- United States

- /

- Medical Equipment

- /

- NasdaqGS:INMD

InMode (INMD) Valuation Spotlight After Shareholder Push for Major Buybacks and Board Overhaul

Reviewed by Simply Wall St

If you have been following InMode (INMD) lately, you will know it is in the spotlight for reasons that go beyond typical market cycles. Just this past week, DOMA Perpetual Capital Management, a major shareholder, sent a public letter urging InMode’s board to approve two substantial share buybacks of 10% each, one in the fourth quarter and another in early 2026. DOMA’s demands did not stop there, criticizing management’s direction and pressing the board to act in shareholders’ best interests or face potential legal exposure. It is the kind of open confrontation that can shake up companies and force leadership’s hand, sparking investor speculation on what happens next.

All this activism comes after a year of mixed signals for InMode. The shares have slipped around 13% over the year, extending a rough three-year patch. Still, with the stock rebounding 11% in the past three months, there is renewed chatter about whether sentiment is beginning to turn, especially after the company’s recent healthcare conference appearance where financial and operational questions were firmly in the air. Management is now under close watch to prove capital allocation and governance are moving in the right direction.

So, does this tug-of-war between activist pressure and management create a bargain for those eyeing value or is the market already building those future improvements into the price?

Most Popular Narrative: 8.7% Undervalued

According to the most widely followed narrative, InMode is seen as undervalued compared to its future earnings potential, even as analysts forecast lower revenues and margins ahead. This narrative bases its valuation on careful projections for revenue, profit margins, and market multiples.

Expansion of direct operations in emerging international markets like Thailand and Argentina, along with a rapidly growing European presence, is expected to drive continued growth in non-U.S. sales. This growth leverages increasing access to healthcare and higher disposable incomes globally to boost revenue and diversify geographic risk.

Are you intrigued by the global growth story underlying this valuation call? The real twist lies in how future revenues, profit margins, and shifting market dynamics combine to set a price target above current levels. Want to know the quantitative assumptions baked into this narrative and which critical financial drivers are at play? There is more behind the fair value calculation than meets the eye.

Result: Fair Value of $16.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory hurdles or prolonged weak demand could quickly undermine this optimistic case for InMode. This could force a re-evaluation of its fair value.

Find out about the key risks to this InMode narrative.Another View: SWS DCF Model

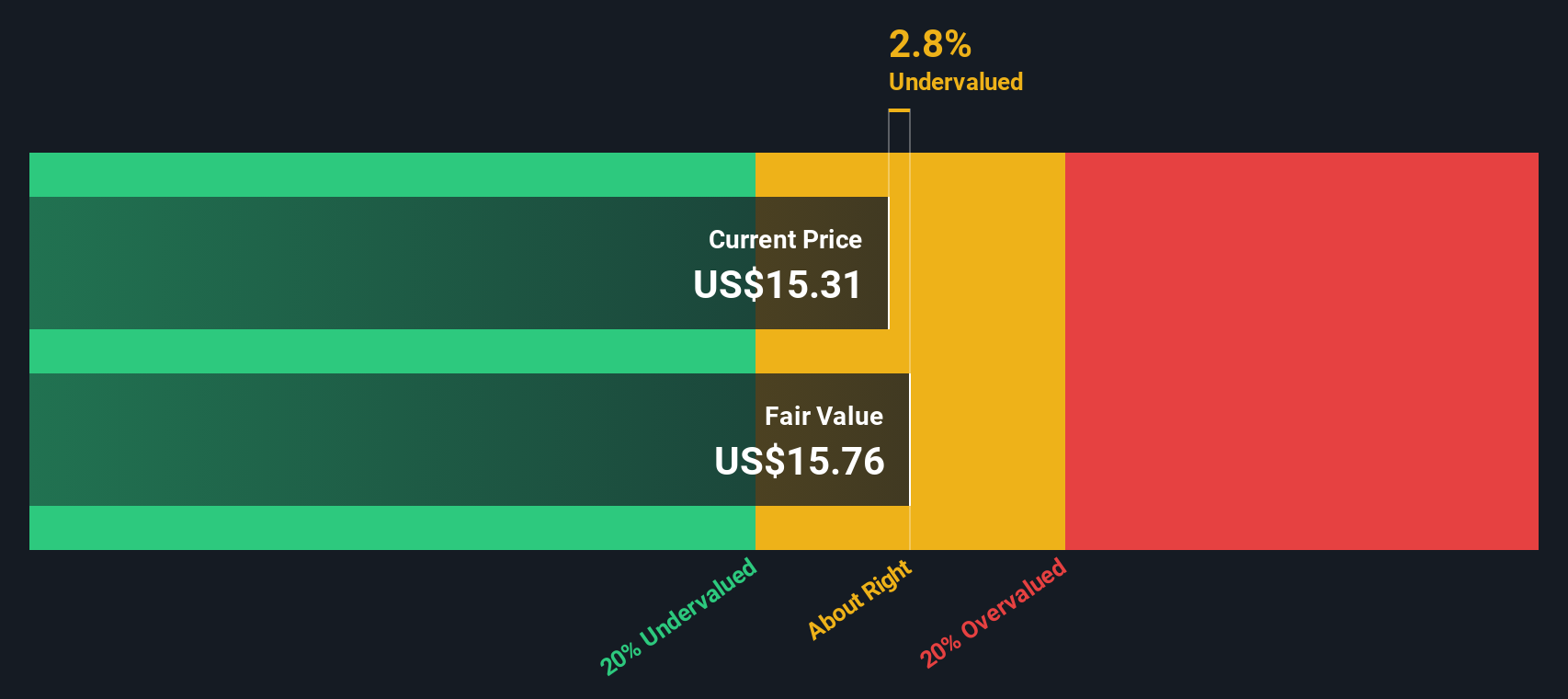

Looking from another angle, our SWS DCF model also suggests InMode is trading below its estimated fair value. This reinforces the earlier case but reminds us that different models sometimes tell a similar story. Is this broad agreement a sign that there is genuine value, or simply a consensus that could quickly shift with changing expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InMode for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InMode Narrative

If you are not convinced, or would rather dig into the numbers and form your own conclusions, you can easily craft a personal narrative in just a few minutes. Do it your way

A great starting point for your InMode research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not limit themselves to a single stock or story. Uncover fresh opportunities and elevate your portfolio by targeting companies that offer standout growth, resilience, and market potential. Let Simply Wall Street’s screeners be your guide to your next winning idea.

- Boost your returns by tapping into breakthrough companies shaping healthcare’s future through powerful healthcare AI stocks advances.

- Secure steady income and long-term stability by adding dividend stocks with yields > 3% to your watchlist, before the rest of the market catches on.

- Go after real value with market leaders trading below their potential with our unique focus on undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INMD

InMode

Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives