- United States

- /

- Medical Equipment

- /

- NasdaqGS:ICUI

Investors bid ICU Medical (NASDAQ:ICUI) up US$206m despite increasing losses YoY, taking one-year return to 80%

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. To wit, the ICU Medical, Inc. (NASDAQ:ICUI) share price is 80% higher than it was a year ago, much better than the market return of around 25% (not including dividends) in the same period. So that should have shareholders smiling. Zooming out, the stock is actually down 17% in the last three years.

Since the stock has added US$206m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for ICU Medical

ICU Medical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year ICU Medical saw its revenue grow by 4.0%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 80%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

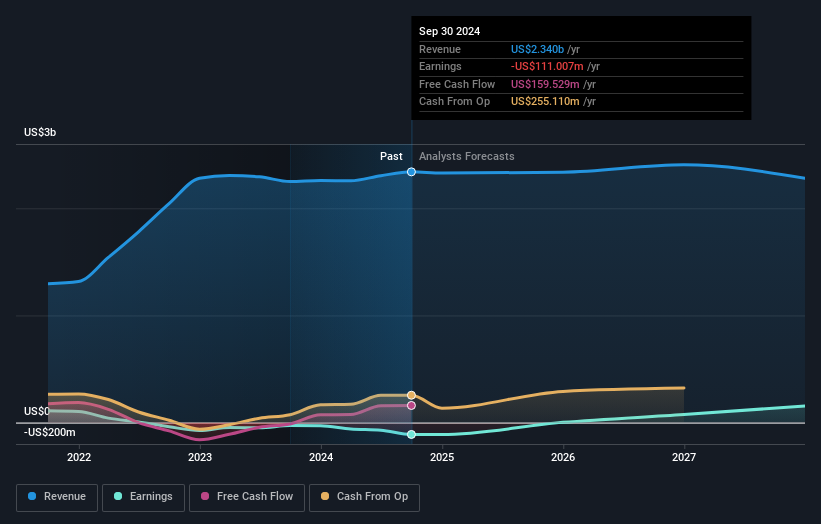

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at ICU Medical's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that ICU Medical has rewarded shareholders with a total shareholder return of 80% in the last twelve months. Notably the five-year annualised TSR loss of 1.1% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand ICU Medical better, we need to consider many other factors. Even so, be aware that ICU Medical is showing 2 warning signs in our investment analysis , and 1 of those is significant...

We will like ICU Medical better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICUI

ICU Medical

Develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives