fly under most investors’ radars.

- Ride powerful innovation waves by targeting these 24 AI penny stocks shaping how businesses use automation and intelligence.

- Strengthen your income stream by focusing on these 14 dividend stocks with yields > 3% that combine yield with underlying business resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026